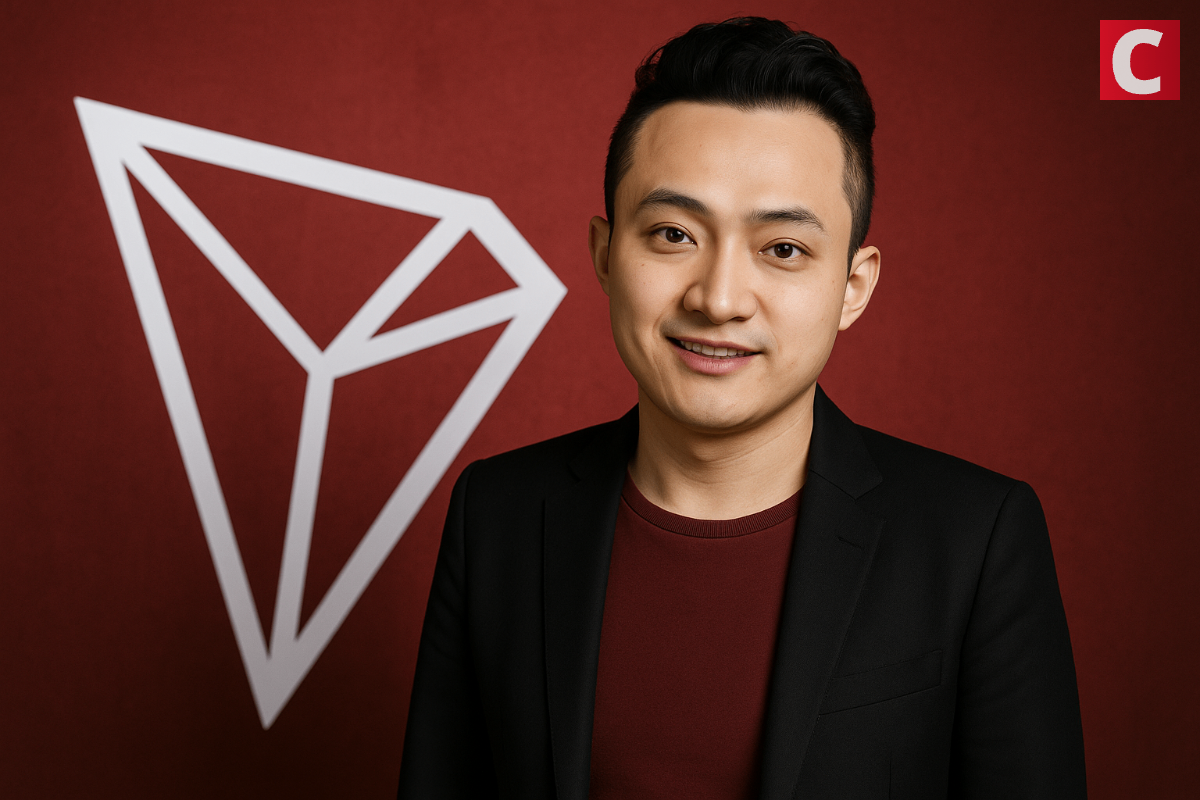

Key Notes Justin Sun has accused Bloomberg of misleading the public by publishing incorrect information about his cryptocurrency holdings. He has also requested a temporary restraining order to prevent Bloomberg from publishing its findings. Sun thinks the outlet is planning to use the information for an “unrelated Bloomberg article”. . Tron TRX $0.36 24h volatility: 1.3% Market cap: $34.54 B Vol. 24h: $2.06 B founder Justin Sun has sued Bloomberg, accusing the outlet of publishing false information about his crypto holdings. The outlet reportedly listed assets Sun never owned while…

Tag: Bloomberg

❌ BITCOIN & ETHEREUM: THIS IS HOW IT ENDS!!!!! ❌ [watch ASAP!!!!!]

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 🔥 Bybit $30’000 Deposit Bonus [NEW 🥳] 🔶 👈 (click here) 🔥 Register on Phemex **$6000 Deposit Bonus** (Phemex Web3) 🔷 👈 (Click here) ✅ Takes only seconds to register ✅ *Bonus Only After Initial Deposit* ❌ BITCOIN & ETHEREUM: THIS IS HOW IT ENDS!!!!! ❌ [watch ASAP!!!!!] 🔥 Join CryptoAnup Platinum Group for FREE 🔥 (for limited time only!!!) 👉 🚀 Follow Crypto Anup Alts: 💎 Telegram: (NEW💥) 🐦Twitter 📸 Instagram 🇩🇪FOLLOW CRYPTO ANUP GERMAN CHANNEL🇩🇪 —————————————————————————————————————————— #cryptocurrency #bitcoin #news #btc…

