Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Strategy, formerly known as MicroStrategy, is on track to report an impressive $14 billion in unrealized gains from its extensive Bitcoin accumulation strategy. Co-founded by Michael Saylor, the company has successfully transformed itself from a struggling…

Tag: Bloomberg

Ex-Blackstone, Tether Execs Seek $1B to Build Multitoken Crypto Treasury: Bloomberg

A blank-check company backed by former Blackstone dealmaker Chinh Chu and Tether co-founder Reeve Collins is looking to raise $1 billion to build a publicly traded cryptocurrency treasury firm, Bloomberg reported citing sources familiar with the plans. The vehicle, M3-Brigade Acquisition V, plans to rebrand and use the cash to buy a basket of tokens including bitcoin , ether and Solana’s sol . The move comes as public companies worldwide are rushing to add cryptocurrencies as treasury assets. Many, however, are focusing on bitcoin, the largest crypto by market cap,…

Hong Kong Family Office VMS to Allocate Up to $10M to First Crypto Play: Bloomberg

VMS Group, a Hong Kong family office with just under $4 billion in assets under management (AUM), is venturing into crypto for the first time, Bloomberg reported on Monday. The firm has earmarked up to $10 million to investment strategies run by decentralized finance (DeFi) hedge fund Re7 Capital, partner Elton Cheung told the news organization. VMS is looking to diversify into more liquid investments, Cheung said. Its investment strategy has largely been focused on private equity during its two-decade existence. Private equity has become less liquid because investees are…

XRP ETF Odds Jump to 95% as SEC Shows Positive Signals, Bloomberg Analysts Say

Bloomberg analysts project XRP’s ETF approval odds at 95%, igniting powerful institutional momentum poised to reshape crypto markets and thrust digital assets into mainstream financial dominance. XRP ETF Nears SEC Approval With 95% Odds, Say Bloomberg Analysts Mounting anticipation is sweeping across the crypto market as multiple digital assets, including XRP, edge closer to potential […] Source CryptoX Portal

Bloomberg Analysts Revises XRP and Cardano ETF Approval Odds To 90%

Key Notes Bloomberg ETF analysts raised the odds of the US SEC approving spot XRP, DOGE, and ADA ETFs to 90%. This is an improvement from the previous position of the analysts regarding the crypto ETF approvals. VanEck recently listed its SOL ETF on DTCC’s clearing and settlement platform. Eric Balchunas and James Seyffart, two top Bloomberg Senior ETF analysts, have raised the odds of the United States Securities and Exchange Commission (SEC) approving spot XRP, Dogecoin, and Cardano ETFs to 90%. Seyffart announced this in an X post, citing…

Bitcoin To ‘Eclipse’ $200k This Year, Here’s When And How | Matt Hougan w/ @BonnieBlockchain

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Matt Hougan, CIO of Bitwise, discusses the outlook for Bitcoin and DeFi in 2025. Use my promo codes to get a 10% discount on BTC Vegas (May 27-29), the world’s biggest Bitcoin conference: BTC Vegas 2025: BitcoinAsia: Subscribe to my free newsletter: Listen on Spotify: Listen on Apple Podcasts: FOLLOW BONNIE BLOCKCHAIN: YouTube: X (@BlockBonnieC): Instagram: TikTok: FOLLOW DAVID LIN: X (@davidlin_TV): TikTok (@davidlin_TV): Instagram (@davidlin_TV): For business inquiries, reach me at david@thedavidlinreport.com *This video is not financial advice. The channel is…

USDC Issuer Circle IPO Pricing Could Jump Above Range After Investor Orders Surge: Bloomberg

Stablecoin issuer Circle Internet Group may price its upcoming initial public offering (IPO) well above its marketed range after demand from investors far outpaced supply, according to Bloomberg. The company has reportedly received orders for more than 25 times the number of shares available in the offering. Circle is expected to finalize its pricing following U.S. market hours on Wednesday. Circle’s most recent filing with the Securities and Exchange Commission (SEC) showed plans to sell 32 million shares at a range between $27 and $28 apiece. At the high end…

