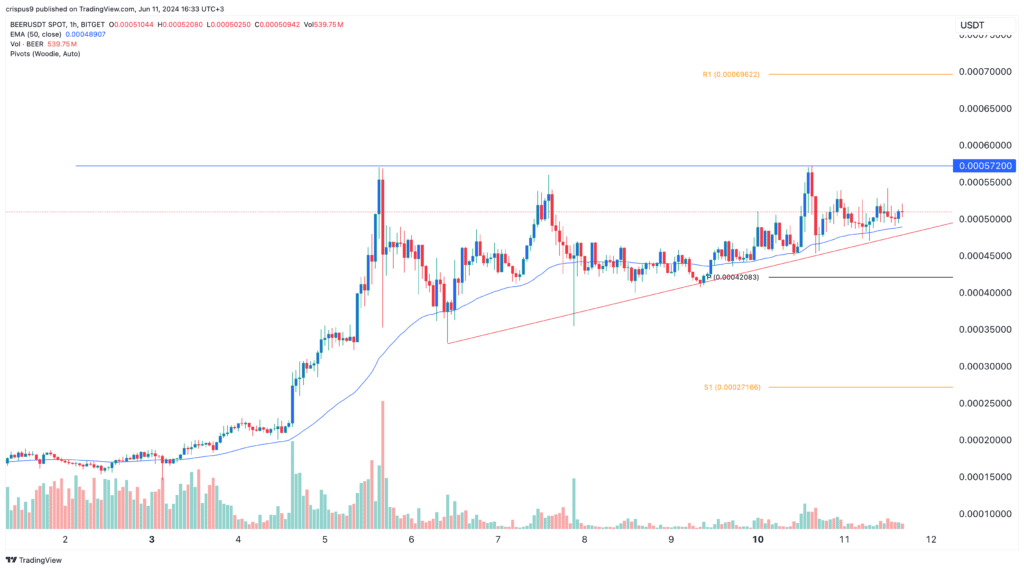

Beercoin price is soaring while Bitcoin and major altcoins are dumping. The $BEER token soared to a record high of $0.000572 and is up more than 700% from its lowest point last week. This surge has brought its market cap to over $276 million, making it one of the top Solana meme coins. Beercoin holders are growing Beercoin, a recently launched Solana meme coin, is doing well as the number of holders jump. According to the developers, there are now over 40,000 holders and the number is growing by the…

Tag: Analysis

Is Now The Time To Buy Bitcoin? Latest Chart Analysis Says Yes

Bitcoin has recently been spotlighted due to an intriguing buy signal identified on its hourly chart. This indication emerges amidst a notable fluctuation in Bitcoin’s price, setting the stage for potential short-term gains. Renowned crypto analyst Ali has highlighted a significant development on the hourly chart of Bitcoin, specifically noting a ‘buy signal’ detected by the TD Sequential indicator. This technical tool, developed by Tom DeMark, is respected for its ability to predict price reversals by analyzing exhaustion points in trends. Related Reading Decoding The TD Sequential Indicator On Bitcoin…

Ethereum Technical Analysis: ETH Faces Tight Trading Range Under Resistance

Ethereum (ETH) continues to showcase its volatility and potential for strategic trading. As of June 10, 2024, ethereum’s price stands at $3,677, reflecting a daily range of $3,654 to $3,714. Ethereum Ethereum’s 1-hour chart reveals short-term volatility, with ether’s price testing lower levels around $3,642 and struggling to maintain above $3,700. Key support is identified […] Source CryptoX Portal

Bitcoin Technical Analysis: BTC Holds Steady Amidst Consolidation Phase

Bitcoin’s price stands at $69,352, within a 24-hour intraday range of $69,213 to $69,840. The leading crypto asset’s market capitalization is $1.36 trillion, with a 24-hour trade volume of $14.83 billion. Bitcoin The hourly chart for bitcoin (BTC) indicates a phase of consolidation with minor fluctuations. The price hit a high of $69,840 before retracting […] Original

Bitcoin Technical Analysis: BTC Shows Promising Signs Across All Time Frames

Bitcoin’s price currently stands at $71,347, showing an impressive rise within the 24-hour intraday range of $70,065 to $71,595. With a trading volume of $25.17 billion and a market capitalization of $1.4 trillion, bitcoin has gained 4.9% this week, 5.6% over the past two weeks, and 14.4% in the last 30 days. Bitcoin Bitcoin’s 1-hour […] Original

Bitcoin Technical Analysis: BTC Bulls Target Upper Resistance Aiming for New Highs

Bitcoin, priced at $70,875, has exhibited strong bullish trends within the last 24 hours, with intraday prices ranging from $68,819 to $71,339. The cryptocurrency boasts a market capitalization of $1.39 trillion and a 24-hour trade volume of $37.14 billion. Analyzing the 1-hour, 4-hour, and daily charts alongside oscillators and moving averages indicates continued positive momentum, […] Original

Bitcoin Technical Analysis: Bulls Poised for Next Leg up, Targeting $70K

Over the past hour, bitcoin’s price has ranged from $68,915 to $69,121, with an intraday spread between $67,440 and $69,305. The 24-hour trading volume for bitcoin (BTC) is $23.02 billion, indicating robust market activity. The market capitalization of bitcoin remains strong at $1.36 trillion. Bitcoin Bitcoin’s daily chart highlights a major uptrend starting in early […] Original

Bitcoin Technical Analysis: BTC Maintains Stability in Narrow Triangular Formation

Bitcoin’s valuation presently resides at $68,402, boasting a market capitalization of $1.34 trillion and a 24-hour trading volume of $23.93 billion. Throughout the previous day, BTC’s price has maintained a tightly consolidated triangular pattern. Bitcoin Bitcoin’s (BTC) daily chart reveals a market that has transitioned from a significant rally to a consolidation phase. After an […] Original

Bitcoin Technical Analysis: BTC Shows Consolidation Phase Amid Recent Volatility

Bitcoin’s price on May 29, 2024, reflects a period of consolidation following recent volatility. The current price stands at $67,739 with an intraday range of $67,201 to $68,880. Technical indicators and moving averages provide a mixed outlook, indicating both potential stability and the possibility of future movements. Bitcoin Bitcoin’s 1-hour chart reveals a high of […] Original

Why is crypto up today? Full analysis

The crypto market cap is now at $2.57 trillion after ranging between $2.17 trillion and $2.7 trillion since March. Many macroeconomic factors are at play here. So why are crypto prices rising? Why are crypto prices rising? The crypto market cap, the sum total of value in the market, has been hitting a range not seen since late 2021 over the last few months. Today, Bitcoin (BTC) is trading at around $68,390 after rising 7% in the last week. This marks a 312% increase since the lows seen in 2022…