Babylon Labs and Fiamma, a Lightspeed Faction-backed platform focused on unlocking real-world assets on Bitcoin, are teaming up to advance a BTC-secured decentralized world. Fiamma has secured a strategic investment from Babylon Labs to help bring this vision to market, according to a press release. As the two platforms look to boost a Bitcoin (BTC) -secured decentralized finance ecosystem, the key focus will be on bringing trust-minimized Bitcoin bridges to developers and blockchains. Babylon Labs and Fiamma plan to integrate zero-knowledge technology into Bitcoin through Fiamma’s BitVM2 protocol, unlocking new…

Tag: DeFi

Defi Frenzy: Dex and Perpetuals Smash $52.81B in January’s First 4 Days

After an unprecedented rise in decentralized exchange (dex) and perpetuals volumes last month, these decentralized finance (defi) platforms have witnessed $52.81 billion in trading volume across the initial four days of January 2025. Uniswap and Hyperliquid Dominate Defi Trading Volumes in 2025 The new year kicks off with a promising note, as the crypto economy’s […] Source BitcoincryptoexchangeExchanges CryptoX Portal

The Defi Era: Redefining Capitalism and Unlocking Economic Freedom for All

Decentralized finance (defi) is more than a catchphrase; it is a revolutionary system that replaces centralized control with individual sovereignty, enabling transparent, trustless, and voluntary exchanges that embody the principles of capitalism. Beyond Amusement: How Defi Brings Capitalism’s Core Values to Life Approximately 20 days ago, Cryptox.trade News shared an editorial exploring how decentralized finance […] Source CryptoX Portal

Metamask Rolls Out Gas Station Feature Aimed at Enhancing Defi Transactions

Metamask, a prominent Web3 wallet, has launched its Gas Station feature, which aims to alleviate users’ challenges with transaction fees on the Ethereum mainnet. Web3 Wallet Metamask Tackles Gas Fee Challenges The new feature, integrated into Metamask’s Smart Transactions with Swaps, provides gas-included transaction quotes. This enhancement addresses a common hurdle for users who run […] Source CryptoX Portal

DeFi Exploits Plunge 40% In 2024, But Centralized Exchange Losses Soar – Report

Este artículo también está disponible en español. According to a report published today by blockchain security firm Hacken, decentralized finance (DeFi) protocols witnessed a steep decline in exploits in 2024, while centralized finance (CeFi) platforms more than doubled their losses due to security breaches. DeFi Platforms Show Better Security Mechanisms In its annual “Web3 Security Report,” Hacken outlined the general trends in the cryptocurrency industry with regard to scams and security infrastructure. The report notes that total losses arising from security failure in 2024 stood at $2.91 billion. Related Reading…

