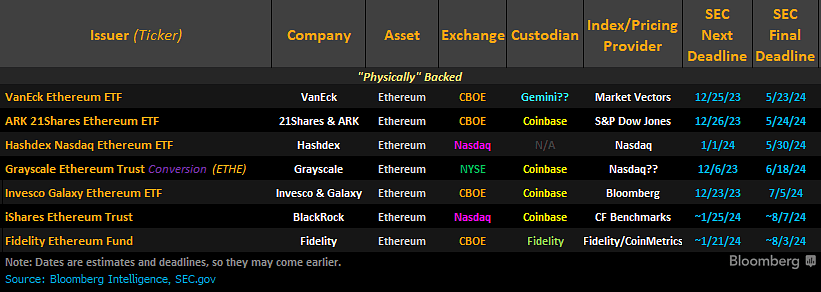

The journey towards the approval of an Ethereum ETF in the United States has seen a new development yesterday as the US Securities and Exchange Commission (SEC) has announced a delay in the decision for Grayscale’s Ethereum trust conversion into a spot Exchange Traded Fund (ETF). The SEC has stated the need for an extended period to evaluate the proposed rule change, pushing the new deadline Grayscale to January 25, 2024. In its reasoning, the SEC has reiterated, “The commission finds it appropriate to designate a longer period within which…

Tag: Bloomberg

Bloomberg Expects Bitcoin Price To Surpass $500,000 In Upcoming Crypto Super Cycle

In a recent Bloomberg report, it has been suggested that the rise of Bitcoin price to over $42,000 is just the beginning of a new crypto super cycle that will push the world’s largest cryptocurrency to over $500,000. According to Bloomberg, proponents of this theory argue that Bitcoin represents a new monetary order that is captivating Wall Street and fueling a “palpable sense of euphoria” within the digital asset community. Bitcoin Price Potential Soars The remarkable performance of the Bitcoin price in recent months took many by surprise, as the…

Bitcoin Eyes New Highs As Bloomberg Analyst Reiterates 90% Chance Of January ETF Approval

Bitcoin (BTC), the leading cryptocurrency, is currently in an upward accumulation phase, inching closer to surpassing its current yearly high of $38,390. This upward trend is further fueled by the anticipation surrounding the approval of Bitcoin spot exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC). Bitcoin ETF Approval By January 10 In a recent post on X (formerly Twitter), Erich Balchunas, a Bloomberg ETF expert, shared his perspective on the probability of Bitcoin ETF approval. Balchunas maintains a 90% chance of SEC approval by January 10, which…

Tether, Bitfinex to Drop Opposition to FOIL Request by Journalists Including Bloomberg Businessweek’s Zeke Faux

Tether previously made a similar announcement after losing in court twice when attempting to block a June 2021 FOIL request filed by CoinDesk. That request pertained to documents produced during the New York Attorney General’s inquiry on allegations that USDT, the U.S. dollar-pegged stablecoin that Tether issues, was not sufficiently backed by reserves from mid-2019 to early 2021, settling charges with the company at the end of that period. Source

Binance in Talks to Pay More Than $4B to End U.S. Criminal Case vs Crypto Exchange: Bloomberg

CryptoX – Cryptocurrency Analysis and News Portal Binance Holding Ltd. would be asked to pay $4 billion to settle U.S. Department of Justice accusations of multiple criminal violations, according to a report from Bloomberg News on negotiations between the DOJ and the company, which are also leaving open the possibility that its founder Changpeng “CZ” Zhao would also face U.S. criminal charges. Source The post Binance in Talks to Pay More Than $4B to End U.S. Criminal Case vs Crypto Exchange: Bloomberg appeared first on CryptoX. CryptoX Portal

Bloomberg Intelligence Envisions $100 Billion Market If Regulatory Approval Granted

As Bitcoin (BTC) continues its upward trajectory toward $38,000, the long-awaited arrival of a US spot Bitcoin exchange-traded fund (ETF) could open the floodgates of digital currency investing for institutional and retail investors. Notably, Bloomberg Intelligence estimates that the potential spot Bitcoin ETF market could reach a staggering $100 billion, signaling a breakthrough for cryptocurrencies on Wall Street. Inquiries Surge As Spot Bitcoin ETF Looms The anticipation surrounding Bitcoin ETFs stems from the expected regulatory approval by the US Securities and Exchange Commission (SEC). After a decade of rejecting various…

Bloomberg analysts estimate spot Bitcoin ETF market to hit $100b

Sources close to Mike Novogratz’s Galaxy Digital say the firm already held a call with hundreds of investment firms about allocating to Bitcoin. Although the U.S. Securities and Exchange Commission (SEC) is yet to approve a spot Bitcoin (BTC) exchange-traded fund (ETF), experts say the market might eventually gain $100 billion from Wall Street investors. As per Bloomberg’s sources familiar with the matter, Galaxy Digital, a crypto bank founded by Bitcoin bull Mike Novogratz, held a call earlier this month with roughly 300 investment professionals about doubling down on Bitcoin.…

Jump Trading, Wormhole Part Ways Amid Tough Crypto Market: Bloomberg

Several high-ranking Wormhole employees, including the project’s CEO and COO, have left Jump to “run Wormhole as an independent entity,” the publication reported, citing people familiar with the matter. The parting of ways comes less than two years after Jump poured $320 million into Wormhole after the inter-blockchain messaging platform suffered a massive hack. Source

Bloomberg analyst reveals realistic approval date for Bitcoin ETF

Bloomberg analyst James Seyffarth believes the SEC will again delay the decision on spot Bitcoin (BTC) ETFs. Seyffarth believes Hashdex and Franklin, whose next deadline is Nov. 17, and the Global X ETF (Nov. 21) bids will be delayed. But Seyffart still believes there is a 90% chance that spot BTC ETFs will be approved before Jan. 10, 2024. Okay, we’re nearing in on deadline dates for 3 spot #Bitcoin ETF applications. I want to get ahead of it because there’s a pretty good chance we’ll see delay orders from…

Blockchain.com Closes $110M Raise: Bloomberg

The exchange’s valuation in the $110 million round was less than half of its previous $14 billion valuation, according to the report. Source