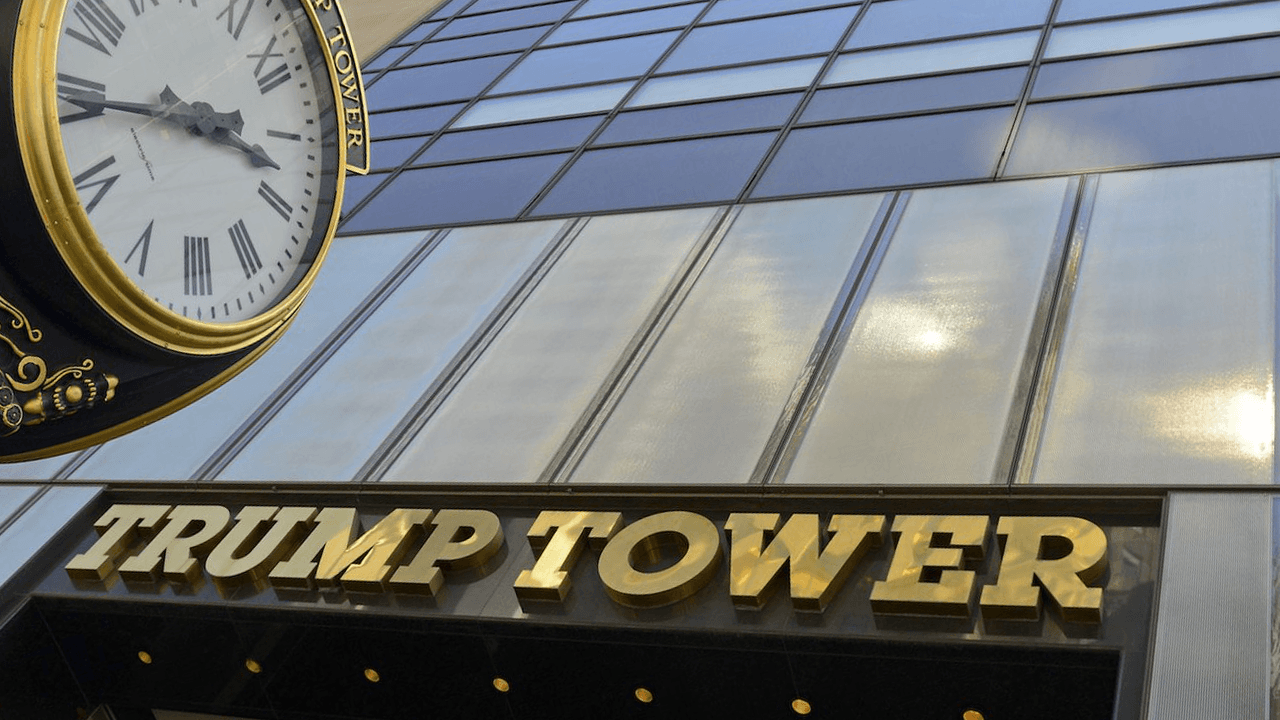

Boutique Trump Tower Bank Is Quietly Stockpiling Bitcoin: Bloomberg

Dominari Holdings Inc., a small investment bank based in Trump Tower, is stockpiling bitcoin as it pivots deeper into crypto, Bloomberg first reported. Investment Bank Tied to Trump Family Deepens Crypto Footprint Dominari Holdings Inc. (Nasdaq: DOMH), a small bank headquartered in New York’s Trump Tower, is increasing its bitcoin ( BTC) holdings while pursuing […] Original

Coinbase considered Saylor-like Bitcoin strategy before opting out: Bloomberg

Coinbase reportedly considered adopting a Bitcoin investment playbook like Michael Saylor’s Strategy on multiple occasions, but decided against it each time out of fear that it would kill the firm’s crypto exchange, Bloomberg reported. “There were definitely moments over the last 12 years where we thought, man, should we put 80% of our balance sheet into crypto — into Bitcoin specifically,” Coinbase CEO Brian Armstrong told Bloomberg in a May 9 video call. Armstrong said the Bitcoin (BTC) strategy could have risked the company’s cash position and potentially killed the…

Morgan Stanley eyes crypto rollout for E*Trade platform: Bloomberg

Banking giant Morgan Stanley reportedly plans to list cryptocurrencies on its E*Trade investment brokerage and trading platform. According to a May 1 Bloomberg report, the firm intends to list crypto assets on E*Trade in 2026. The plan is still in early development, and the bank is said to be exploring partnerships with established crypto firms to power the service. Internal discussions about cryptocurrency support reportedly began in late 2024. E*Trade homepage. Source: E*Trade This would not be Morgan Stanley’s first exposure to digital assets. The bank’s wealthiest clients have had…