A New Jersey judge has given preliminary approval for a $13-million settlement between a group of investors and cryptocurrency lending company BlockFi after months of delays. In a Thursday filing in the US District Court for the District of New Jersey, Judge Claire Cecchi ordered BlockFi’s insurers to pay more than $13 million to an escrow account within 30 days as part of a class-action lawsuit filed in 2023. The order followed a February motion for preliminary approval, which was held up in part due to an objection from one…

Tag: BlockFi

BlockFi Bankruptcy Administrator and DOJ Settle $35M Crypto Lawsuit

The administrator overseeing BlockFi’s bankruptcy wind-down and the US Department of Justice (DOJ) have reached a settlement to dismiss a $35 million crypto asset transfer lawsuit involving the crypto lender. The agreement was approved by Judge Michael B. Kaplan of the US Bankruptcy Court for the District of New Jersey on Friday, according to court filings. The lawsuit, filed in May 2023, sought to transfer over $35 million in crypto assets from BlockFi to the US government. The DOJ said it had warrants to seize the funds from the BlockFi…

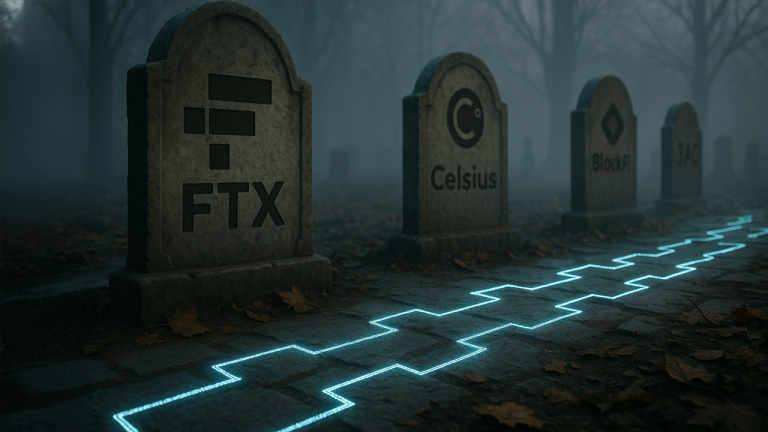

$1.5B in Crypto Still Sits in the Ruins of Firms Like FTX, Terraform, Celsius, and Blockfi

Over the past few years, a wave of digital asset firms collapsed for a mix of reasons—some dragged down by earlier disasters like the FTX and Terraform Labs fiascos. Here’s a closer look at a handful of wallets tied to those now-defunct ventures and a glimpse at what’s still sitting onchain. Collapsed Crypto Entities Still […] Source CryptoX Portal

BlockFi Administrator Submits Plan in Court to Make Customers Whole

“This transaction marks a final chapter in the wind-down and is the best possible outcome for customers of BlockFi,” said Mohsin Y. Meghji, Plan Administrator of BlockFi Inc. Source

BlockFi to Start Interim Crypto Distributions This Month Through Coinbase

“The distributions will be processed in batches in the coming months, and eligible clients will receive a notification to the BlockFi account email on file,” the announcement said. “Please note that non-US Clients are unable to receive funds at this time due to the regulatory requirements applicable to them.” Source

Bankrupt Crypto Lender Blockfi Enlists Coinbase to Distribute Crypto Payouts

The now-defunct crypto lender Blockfi is officially shutting down the firm’s web portal this month according to an update from the firm. Blockfi said that it has partnered with Coinbase to help facilitate the execution of withdrawals to eligible Blockfi customers. Blockfi Collaborates With Coinbase for Withdrawals, Plans to Shut Down Web Portal After the […] Source CryptoX Portal

Zac Prince Departs BlockFi for Real Estate Tech Startup Re Cost Seg

“In marketing, crypto is unique with its 24/7 media cycle, so learning to navigate that and developing strategies, such as partnering with big podcasters, was key,” he continued. I also learned a lot about team building; we had a phenomenal team at BlockFi, many of whom are staying in the crypto industry, and some have even started new crypto companies, which makes me proud.” Source

BlockFi Settles With FTX, Alameda Estates for $874.5M

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

FTX, BlockFi claims settlement allowed to proceed, judge declares

Bankrupt crypto companies FTX and BlockFi are allowed to proceed in negotiations for their claims settlement, according to a new court filing. On Nov. 13, United States bankruptcy Judge Michael Kaplan ordered the end of an automatic holding placed on proceedings between the two firms. FTX debtors can now pursue their “arguments, defenses, counterclaims, setoffs, or otherwise” concerning the BlockFi claims in the FTX bankruptcy proceeding. Both entities filed for Chapter 11 bankruptcy status in November 2022 after the implosion of FTX at the beginning of that month. BlockFi is…

BlockFi, FTX Can Start Mediation, File Counterclaims as Automatic Stay Is Lifted by U.S. Judge

The stay has been modified to allow FTX debtors to make “arguments, defenses, counterclaims, setoffs, or otherwise … with respect to the BlockFi claims in the FTX bankruptcy proceeding,” according to a Nov. 13 court order by U.S. bankruptcy judge Michael Kaplan. Source