Operation Choke Point 2.0, a campaign of regulatory pressure against cryptocurrency firms, has sparked a fresh wave of criticism from notable industry figures, including former Silvergate Bank Chief Technology Officer Chris Lane and entrepreneur David Sacks, recently appointed “Crypto Czar” by President-elect Donald Trump. Operation Choke Point 2.0 Under Fire from Industry Voices and Trump’s […] Source CryptoX Portal

Tag: Bank

No Bitcoin! Central Bank of Chile Rejects Adding BTC as a Reserve Asset

The Central Bank of Chile recently stated that it could not add bitcoin to its reserves, as this crypto asset fails to comply with the requirements to be included as a bank investment. Central Bank of Chile Would Not Add Bitcoin to Its Reserves The debate about bitcoin as a reserve asset and the issue […] Original

Iran’s Digital Rial Near Launch, Central Bank Signals Progress

Iran’s central bank signals the imminent launch of the digital rial, a central bank digital currency (CBDC), to streamline payments and bolster international financial integration despite sanctions. Iran’s Central Bank Sends Clear Signals on the Digital Rial Breakthrough Central Bank of Iran (CBI) Governor Mohammad Reza Farzin discussed the digital rial, Iran’s central bank digital […] Source CryptoX Portal

Largest Digital Bank in Hong Kong to Offer Bitcoin Trading to Retail Users

ZA Bank combines traditional banking with digital assets to offer cryptocurrency services to retail users. Bitcoin Trading for Retail Customers in Asia Zhong An (ZA) Bank, a digital bank in Hong Kong, has declared that it has become the first bank in Asia to provide retail customers with bitcoin trading services. The launch of the […] Original

Bitget Now Supports Bank Transfers in Vietnam via QR Codes

Bitget has announced its integration of bank transfers in Vietnam through QR codes, making it the first exchange to adopt this payment method. This new feature allows users to deposit Vietnamese Dong (VND) and withdraw funds seamlessly, enhancing accessibility to the crypto market. By utilizing Viet QR, a standardized QR code system that enables secure […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Bitcoin Open to a Bank Run, Smaller Parties Vulnerable to Death Spiral Event

Justin Bons, founder and CIO of Cybercapital, a European cryptocurrency fund, alerted about the vulnerability of smaller parties in the case of a bitcoin bank run. A price drop event would trigger the hypothetical event, forcing miners to shut down their operations due to unprofitability and affecting network operativity. Cybercapital CIO Justin Bons Alerts About […] Original

Polymarket Trader Loses Millions on Tyson After Making Bank on Trump

Prediction markets are usually structured as yes/no bets on a given outcome; each share pays out $1 (in cryptocurrency, in Polymarket’s case) if the bet proves correct, and zero if not. The price of a share, expressed in cents on the dollar, indicates the market’s assessment, when translated into percentage terms, of the prediction coming true. Source

Goldman Sachs’ Bold Bet: Bank Boosts Its Bitcoin ETF Stake to $710 Million

The substantial increase in Goldman Sachs’ bitcoin ETF holdings demonstrates the growing interest of institutional investors in bitcoin. Institutional Investments in Bitcoin Keeps Rising The U.S. Securities and Exchange Commission’s (SEC) 13F report for Q3 ending Sept. 30 revealed that Goldman Sachs now owns $710 million in cryptocurrency assets. The 13F report is a mandatory […] Original

Bank Clients Just Dipped Their Toes Into Bitcoin (BTC) ETFs, but Q4 Could See a FOMO Spike

Other top-tier banks/wealth management operations, including Morgan Stanley, Cantor Fitzgerald, Royal Bank of Canada, Bank of America, UBS and HSBC, didn’t add to or subtract much from their positions. A new entrant was Australian investment bank Macquarie Group, which purchased 132,355 shares of IBIT worth $4.8 million. Wells Fargo, which has a very minor stake in the ETFs, held most of its shares in the Grayscale Bitcoin Trust (GBTC) and Grayscale Bitcoin Mini Trust (BTC). Source

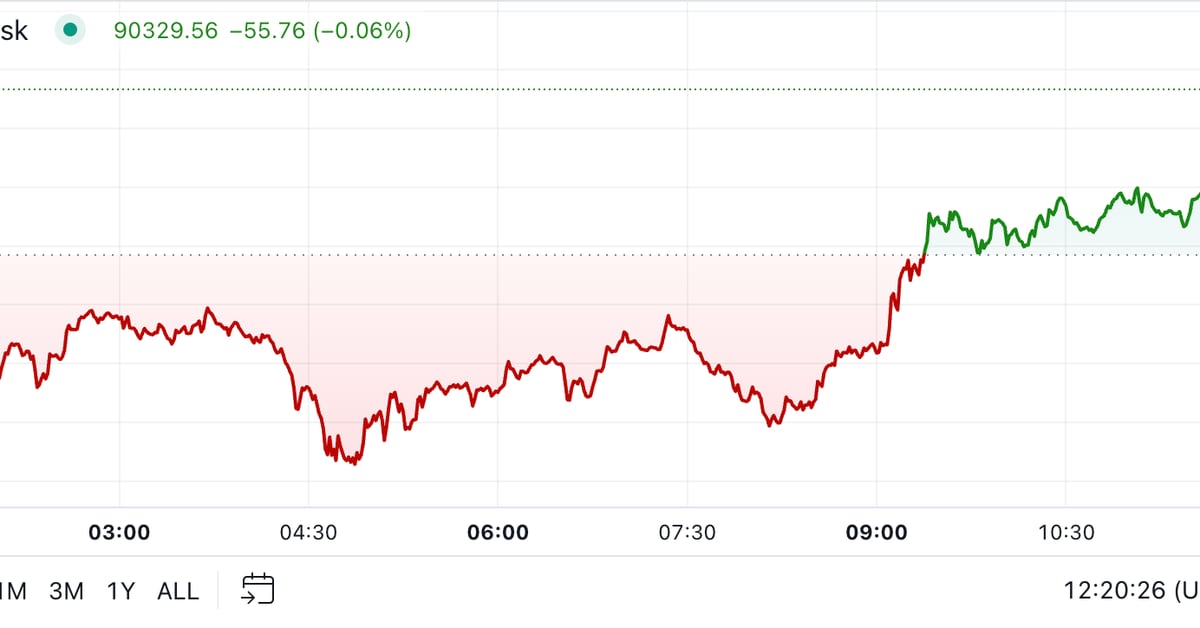

Bitcoin Shaky as Traders Bank Profits

Bitcoin pared some of Thursday’s losses during the European morning to trade above $90,000. BTC remains over 1% lower in the last 24 hours, a possible sign of profit-taking following its surge above $93,000 earlier in the week. The drop was catalyzed by Fed Chair Jerome Powell’s hawkish comments that damped hopes of swifter interest-rate cuts. “The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell said in prepared remarks at a Dallas conference. As of Friday, the market is pricing…