The mayor of Panama City, Mayer Mizrachi, made several announcements at the Bitcoin 2025 conference. Mizrachi revealed that Caja de Ahorros, the second-largest bank in the country, would launch bitcoin-based savings accounts and floated the idea of accepting bitcoin payments for the canal. Panama Prepared to Become Bitcoin Hub: Mayer Mizrachi Made Major Announcements Panama […] Original

Tag: Bank

China’s state-backed think tank considers Bitcoin reserve, Sony Bank goes Web3: Asia Express

China’s finance think tank gently pushes Bitcoin into reserve asset spotlight The International Monetary Institution (IMI), China’s state-backed finance think tank, has republished an article that quietly elevates Bitcoin in the reserve asset debate. The report by former White House economist Matthew Ferranti, originally published in October by the Bitcoin Policy Institute, argues that Bitcoin can serve as a hedge for central banks in developing economies, particularly those exposed to US dollar weaponization. It was republished by the IMI on its official WeChat account on May 28 with an editorial…

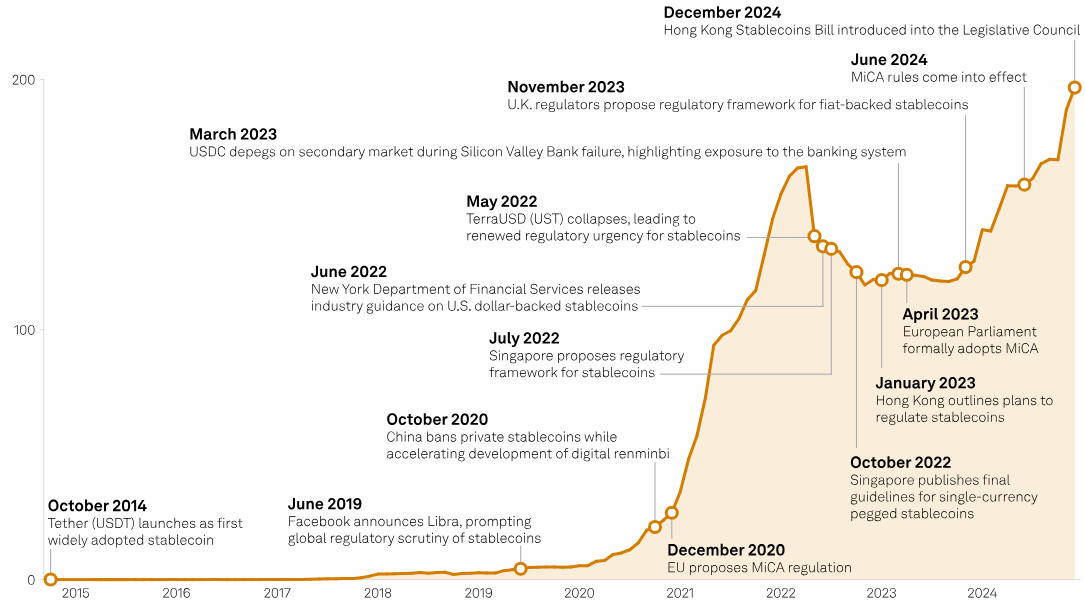

Stantander bank may issue stablecoin

Banco Santander SA, a global banking institution, is considering expanding crypto services to retail clients and potentially launching a stablecoin product. The stablecoin plans are still in the early phases. According to a May 29 Bloomberg report, the bank is considering offering both dollar and euro-pegged fiat tokens. Large banking institutions, including JPMorgan, Bank of America, Citigroup and Wells Fargo, are reportedly looking into launching stablecoins, following an industry-positive regulatory shift in the United States under US President Donald Trump. Proponents of stablecoins argue they are a way to extend…

