Is it 2021 all over again? Circle (CRCL) debuted to wild upside action on the New York Stock Exchange on Thursday, its shares more than tripling from the IPO price of $31. The event was the culmination of a long journey for the USDC stablecoin issuer, which had been pursuing an IPO for several years. For the crypto industry, it’s certainly a win — a sign of strong traditional investor demand and that under the Trump administration, crypto native firms really do have a path to going public. But cryptocurrencies…

Tag: Coinbase

Elon Musk Backs Coinbase Warning: Bitcoin Could Replace Dollar Amid US Fiscal Crisis

Bitcoin is surging into the spotlight as Coinbase’s CEO and Elon Musk sound alarms on U.S. debt, signaling the crypto’s rise as a serious reserve currency contender. Elon Musk Supports Coinbase Outlook: Bitcoin May Topple US Dollar as Reserve Currency Coinbase CEO Brian Armstrong voiced concern on June 3 on social media platform X over […] Original

BLACKROCK: “MOST MASSIVE BULL RUN in BITCOIN HISTORY HAS BEGUN!”

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io BlackRock: Here is what you NEED to know! 🟡 Try Bitunix to long or short crypto! No KYC: Use Code ‘AltcoinDaily’ for up to $8,000 USDT Trading Bonus! 🔴 Best Crypto Exchange to Buy & Trade Bitcoin: 💰Grab up to $30,000 worth of deposit bonuses ☝️ ** Accounts cannot be created within the US. 🔵 Swap your crypto assets on SilentSwap (PRIVATE & noncustodial)! 10% off fees – Just use my affiliate link: * always pay your taxes & follow all laws…

Coinbase wants Oregon AG case in federal court

Coinbase has asked a US federal judge to hear a lawsuit from Oregon’s attorney general, claiming that it is a copy of a prior Securities and Exchange Commission lawsuit that belongs in federal court. In a June 2 motion filed in a Portland federal court, Coinbase claimed Oregon Attorney General Dan Rayfield’s April lawsuit accusing the firm of selling unregistered securities to the state’s residents exceeded his authority and is an “attempt to invade the province of federal law.” The crypto exchange said Rayfield’s suit is a “copycat case” of…

Report: Coinbase Knew of Data Leak Months Before $400M Breach

Coinbase was informed of a customer data leak at its outsourcing partner, Taskus, some four months before a significant breach that is expected to cost the company $400 million. Breach Causes 200 Employees to Lose Jobs? U.S. cryptocurrency exchange Coinbase was made aware of a customer data leak at one of its outsourcing companies four […] Source CryptoX Portal

🚀 Coinbase Partners with Morpho for Bitcoin-Backed Loans! 📈

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Coinbase has partnered with Morpho to offer Bitcoin-backed loans of up to $100K in $USDC, driving new decentralized finance options. #CryptoNews #Blockchain #Bitcoin #BTC #Loans #Coinbase #base #morpho ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Coinbase data hack sparks calls to scrap KYC

Coinbase’s recent data breach is prompting renewed calls to remove Know Your Customer (KYC) requirements in licensed cryptocurrency exchanges. Illicit actors bribed the exchange’s overseas customer service agents in December 2024 to gain access to the personal information of 70,000 users. In May, Coinbase admitted that hackers had obtained data such as government-issued ID photos and home addresses. “All this security theater needs to be abolished asap. Time and again it only benefits hackers and extortionists,” said pseudonymous developer Banteg on X. “KYC actually enables crime.” However, it’s not feasible…

312 Million DOGE Moved To Coinbase. What’s Going On?

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. The price action of Dogecoin in the past 48 hours have seen it finally break below the $0.2 mark after a whole week of bullish investors trying to hold…

