▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io CryptoCache Premium™ Trading Community / Signal Group What is CryptoCache Premium™? =========================================== Join the Community: Telegram: Discord: Social Media: Twitter: Instagram: @CryptoCacheTech =========================================== TradingView $30 Referral Link: Crypto.com $25 Referral Link: Voyager $25 BTC Referral Link: Referral Code: JAS3BE Binance Referral Link: Bittrex Referral Link: Referral Code: VYH-CDK-J5I KuCoin Referral Link: Referral Code: rJ8GB5C Coinstats Referral Link: coinstats.app/pricing?promo=cryptocache I am not a financial advisor and my opinions reflect mine only and no other entities. The ideas presented in this video are for…

Tag: Analysis

Bitcoin metrics demand BTC price gains as analysis calls for ‘near-term caution’

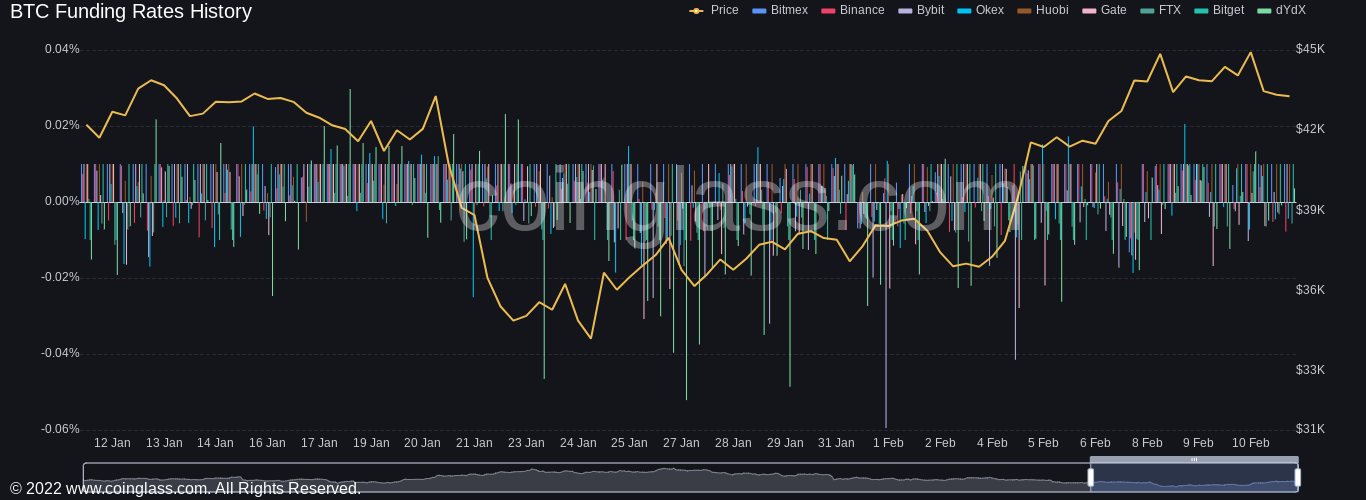

Bitcoin (BTC) has a “possibility” of winning back more lost ground this month, but a retest of $40,000 may test bulls beforehand. In its latest market update on Feb. 11, trading suite Decentrader voiced cautious optimism over BTC price action. Derivatives turn complementary After rallying above $45,500 on the back of United States economic data, BTC/USD has since dropped back into the range that has defined it this week. For Decentrader, the chances of a low-timeframe decline are there, even if on-chain metrics are putting in rare bull signals. “Bitcoin is at…

Bitcoin metrics demand BTC price gains as analysis calls for ‘near-term caution’

Bitcoin (BTC) has a “possibility” of winning back more lost ground this month, but a retest of $40,000 may test bulls beforehand. In its latest market update on Feb. 11, trading suite Decentrader voiced cautious optimism over BTC price action. Derivatives turn complementary After rallying above $45,500 on the back of U.S. economic data, BTC/USD has since dropped back into the range which has defined it this week. For Decentrader, the chances of a low-timeframe decline are there, even if on-chain metrics are putting in rare bull signals. “Bitcoin is…

A Deep Dive into Technical Analysis

Sometimes it sounds suspenseful and scary. There’s talk about a dead cat, a black swan, and a death cross. At other times, it sounds Einsteinian. There are EMAs, SMAs, and RSIs. There are Fibonacci levels, Elliot waves, and don’t forget about the Moving Average Convergence-Divergence (MACD). Pretty heady stuff. It can even sound poetic. “The trend is your friend. When in doubt, zoom out.” The “IT” I refer to is Technical Analysis (or what is commonly called TA). This tool in the toolbox of so many financial advisers is not…

BITCOIN BTC COIN PRICE PREDICTION – DOUBLE DOJI!? – TECHNICAL ANALYSIS FOR JANUARY 2022 FORECAST

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io CryptoCache Premium™ Trading Community / Signal Group What is CryptoCache Premium™? =========================================== Join the Community: Telegram: Discord: Social Media: Twitter: Instagram: @CryptoCacheTech =========================================== TradingView $30 Referral Link: Crypto.com $25 Referral Link: Voyager $25 BTC Referral Link: Referral Code: JAS3BE Binance Referral Link: Bittrex Referral Link: Referral Code: VYH-CDK-J5I KuCoin Referral Link: Referral Code: rJ8GB5C Coinstats Referral Link: coinstats.app/pricing?promo=cryptocache I am not a financial advisor and my opinions reflect mine only and no other entities. The ideas presented in this video are for…

Bitcoin Technical Analysis!Bitcoin Cryptocurrency market!Bitcoin price forecast!#shortsvideo #shorts

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version