Bank of Russia Greenlights Crypto Offerings to Institutional Players

Key Notes T-Bank, formerly Tinkoff Bank, introduced digital financial assets tied to Bitcoin through Atomyze. During Q1 2025, Russian crypto inflows rose by 51%, reaching over $81.5 billion. Russians hold an estimated $9.2 billion in cryptocurrency on centralized exchanges, with Bitcoin leading at 62%. In a major development, Bank of Russia said that it would allow selected financial institutions to offer crypto-based products to institutional and accredited investors. As a result, some banks and financial firms will be able to offer different products like crypto derivatives, security instruments, as well…

AMINA Bank Posts Record $40.4M Revenue in 2024

Swiss crypto bank AMINA Bank AG, formerly SEBA Bank AG, reported record financial results for 2024, with revenue climbing 69% year-over-year to $40.4 million. The bank also saw its assets under management (AUM) rise by 136% to $4.2 billion, driven by institutional demand and strategic expansion, according to a May 28 news release. The Zurich-based bank credited the growth to its multi-jurisdictional footprint, 24/7 trading capabilities and a lending book that has maintained zero defaults over five years. “I’m incredibly proud of our team’s tenacity and focus, which led to…

BRICS Bank Fuels Russia’s De-Dollarization Push—Global Finance Faces Reset

Russia is turbocharging its de-dollarization drive through the BRICS Bank, championing non-dollar financing and pushing a multipolar system to disrupt Western dominance in global finance. Russia Unleashes Non-Dollar Push With BRICS Bank—Is the USD Era Crumbling? Russian Deputy Foreign Minister Sergey Ryabkov reaffirmed Russia’s strategic engagement with the BRICS New Development Bank (NDB) to advance […] Source CryptoX Portal

Saylor Slams Proof-of-Reserves: ‘It’s Like Publishing Your Kids’ Bank Accounts’

Warming up for the Bitcoin 2025 conference in Las Vegas, Strategy founder Michael Saylor was asked to weigh in on the concept of proof-of-reserves. Saylor didn’t mince words, dismissing the idea entirely by stating it “dilutes the security” and calling it a flat-out “bad idea.” Saylor’s ‘Bad Idea’ Comment on Reserve Transparency Ignites Crypto Clash […] Source CryptoX Portal

Bank lobby is ‘panicking’ about yield-bearing stablecoins — NYU professor

America’s powerful banking lobby is “panicking” over the potential of stablecoins to disrupt their traditional business model, particularly when it comes to yield-bearing stablecoins, according to Austin Campbell, a New York University professor and founder of Zero Knowledge Consulting. In a May 21 social media post that begins with, “The Empire Lobbies Back,” Campbell claimed that the banking industry is especially alarmed by the potential for stablecoins to offer interest or rewards to holders. In a pointed message aimed at Democratic lawmakers, Campbell wrote that “banks want you to protect…

Guatemala’s largest bank integrates blockchain for cross-border payments

Guatemala’s largest bank, Banco Industrial, has integrated crypto infrastructure provider SukuPay into its mobile banking app, allowing locals to more easily receive remittances powered by blockchain technology. SukuPay’s infrastructure has been fully embedded inside the Zigi payment app, allowing Guatemalans to receive funds from the United States instantly for a $0.99 flat fee, the company disclosed on May 21. Users of the Zigi app do not need a crypto wallet or an International Bank Account Number (IBAN) to receive the funds, the company said. SukuPay CEO Yonathan Lapchik told Cointelegraph…

JPMorgan boss says bank users can soon buy Bitcoin

Jamie Dimon, the CEO of JPMorgan, said his bank will soon allow its clients to buy Bitcoin, but it won’t custody the cryptocurrency. “We are going to allow you to buy it,” Dimon said at JPMorgan’s annual investor day on May 19. “We’re not going to custody it. We’re going to put it in statements for clients.” CNBC reported that Dimon also remarked on his long-held skepticism about crypto assets, pointing to their use in money laundering, sex trafficking and terrorism. “I don’t think you should smoke, but I defend…