Crypto lender BlockFi has halted client withdrawals on its platform as part of a broader limit on platform activity in the wake of FTX’s collapse. The company said in a Nov. 11 tweet that a “lack of clarity on the status of FTX.com, FTX US and Alameda” has prevented it from being able to operate as normal. As a result, it has limited platform activity until there is further clarity on the developing situation, it said. The firm has also requested that clients do not deposit to BlockFi wallets or…

Tag: BlockFi

Crypto Lender BlockFi Pauses Withdrawals in Wake of FTX Collapse

Crypto Lender BlockFi said it could not conduct business as normal and would be limiting activity in the wake of FTX’s collapse. Source

3 Senior Executives Jump From Crypto Lender BlockFi: Sources

BlockFi, which was caught up in a cascade of failing crypto companies earlier this year, escaped bankruptcy court, where crypto lender Celsius Network and crypto broker Voyager Digital have ended up – but at the cost of agreeing to hard-nosed acquisition terms set out by Bankman-Fried. Source

Sam Bankman-Fried’s Crypto Exchange FTX Could Buy BlockFi for Only $15M – or a Lot More If the Lender Hits Big Goals

FTX US, the sources said, would pay an additional $25 million if, by Dec. 31, BlockFi wins an important regulatory clearance from the U.S. Securities and Exchange Commission for BlockFi Yield, a product that would generate interest on depositors’ crypto by lending the crypto out at a higher rate. Source

BlockFi shows top growth among U.S. companies, the U.K. posts over 10% inflation and BitGo plans to bring a lawsuit against Galaxy Digital.

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Fed to issue long-awaited guidelines for granting master accounts to crypto banks Crypto’s continued journey into the mainstream has come with various levels of regulatory action across the globe. This week brought clarity in terms of expectations for crypto-focused banks seeking accounts with the…

BlockFi tops the Inc. 5000 list with almost 250,000% revenue growth in three years

Inc. magazine has named BlockFi the fastest growing company in the United States in 2022. At the top of the magazine’s Inc. 5000 2022 list, it experienced 245,616% growth, a lead of more than 99,000% over the second-place company, a platform for hiring nurses. The median growth rate was 230% across all 5,000 entries. The Inc. list “ranks companies by overall revenue growth over a three-year period,” according to the magazine. In the fast-moving world of crypto, three years is practically an epoch, and BlockFi’s achievement is especially notable after…

Have You SEEN THIS Crypto Report?! What It Says!!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 🛒 Get The Hottest Crypto Deals 👉 📲 Insider Info in my Socials 👉 👕 My Merch Store 👉 🔥 TOP Crypto TIPS In My Newsletter 👉 ~~~~~ 📺Essential Videos📺 Coinmarketcap vs. Coingecko 👉 Ethereum Updates 👉 Exchange Tokens 👉 BNB Potential 👉 Crypto Market Low 👉 Terra Collapse Investigation 👉 Three Arrows Capital Insolvency 👉 Coin Bureau Clips Livestream 👉 Axie infinity Analysis 👉 Crypto.com CRO Controversy 👉 GBTC vs. Spot Bitcoin ETF 👉 European Energy Crisis 👉 ~~~~~ ⛓️ 🔗…

Chute du BITCOIN et des CRYPTOS, qu'attendre de la suite ?

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io S’il n’est pas possible de prévoir l’avenir, nous pouvons malgré tout analyser la situation actuelle et concentrer notre attention sur les sujets d’importance encore sous les feux des projecteurs. Dans cette vidéo nous revenons sur l’actualité crypto, macro éco et nous réalisons un zoom sur les questions encore ouvertes au coeur de la chute des dernières semaines. 🔗LIENS DE LA VIDEO & SOURCES: Mise en pause des retraits chez Celcius : Celsius détenait beaucoup de stETH : Le token $CEL : Les…

END OF CRYPTO LENDING | FTX BUYING IN FIRE SALE

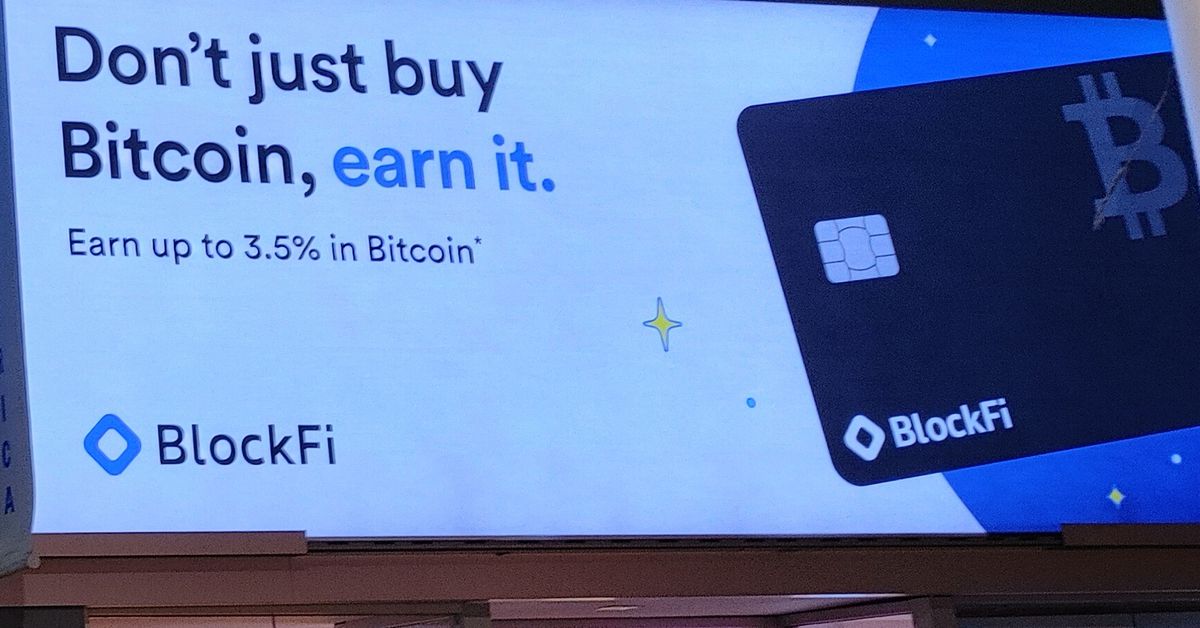

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Big news about Celsius Network, Voyager, Blockfi and FTX. Is this the end of CeFi and crypto lending? 🟪Buy Bitcoin & Crypto with IRA/401k w/ItrustCapital ($100 Bonus) 📊Buy Bitcoin & Crypto w/Bitget (No KYC and up to $8000 Bonus) 💳Get a Blockfi Bitcoin Reward (1.5% Back in BTC) Credit Card: 🚧Buy Crypto Domain Names w/ Unstoppable Domains: 💰Earn Interest and DCA Crypto w/ Vauld: 🔒Safeguard Your Bitcoin and Crypto w/ Ledger Hardware Wallet 🚨Protect Yourself with NordVPN (69% off) 🔥CryptosRus’ Best Crypto…

Crypto Lender BlockFi Had $1.8B in Open Loans at End of June and $600M of Exposure

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity…