More than 70 cryptocurrency exchange-traded funds (ETFs) are slated for review by the US Securities and Exchange Commission (SEC) this year. According to Bloomberg analyst Eric Balchunas, the list includes proposed ETFs holding a range of assets, from altcoins to memecoins to derivatives instruments. “Everything from XRP, Litecoin and Solana to Penguins, Doge and 2x Melania and everything in between,” Balchunas said in an April 21 post on the X platform. “Gonna be a wild year.” Crypto ETFs’ SEC review schedule. Source: Eric Balchunas/Bloomberg Related: ARK adds staked Solana to…

Tag: Bloomberg

Bloomberg warns of a financial crisis: will it boost Bitcoin, altcoins?

Bloomberg’s editorial board has warned of a potential financial crisis similar to what happened in 2008/9 happening this year as geopolitical risks rise. In an article, the board warned that such a crisis could be triggered by the substantial sums… Original

This year’s top ETF strategy? Shorting Ether — Bloomberg Intelligence

Betting against Ether has been the best performing exchange traded fund (ETF) strategy so far in 2025, according to Bloomberg analyst Eric Balchunas. Two ETFs designed to take two-times leveraged short positions in Ether claimed (ETH) first and second place in a Bloomberg Intelligence ranking of the year’s top-performing funds, Balchunas said in a post on the X platform. In the year-to-date, ProShares UltraShort Ether ETF (ETHD) and T Rex 2X Inverse Ether Daily Target ETF (ETQ) are up approximately 247% and 219%, respectively, Bloomberg Intelligence data showed. The implications…

As Schiff calls Bitcoin’s death, a Bloomberg analyst sees the S&P now mirroring its chaos

As Bitcoin falls and volatility spreads, Schiff sees the end. But with the S&P now mirroring BTC’s behavior, is Bitcoin really failing? Bitcoin “dies” again Peter Schiff has long been one of Bitcoin’s (BTC) most vocal critics. Over the years, he has maintained that the asset lacks intrinsic value, that its price is driven purely by speculation, and that it would collapse in the face of a real economic crisis. Bitcoin was born out of the financial crisis of 2008. Ironically, the financial crisis of 2025 will kill it. —…

Ether ETF staking could come as soon as May — Bloomberg analyst

Ether exchange-traded funds (ETFs) in the United States may be able to start staking a portion of their tokens as soon as May, according to Bloomberg Intelligence analyst James Seyffart. On April 9, the US Securities and Exchange Commission (SEC) authorized exchanges to begin listing options contracts tied to spot Ether (ETH) ETFs after greenlighting Bitcoin (BTC) ETF options in September. However, issuers are still waiting for the regulator to allow Ether ETFs to offer staking after filing numerous requests for permission earlier this year. Source: James Seyffart The approval of…

DekaBank Debuts Crypto Trading, Custody Services for Institutional Clients: Bloomberg

DekaBank, a German investment bank with 377 billion euros ($395 billion) in assets under management, introduced cryptocurrency trading and custody services for institutional clients after almost two years of development. The Frankfurt-based company’s move follows regulatory approval for a crypto custody license from the Federal Financial Supervisory Authority (BaFin), while operating under the supervision of the European Central Bank (ECB), Bloomberg reported. “We have the necessary experience, required licenses and a tested, ready-to-use infrastructure to support savings banks and our institutional clients,” board member Martin K. Müller told Bloomberg. DekaBank,…

Dogecoin Outperforms Bitcoin: Bloomberg Expert Explains Why

Este artículo también está disponible en español. Over the past few weeks, Dogecoin (DOGE) has exhibited a massive surge, significantly outperforming Bitcoin (BTC) and other major altcoins. The memecoin has soared by 170% in the last two weeks, an astounding 250% over the past five weeks, and 95% in just the last five days. This meteoric rise has positioned Dogecoin as one of the top-performing digital assets in the current market landscape. Why Is Dogecoin Outperforming Bitcoin? Michael P. Regan, the global team leader for cryptocurrencies at Bloomberg and a…

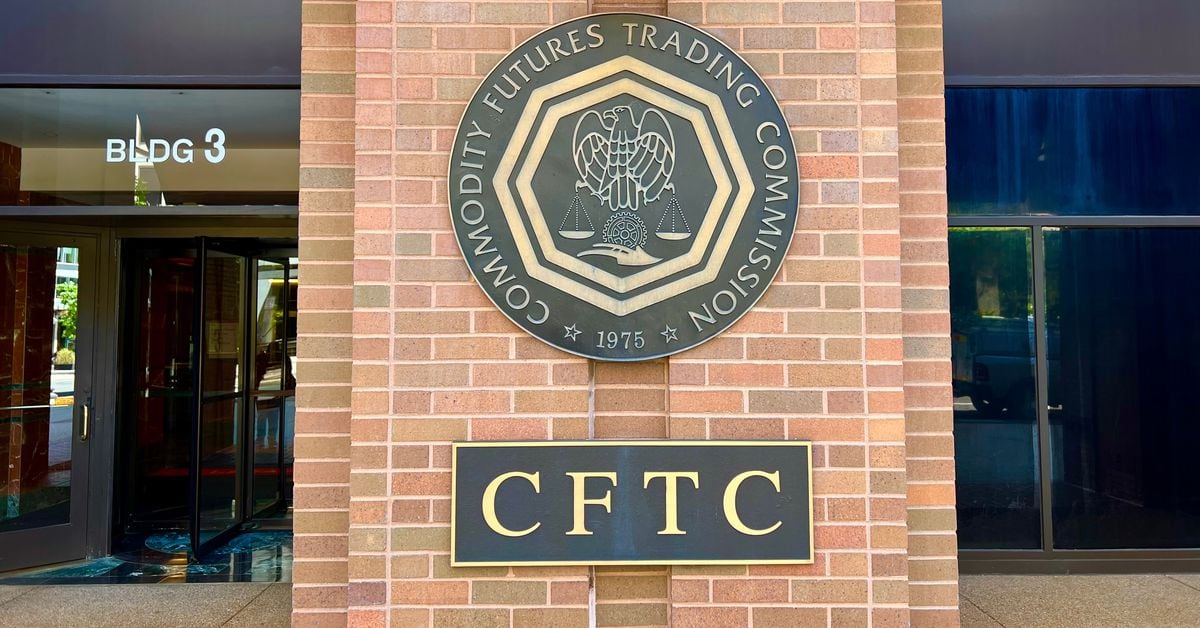

Tokenized Shares of BlackRock, Franklin Templeton’s Funds Could Soon Be Used as Collateral as CFTC Committee Sends Up Recommendations: Bloomberg

A subcommittee of the CFTC’s Global Markets Advisory Committee voted to pass the recommendations on to the full committee, which is expected to vote on the recommendations later this year, the report said citing two people familiar with the matter. Source

Bloomberg Veteran Assumes Head of Exchange Traded Derivatives at Sucden Financial

Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 Transformation in the APAC Trading Landscape and Beyond | FMPS:24 As the financial services industry experiences rapid and transformative changes, leading fintech experts and policymakers come together to discuss the present and future of retail trading and the evolving regulatory…

Turkey Shelves Additional Plans to Tax Stocks and Crypto: Bloomberg

We don’t have a stocks tax on our agenda. It was discussed previously and fell from our agenda, Vice President Cevdet Yilmaz told Bloomberg, talking about plans that also affect crypto. Source