Crypto platform Magic Eden has announced a partnership with Spark to enhance trading on bitcoin by providing fast and low-cost settlement for native assets. By integrating with Spark, Magic Eden plans to unlock efficient transactions for various market types, including stablecoin-to- BTC swaps, while maintaining the integrity of bitcoin’s trust model. Spark is designed to […] Original

Tag: DeFi

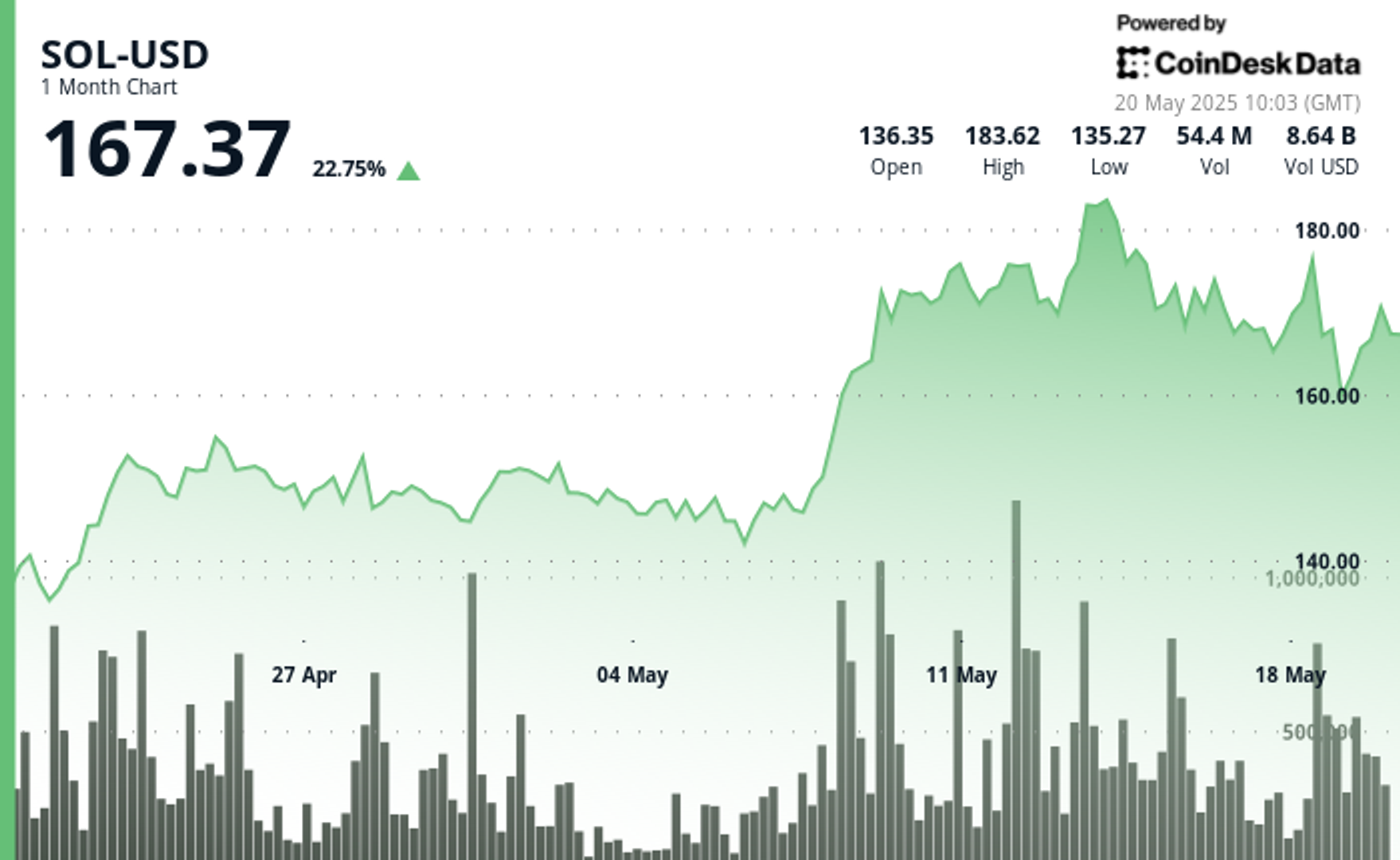

6.3% Rally Fueled by DeFi Demand and Volume

The cryptocurrency market continues to respond to broader economic factors as Solana demonstrates resilience amid global trade uncertainties. SOL’s price action formed a clear uptrend with higher lows and higher highs, breaking through key resistance levels with institutional-grade volume suggesting accumulation despite a brief 1.35% correction in recent hours. Meanwhile, analysts point to the $166.82 level as a crucial short-term pivot, with potential for significant upward movement if SOL can maintain momentum above $177 resistance. Technical Analysis Highlights SOL climbed from a low of $159.69 to a high of $173.03,…

