Stacks continues to push the boundaries of possibilities on Bitcoin with a planned launch of SBTC. SBTC to Promote Bitcoin Defi Ecosystem Stacks, a Bitcoin layer two (L2) platform recently teased the impending launch of SBTC, a 1:1 bitcoin-backed asset designed to bridge bitcoin with decentralized finance (defi) and Web3. This was stated in an […] Original

Tag: DeFi

DTX Exchange approaches 250,000 users after SOL traders join the DeFi project

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. The rejection of Solana ETF has led the SOL community to take a major shift to the next major DeFi project DTX Exchange after a $9.6m presale. The DeFi market is ready to witness a historic revolution as Bitcoin has hit new success levels after the $100k milestone and institutional adoption. After Trump picks the next crypto-friendly SEC Chair, the decentralized economy will take a major turn with new…

XRP’s $149B Power Play: Tokenization, Defi, and a Regulated Stablecoin

XRP, with a market cap of $149 billion, isn’t just a heavyweight in cryptocurrency—its distributed ledger network has been diving headfirst into tokenization and decentralized finance (defi). Meanwhile, Ripple is turning heads with the forthcoming launch of its much-anticipated stablecoin, ripple usd (RLUSD). A Focus on RLUSD and Defi Marks Strategic Shift for XRP Ledger […] Source CryptoX Portal

Can XLM price hit $1 as DeFi TVL and open interest soars?

Stellar price went parabolic on Friday, Nov. 29, as its DeFi ecosystem boomed and its futures open interest reached a record high. Stellar Lumens (XLM) surged to an intraday high of $0.5510, marking its highest level since Monday. This represents a 27% increase from its weekly low, bringing its market cap to over $16 billion. Stellar’s rally mirrored that of Ripple (XRP), which jumped by over 20% as its demand jumped. The two coins have a close correlation because of their role in the cross-border payment industry. Its most recent…

Trump’s pro-crypto leadership could fuel ‘defi renaissance’ in US, analysts say

As Trump’s crypto-positive cabinet takes shape, the U.S. might be on track for a potential revolution in the decentralized finance space, analysts at Matrixport anticipate. Donald Trump‘s prospective nominees for the U.S. Treasury, Commerce, and potentially the Securities and Exchange Commission are viewed as crypto-friendly leaders who, if appointed, could transform financial policy and align the country more closely with the rapidly evolving crypto sector, according to analysts at Matrixport. In a recent analytical report, the analysts expressed a belief that the narrative of 2024 — Bitcoin (BTC) as digital…

Babylon Labs teams up with SatLayer to unlock DeFi for Bitcoin

Babylon Labs has partnered with Castle Island Ventures-backed SatLayer to bring the benefits of Bitcoin staking and restaking to more users. The move aims to offer Bitcoin (BTC) holders the opportunity to explore the decentralized finance ecosystem around the world’s largest and most popular cryptocurrency. Babylon, whose total value locked has surpassed $2 billion, is a leading BTC staking protocol. The platform eyes further liquidity, shared security, and capital efficiency for BTC holders in this partnership, according to a press release. SatLayer will enable this functionality by offering restaking opportunities…

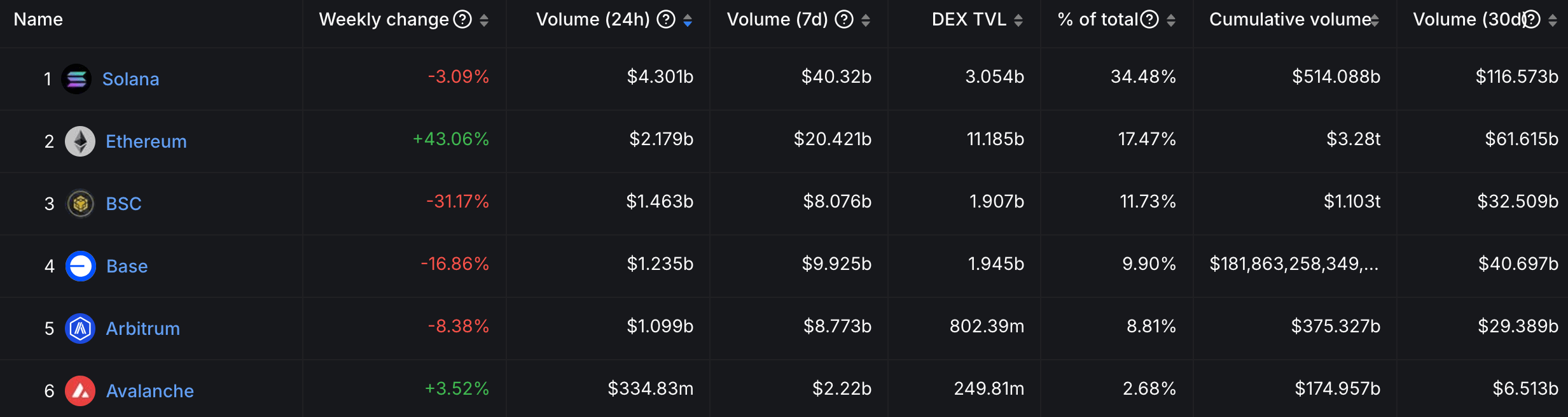

Solana Outpaces Ethereum In DeFi Activity As Monthly DEX Volume Surpasses $100 Billion

Este artículo también está disponible en español. Solana (SOL) decentralized finance (DeFi) activity has gained significant momentum, with its decentralized exchanges (DEX) surpassing Ethereum (ETH) DEX in monthly trading volume. So far in November, Solana-based DEXes have recorded over $100 billion in trading volume, marking a major milestone for the ecosystem. Solana DeFi Ecosystem Gains Momentum, Outshines Ethereum DeFi Solana, the fourth-largest cryptocurrency with a reported market cap of $118.34 billion has been on a record-breaking price trajectory. Recently, the digital asset established a new all-time-high (ATH) of $263 after…

Pro-crypto Legislation Could Usher in Renaissance for DeFi as TVL Rises 31%

Historically, institutions have hesitated to move on-chain due to regulatory risks. However, with bitcoin ETF AUM inflows on track to surpass the gold ETFs’ AUM within a year, finance and tech companies exploring the technology and offering crypto products, and corporates adding digital assets to their balance sheets, institutional interest in crypto has never been higher. That said, the coexistence of off-chain and on-chain capital thus far has mainly involved using on-chain capital to capture off-chain yield (e.g., Tether purchasing billions of dollars in U.S. treasuries). With regulatory clarity, we…

Securitize Unveils Vault System to Revolutionize Institutional Defi Liquidity

Securitize has rolled out its S-Token Vault, utilizing ERC4626 technology to elevate liquidity and streamline portfolio management for institutions holding tokenized real-world assets (RWAs). Bridging Finance and Defi: Securitize Launches Next-Gen S-Token Vault The project, revealed in a statement shared with Cryptox.trade News, was developed by Securitize Credit, a subsidiary of Securitize. It links up […] Source CryptoX Portal

How DeFi Is Preparing for DC’s Next Chapter

Second, build useful applications. During the hearing, representatives asked about financial and non-financial use cases. It was a privilege to answer questions and discuss The Value Prop, an open database cataloging use cases for blockchain-based applications across all crypto networks, like Ethereum, Bitcoin and more. I’ll say the quiet part out loud: For many, speculation is fun. But if the industry only chases the pump, it will never demonstrate the transformative value of DeFi. Source