XRP ETF Approval Expected in September or October: Bloomberg

Key Notes Bloomberg’s Eric Balchunas predicts XRP ETF approval by September or October. SEC’s new “listing standards” favor altcoins with six months of futures trading, XRP included. XRP price eyes a breakout from an ascending channel, with resistance near $3.90. Bloomberg analyst Eric Balchunas has projected a likely September or October approval window for altcoin ETFs, including the long-anticipated XRP ETF. The forecast follows the United States Securities and Exchange Commission’s recent reveal of new listing standards for crypto exchange-traded products (ETPs). The SEC’s “Listing Standards” for crypto ETPs is…

Bitmain to launch first U.S. Bitcoin mining chip factory by 2026: Bloomberg

Bitmain plans to open its first U.S.-based manufacturing facility by early 2026 and set up a new headquarters in either Texas or Florida later this year. Bitmain, the world’s leading manufacturer of Bitcoin (BTC) mining ASIC chips, plans to launch… Original

Michael Saylor’s Strategy Boosts Latest Preferred Share Raise to $2B From $500M: Bloomberg

Strategy (MSTR), the world’s largest corporate bitcoin (BTC) holder helmed by Michael Saylor, has lifted the size its preferred stock offering STRC to $2 billion, Bloomberg reported on Thursday. That’s a significant raise from the original plan of issuing 5 million shares for $100 $100 each for a total of $500 million announced on Monday. STRC (dubbed “stretch” by the company) aims to deliver a regular dividend to investors, initially set at a 9% rate. According to the Bloomberg report, the firm is…

BlackRock’s Bitcoin ETF Blows Past $80,000,000,000, Faster Than Any Other Exchange-Traded Fund in History: Bloomberg Analyst

Senior Bloomberg analyst Eric Balchunas says that BlackRock’s Bitcoin (BTC) exchange-traded fund has surpassed the $80 billion landmark faster than any ETF in history. In a new thread on the social media platform X, Balchunas says that the iShares Bitcoin Trust ETF (IBIT) is now worth $83 billion, the 21st largest ETF overall. “IBIT blew through the $80 billion mark [on Friday], fastest ETF to get there in 374 days, about 5x faster than the previous record, held by VOO, which did it in 1,814 days.” Source: Eric Balchunas/X Balchunas…

Binance Founder CZ Threatens To Sue Bloomberg For Defamation

Key Notes Binance Founder CZ has hinted at the possibility of pursuing legal actions against Bloomberg. The media house allegedly defamed the exchange by publishing a “hit piece.” CZ has been accused of having ties with WLFI amid a broader media debacle. Changpeng Zhao, the founder of leading cryptocurrency exchange Binance, is upset with Bloomberg. He is considering legal actions. This is regarding a news article from the media outlet that supposedly included a factual error, believed to be sponsored by a competitor, although no specific name was mentioned. Pattern…

Binance’s CZ Denies Bloomberg Report on Trump-Backed USD1 Stablecoin

Binance co-founder and former CEO Changpeng “CZ” Zhao has rejected a recent Bloomberg report linking him to a stablecoin issued by World Liberty Financial (WLF), one of the crypto businesses tied to US President Donald Trump. In a post on X responding to the investigation, Zhao called the article a “hit piece (sponsored by a competitor)” filled with “so many factual errors” that he “doesn’t even know where to begin.” He added, “Might have to sue them again for defamation.” The Bloomberg report claimed Binance developed the original smart contract…

BlackRock’s Bitcoin Exchange-Traded Fund (IBIT) Just Two Spots Away From Being Firm’s Top Revenue-Generating ETF: Bloomberg Analyst

BlackRock’s iShares Bitcoin Trust ETF (IBIT) is already generating substantial revenue for the world’s largest asset manager, despite being on the market for less than two years. In a new post on the social media platform X, Bloomberg analyst Eric Balchunas says that IBIT needs to grow its fund’s assets by less than $10 billion to rank as BlackRock’s top revenue-generating exchange-traded fund (ETF). “IBIT is now the third-highest revenue-generating ETF for BlackRock out of 1,197 funds, and is only $9 billion away from being #1. Just another insane stat…

Italian Banking Group Banca Sella Pilots Stablecoin Custody With Fireblocks: Bloomberg

Banca Sella, an Italian banking group known for tech experiments, has begun an internal trial that lets a handful of employees hold crypto, including stablecoins, through custody software from Fireblocks. The trial runs until the end of the summer, after which executives will decide whether to open the vault to the group’s 1.4 million customers who keep more than €66 billion ($77.5 billion) under custody, Bloomberg reports. Sella’s test covers custody only. Trading in bitcoin or other volatile tokens is not on its roadmap, according to the story. Europe’s clearer…