▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 跟股人講股: 每日觀察: Chapters: 0:00 – 10:57 COIN 10:57 – 17:05 CRCL 17:05 – 20:32 PLTR ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Tag: ETF

ETH Price Shows Signs of Reversal Despite Ethereum ETF Outflows

Key Notes Analysts note that ETH price needs a daily close above the key $3,400 resistance level for a sustained uptrend. BitMine Technologies Chairman Tom Lee noted that Ethereum is undervalued at current levels of around $3,000. A BitcoinOG whale “1011short” has expanded his long position to 150,466 ETH, worth $491 million. After falling to $3,150 on Dec. 11, in post-FOMC volatility, Ethereum ETH $3 232 24h volatility: 1.1% Market cap: $390.11 B Vol. 24h: $24.71 B is once again showing signs of reversal. The ETH price is trading over…

Cardano Price Prediction: Bitwise ETF Goes Live With ADA Inside – Will Wall Street Pump ADA Next?

Cardano just got a major visibility boost, thanks to Bitwise uplisting its Bitwise 10 Crypto Index ETF (BITW) to NYSE Arca. ADA now sits inside a regulated Wall Street product with national exchange exposure, placing it alongside the ten largest crypto assets in the market. The move gives Cardano broader investor access and a stronger foothold in institutional portfolios as crypto adoption continues to expand While ADA carries only a 0.65% share of the index, its inclusion alongside Bitcoin, Ethereum, Solana and XRP means that investors can buy the token…

Bitcoin ‘AfterDark’ ETF targets BTC’s overnight edge, skips U.S. hours

New Nicholas AfterDark ETF plans to hold Bitcoin only overnight and rotate into Treasuries during U.S. hours to exploit BTC’s non-U.S. session outperformance. Summary Velo.xyz data shows Bitcoin has delivered stronger returns when U.S. markets are closed and weaker or negative performance during regular Wall Street hours. Nicholas Financial filed for the Nicholas Bitcoin and Treasuries AfterDark ETF, buying BTC at 4 p.m. ET and exiting by 9:30 a.m. while holding short-term Treasuries intraday. The ETF seeks to monetize overnight moves, dampen drawdowns, and reflects a maturing Bitcoin ETF market…

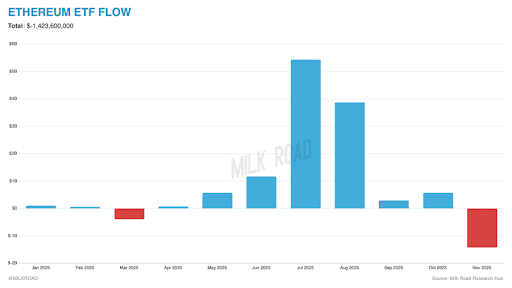

Ethereum ETF Flows Plunge To Worst Month Since Launch

Ethereum’s momentum in institutional markets just hit a major roadblock. After months of enthusiasm surrounding spot Ethereum exchange-traded funds (ETFs), new data has shown that ETF flows have sunk to their worst monthly total since their launch. The sharp drop reflects a broader cooldown in investor demand, as market volatility and shifting risk appetite weigh on crypto allocations. Will Staking ETFs Emerge To Stabilize Flows? In an X post, a crypto analyst known as Milk Road revealed that the Ethereum ETFs had just printed their worst month on record since…

‘Bitcoin After Dark’ ETF Lands at SEC as Nicholas Wealth Unveils Night-Only Strategy

Two unconventional bitcoin exchange-traded funds (ETFs) landed at the U.S. Securities and Exchange Commission (SEC) on Dec. 9, 2025, and they arrived with enough personality to make even the most jaded ETF watcher raise an eyebrow. Bitcoin ETFs Get Weird: Night-Trading and Tail-Risk Designs Filed With SEC On Tuesday, Nicholas Wealth, LLC, in partnership with […] Original

XRP Secures $1B AUM Milestone, Sets ETF Speed Record In US

XRP Spot ETFs have nearly crossed the $1 billion mark in assets under management (AUM), marking one of the quickest ramps since Ethereum, according to Ripple’s CEO. Related Reading Rapid Fund Growth In Weeks According to the disclosure, the four XRP ETF products now hold about $1.23B in total net assets, which equals 597 million XRP at a reported XRP price of $2.06. Reports have disclosed a fresh inflow of $30 million on Monday, Dec. 8, and the cumulative net inflow into these products stands close to $935 million. Ripple…

XRP ETF Outperforms BTC, SOL, ETH, but XRP Price in a Make-Or-Break Situation

The spot XRP exchange-traded funds (ETFs) continued to see healthy inflows at $38 million on December 8, outperforming some of the top assets like Bitcoin BTC $90 432 24h volatility: 1.5% Market cap: $1.80 T Vol. 24h: $43.89 B , Ethereum ETH $3 120 24h volatility: 0.6% Market cap: $376.31 B Vol. 24h: $22.50 B , and Solana SOL $132.9 24h volatility: 3.9% Market cap: $74.62 B Vol. 24h: $4.62 B . While XRP ETFs approach the $1 billion mark, the XRP XRP $2.07 24h volatility: 1.0% Market cap: $124.76…

Ethereum Attempts Breakout As BlackRock Files For Staked ETF

After weeks of speculation, BlackRock, the world’s largest asset manager, has officially filed for a staked Ethereum (ETH) Exchange-Traded Fund (ETF) with the US Securities and Exchange Commission (SEC). Amid the bullish news, the King of Altcoins’ price is attempting to break out of a two-month resistance, which could set the stage for a retest of higher levels. Related Reading BlackRock Files For Staked Ethereum ETF BlackRock has submitted an S-1 form with the US SEC to get approval for its iShares Ethereum Staking Trust (ETHB), which “seeks to reflect…

ETF Flows Recap: Red Week for Bitcoin and Ether, Green for Solana and XRP

A volatile first week of December left bitcoin and ether ETFs in net outflows, while solana and XRP funds bucked the trend with steady gains. Fund-by-fund flows revealed sharp divergences across issuers, with several products enduring heavy single-day swings. Bitcoin and Ether ETFs End Week in the Red as Solana and XRP Shine The first […] Original