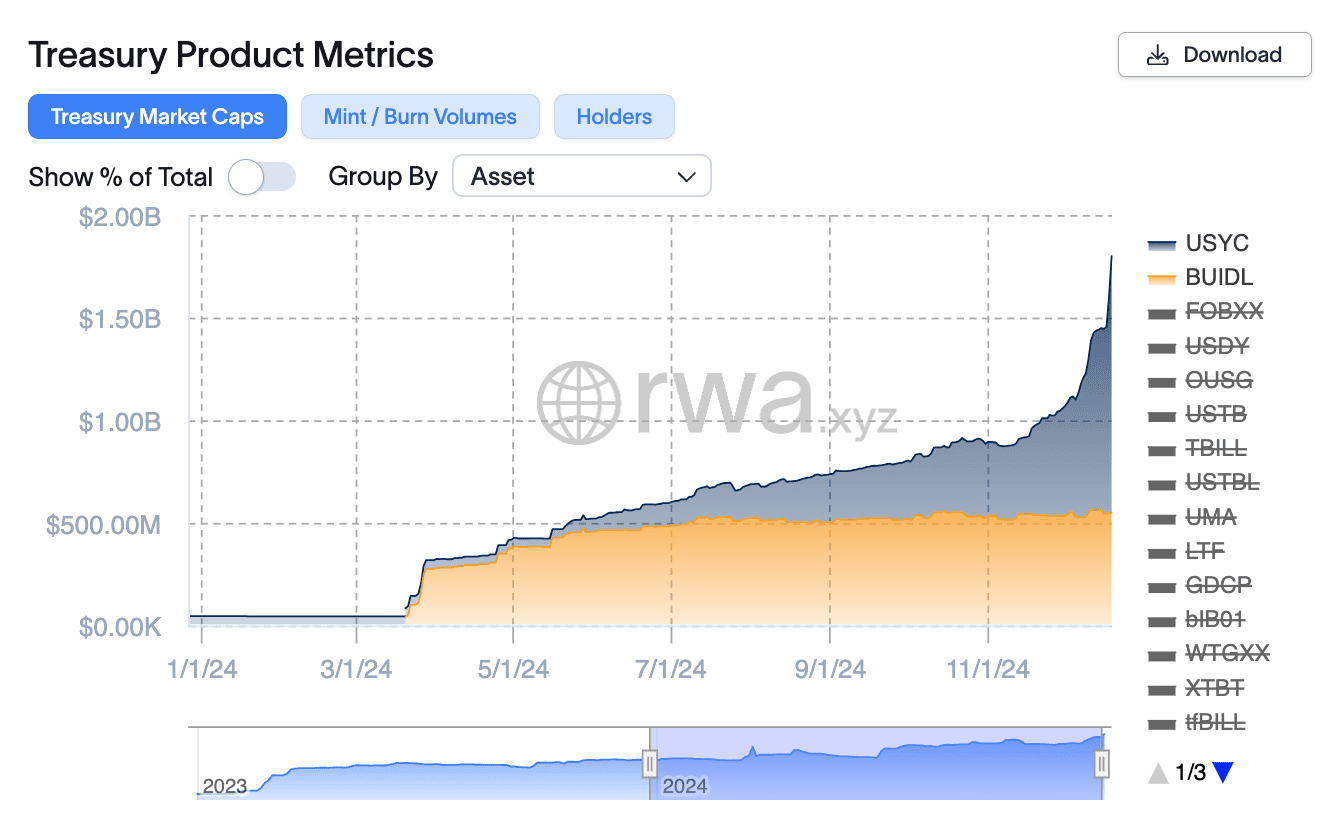

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

There’s been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market. Asset manager Hashnote’s USYC token zoomed over $1.2 billion in market capitalization, growing five-fold in size over the past three months, rwa.xyz data shows. It has toppled the $450 million BUIDL, issued by asset management behemoth BlackRock and tokenization firm Securitize, which was the largest product by size since April. Market cap of Hashnote’s USYC and BUIDL over time (rwa.xyz) USYC is the token representation of the Hashnote International Short Duration Yield Fund, which,…

2025: Crypto’s Next Boom – 3 Key Predictions (DeFi, Stablecoins, Retail)

No one can argue with 2024 being a breakthrough year for crypto. BTC and ETH ETFs launched, BlackRock spearheaded bitcoin adoption, a pro-crypto president was elected and BTC broke the 15-year all-time-high, to name a few. But the inflection point for crypto still awaits. Here are three predictions for 2025 that can help spark it: You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday. 1. DeFi is about to skyrocket…

AAVE Dominates DeFi Lending – Metrics Reveal 45% Market Share

Este artículo también está disponible en español. Aave (AAVE), the leading decentralized finance (DeFi) lending protocol, has captured the spotlight with an extraordinary surge of over 200% since November 5. Outperforming the broader market, AAVE has reached its highest levels since 2021, marking a remarkable recovery and reaffirming its dominance in the DeFi ecosystem. Related Reading Key metrics from IntoTheBlock underscore AAVE’s unmatched position in the lending sector. With an impressive 45% market share, it remains the top choice for users seeking decentralized borrowing and lending solutions. With AAVE trading…

ETFs now hold more Bitcoin Than Satoshi, this could be a bullish sign for this new DeFi coin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. U.S. spot ETFs now hold 1.1M+ BTC, surpassing Satoshi’s stash, fueling bullish momentum for the altcoin Cutoshi U.S. spot ETFs have accumulated over 1.1 million Bitcoin and now officially own more BTC than the anonymous founder Satoshi Nakamoto. The ETF firms have achieved this milestone within a year of their inception. This has proven to be a bullish sign for the new altcoin Cutoshi (CUTO), which follows Satoshi’s vision…

Ethereum Fees Hit Nine-Month High Amidst Strong DeFi Activity

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency. Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems. In two years of active…