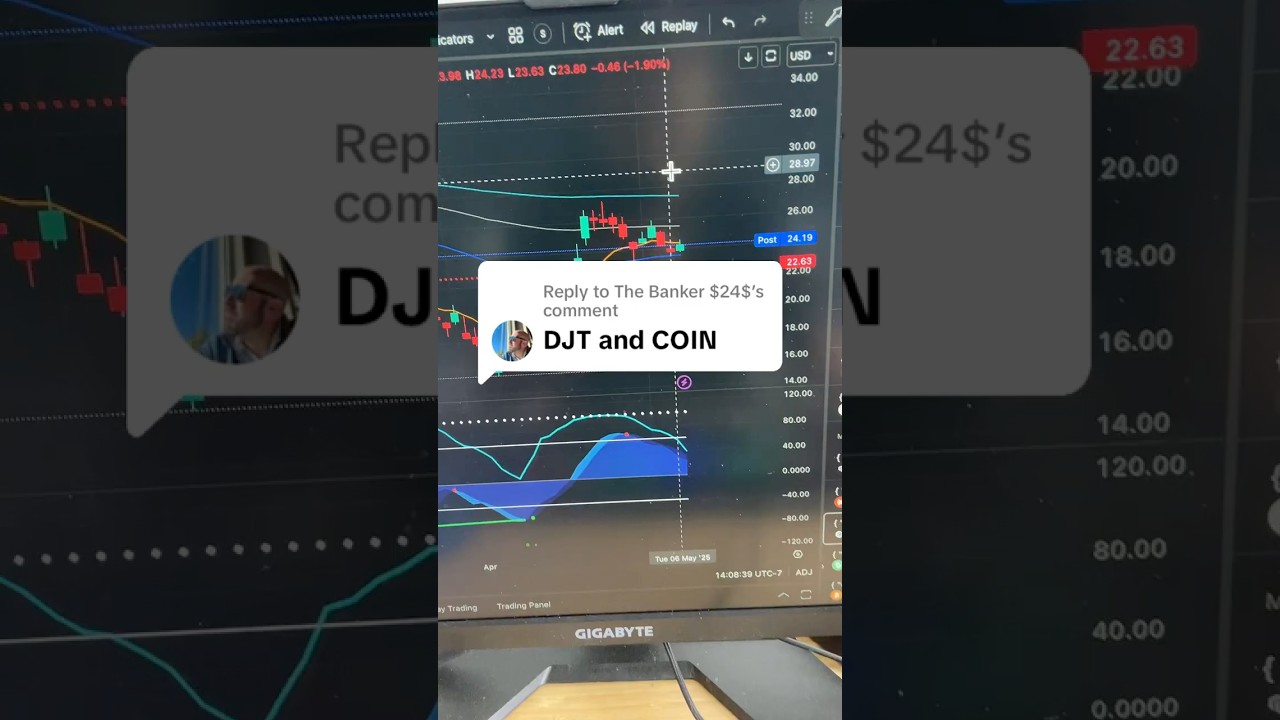

2 STOCKS: DJT & COINBASE 📈 MAY 7, 2025

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Discord/Trading Indicator ➡️ 📈 DJT & COINBASE Stock Update – May 7, 2025! 🚀 Trump Media & Technology Group (DJT) and Coinbase (COIN) are making notable moves this week. In this quick breakdown, we analyze their recent price actions, key support and resistance levels, and what traders should watch next. Are these stocks setting up for a breakout or facing headwinds? 📈 Get daily stock analysis, trade setups, and technical breakdowns! 👉 [Subscribe and turn on notifications!] #DJT #COIN #TrumpMedia #Coinbase #StocksToWatch…

Multichoice’s Irdeto and Coinbase Unite Against Illicit Cryptocurrency Use

Irdeto, the African entertainment platform Multichoice’s digital security subsidiary, has partnered with Coinbase to combat cybercriminals using cryptocurrency for piracy and other illicit activities. Irdeto’s intelligence-led investigations have shown an increasing use of cryptocurrency by illicit service providers, rising from 13% in 2022 to 19% in 2024. Through this collaboration, the Multichoice subsidiary provides Coinbase […] Source