New DeFi platform set to challenge XRP with $30 million AUM

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. As XRP’s price movements come under speculation following a recent court ruling, Unilabs is attracting investors, gaining over $30m AUM. Unilabs (UNIL), a new AI-powered DeFi platform, has been gaining traction after a successful presale launch, garnering over $30m in AUM. Ripple, on the other hand, continues to demonstrate strong potential within the crypto market. However, a recent court ruling has seen XRP’s price dip to the $2.40 level.…

The DeFi mullet — Fintech needs DeFi in the back

Opinion by: Merlin Egalite, co-founder at Morpho Labs Fintechs in the front, decentralized finance (DeFi) in the back: the DeFi Mullet. Today’s fintech companies offer excellent user experiences but are constrained by traditional financial infrastructure — siloed, slow, expensive and inflexible. Meanwhile, DeFi provides lightning-fast, cost-effective, interoperable infrastructure but lacks mainstream accessibility. The solution? Combine fintech’s distribution and user experience with DeFi’s efficient back end. The mullet is inevitable Fintech companies heavily rely on traditional financial (TradFi) infrastructure that is siloed, slow to deploy and run, and costly to maintain.…

How Bitcoin Mining Works: A Complete Beginner’s Guide

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io If you’ve ever heard about crypto, chances are that you’ve heard about Bitcoin mining. But if you’ve heard about Bitcoin mining, chances are that you don’t know what it is, even if you’re into crypto. Bitcoin mining is complex, but it doesn’t have to be. When you break down the individual components step by step, it makes it easy to understand Bitcoin, as well as why BTC is so valuable. That’s why today we’re going to give you the most comprehensive breakdown…

Animoca’s Yat Siu says student loans can supercharge DeFi growth

Bringing student loans onchain would increase the total value locked (TVL) in decentralized finance (DeFi) by more than four times, supercharging the industry, according to Yat Siu, chairman of Animoca Brands. Speaking at Consensus 2025 in Toronto, Siu pointed to the $3 trillion global student loan market as an untapped opportunity for the crypto industry. He said moving even 10% of that market onchain could significantly boost DeFi’s growth. “You basically more than quadruple TVL in all of DeFi,” he said, underscoring how the industry is still in its early…

XRP takes real step into DeFi with Flare’s FAssets upgrade

Flare rolls out an alternative way to give XRP DeFi capabilities, without the risks of traditional blockchain bridges. Flare (FLARE) has launched a major upgrade that will enable traders to use real XRP (XRP) tokens in DeFi. On Wednesday, May 14, Flare launched its FAssets on Songbird, bringing non-smart contract assets to DeFi, according to a note shared with crypto.news. The network will allow users to perform complex DeFi operations with assets such as Bitcoin (BTC) and Dogecoin (DOGE). The first asset that will be available on the platform is…

SUI DeFi TVL Shoots $2.1 Billion, SUI Price Rally to $10 Soon?

Key Notes Sui’s infrastructure is enabling innovations beyond DeFi, such as Mojito Loyalty, a gamified loyalty platform that integrates on-chain rewards. This reflects Sui’s expanding footprint in commerce and loyalty markets projected to reach $155 billion by 2029. SUI price has rallied 16.7% in the past week, fueled by speculation of a potential third-ever golden cross on its 1D chart. The Sui blockchain SUI $3.65 24h volatility: 5.3% Market cap: $12.18 B Vol. 24h: $1.76 B network has been making inroads in the decentralized finance (DeFi) space as it positions…

Coinbase Wallet Tutorial | Step-by-Step Guide for Beginners

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Coinbase Wallet Tutorial | Step-by-Step Guide for Beginners | How to Set Up Coinbase Wallet 📢 CryptoSnake Deals: ✉️ For business inquiries: fredfking@gmail.com MusicSnake: #bitcoin #crypto #coinbase ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

DeFi Development Corp. Acquires $23.6 Million in Solana, Expanding Total Holdings to 595,988 SOL

DeFi Development Corp. (Nasdaq: DFDV) announced the acquisition of 172,670 solana ( SOL) tokens at an average price of $136.81, totaling approximately $23.6 million, marking the company’s largest purchase of solana to date and its tenth acquisition under its digital asset treasury strategy. Following this transaction, DeFi Development Corp. now holds a total of 595,988 […] Source CryptoX Portal