▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io On today’s episode of CNBC Crypto World, major cryptocurrencies climb after it was revealed that consumer prices rose less than expected in May as President Trump’s tariffs had yet to show significant impact on inflation. Plus, two House committees advanced the CLARITY Act crypto market structure bill, which now moves to the House floor. And, Stellar CEO Denelle Dixon discusses a new partnership between the Stellar blockchain and PayPal. Chapters: 00:00 – CNBC Crypto World, June 11, 2025 0:27 – Crypto rises…

Tag: ETF

BlackRock Staking For Its Spot Ethereum ETF Has Been Acknowledged — But What’s Coming For ETH?

The US Securities and Exchange Commission (SEC) has acknowledged a Nasdaq filing proposing an amendment to BlackRock iShares Ethereum Trust (ETHA). This proposal seeks to enable the ETF to stake its Ethereum holdings, allowing it to participate in the ETH proof-of-stake consensus mechanism and potentially earn staking rewards. What Happens When Institutional Staking Goes Mainstream? BlackRock just received regulatory acknowledgment to include staking in its Spot Ethereum ETF. As mentioned by Çağrı Yaşar on X, acknowledging the filing isn’t a minor regulatory checkbox. It’s the US Securities and Exchange Commission…

Crypto ETF Flows Favor Ether Again With $219 Million vs $80 Million for Bitcoin

Ether exchange-traded funds (ETFs) extended their winning streak to 18 days with $219 million in inflows, while bitcoin ETFs posted a modest $80 million as outflows from key funds muted Blackrock’s strong entry. Ether Streak Hits 18 Days As Bitcoin Sees Modest Gains The green wave for ether ETFs shows no signs of slowing down. […] Source CryptoX Portal

Litecoin Breakout Looms Despite ETF Delay by US SEC

Key Notes Crypto analyst Ali Martinez sees a potential rebound to $115–$120 in the near term, if LTC price holds above $108. Carl Moon highlights symmetrical triangle formations on both short and long timeframes, suggesting a possible breakout to $200 in the current altcoin cycle. The SEC has designated a 60-day extension to evaluate Grayscale’s plan to convert its Litecoin Trust into a spot ETF. Litecoin LTC $107.3 24h volatility: 1.4% Market cap: $8.18 B Vol. 24h: $617.29 M participated in the broader crypto market rally this month with 27%…

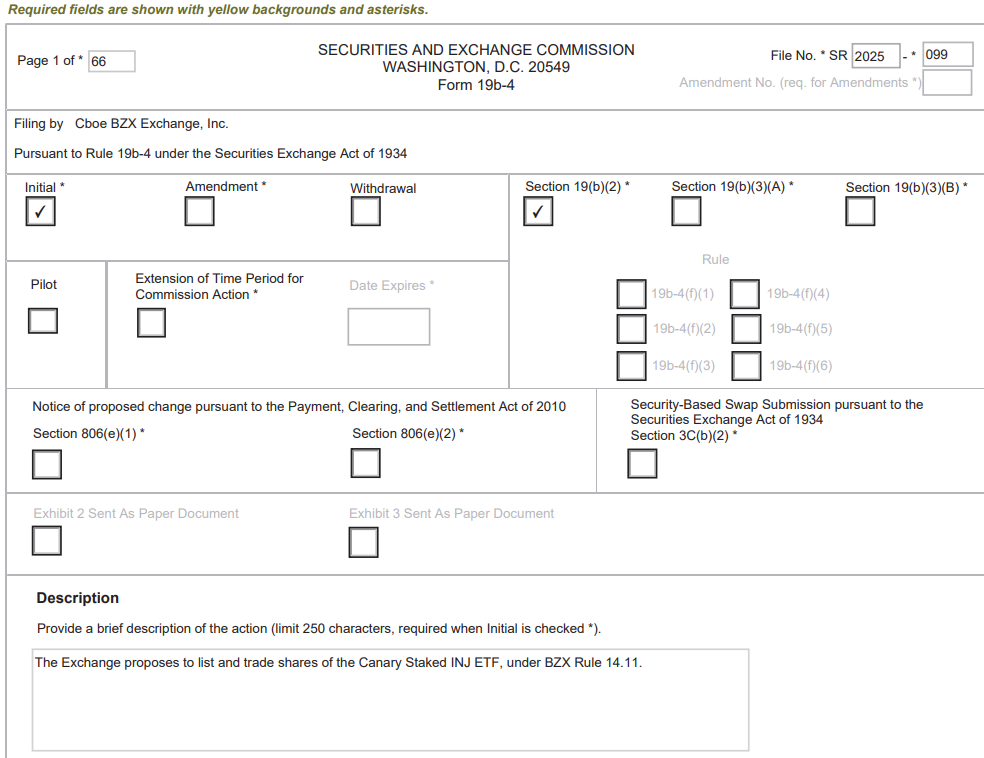

CBOE files for Staked INJ ETF on behalf of Canary Capital

The Chicago Board Options Exchange (CBOE) has filed to list shares of Canary Capital’s proposed staked Injective exchange-traded fund (ETF), further expanding the wave of regulated crypto investment products in the United States. The CBOE’s 19b-4 filing, submitted Monday, comes shortly after investment firm Canary Capital filed an S-1 application for a staked Injective (INJ) token fund with the US Securities and Exchange Commission (SEC) last Thursday, Cointelegraph reported. The fund aims to accrue staking rewards by offering validation services using an “approved staking platform.” If approved, it would be…

SEC pushes back decision on Truth Social Bitcoin ETF to September

The US Securities and Exchange Commission won’t decide on the Truth Social Bitcoin ETF until at least Sept. 18. On Monday, the Commission said it had extended the review period for the proposed fund, which NYSE Arca submitted on behalf… Original

$5K ETH Price Possible Due To ETF Inflows, Treasuries

Key takeaways: ETH futures and options data show no signs of defensive positioning despite Ether’s 7-month price high. Ether ETF inflows and corporate holdings signal growing conviction from institutional investors. Ether (ETH) price fell 4% after briefly touching $3,940 on Monday. This drop aligned with the broader cryptocurrency market correction, suggesting that no ETH-specific factors triggered the move. While some traders may have been spooked, Ether derivatives held steady, indicating that a potential rally toward $5,000 remains on the table. ETH traders cautiously predict move to $5,000 Global markets remain…

Ethereum Soars on $1.9B Inflows and ETF Optimism as BlackRock and SharpLink Double Down

Ethereum (ETH) is once again at the center of investor attention, pulling in a staggering $1.59 billion in inflows over the past week. This marks the second-largest weekly inflow in Ethereum’s history, amid growing optimism that U.S. regulators will soon approve a spot Ethereum ETF. Overall, digital asset investment products attracted $1.9 billion, marking 15 consecutive weeks of positive flows. Related Reading This surge in capital has pushed Ethereum’s price up 62% this month to $3,900, positioning it just below the critical $4,000 breakout level. Ethereum price trends to the…

SEC delays trump-backed Bitcoin ETF decision as well as Grayscale’s Solana Trust

The US Securities and Exchange Commission (SEC) on Monday delayed its decision on the proposed Truth Social Bitcoin exchange-traded fund (ETF), extending the review deadline to Sept. 18 from Aug. 4. The fund, backed by the Trump Media and Technology group, is seeking approval to list the Truth Social Bitcoin ETF on the NYSE Arca exchange under the SEC’s commodity-based trust share framework. Source: SEC.gov The agency, which can take up to 270 days to approve or reject ETF applications, said it extended the review period to allow more time to…

ETF Weekly: Ether Records Second-Highest Ever Inflow as Bitcoin Posts Modest Gains

Ether exchange-traded funds (ETFs) delivered a staggering $1.85 billion in inflows during the week, extending their dominance streak to 11 consecutive weeks. Bitcoin ETFs, on the other hand, saw a modest $73 million in net inflows, weighed down by early-week red days. Institutional Flow Shift? Ether ETFs Soar While Bitcoin ETFs Post Modest Gains Ether […] Original