As Ethereum (ETH) continues to drive innovation in the cryptocurrency space, a new player is emerging that’s catching the eye of ICO investors: Mpeppe (MPEPE). Built on the Ethereum (ETH) blockchain, Mpeppe (MPEPE) is capturing attention for its unique blend of sports enthusiasm, blockchain innovation, and meme culture. Here’s why Ethereum (ETH) ICO investors are flocking to this new cryptocurrency. Mpeppe (MPEPE): A Fusion of Sports Passion and Blockchain Innovation Ethereum (ETH) has long been celebrated for its pioneering role in smart contracts and decentralized applications. The Ethereum (ETH) blockchain…

Tag: ETH

3 Reasons Ethereum (ETH) Investors Are Buying Mpeppe (MPEPE) Over ETH ETF

As Ethereum (ETH) continues to shape the cryptocurrency landscape, a new player is emerging that’s catching the attention of seasoned investors. Mpeppe (MPEPE), a groundbreaking meme cryptocurrency, is drawing significant interest from those who previously focused on Ethereum (ETH) and its associated financial products like ETFs. Here’s why Ethereum (ETH) investors are turning their attention to Mpeppe (MPEPE) instead of traditional ETH ETFs. Mpeppe (MPEPE): A Fresh Take on Cryptocurrency Investment Ethereum (ETH) has been a cornerstone of the cryptocurrency world, known for its smart contracts and decentralized applications. However,…

US ETH ETFs Draw $48.73M on Monday; Grayscale’s $46.84M Outflow Dampens Impact

On Monday, U.S. spot ethereum exchange-traded funds (ETFs) recorded their second-highest inflows since their inception. Approximately $48.73 million was added, yet the nine funds collectively remain in the red, with a deficit of $461.98 million, primarily due to significant outflows from Grayscale’s Ethereum Trust. Blackrock Leads $48.73M Inflows for U.S. ETH ETFs as Crypto Market […] Source CryptoX Portal

Bitcoin Rebounds Past $56,000, ETH Over $2,500: Key Factors

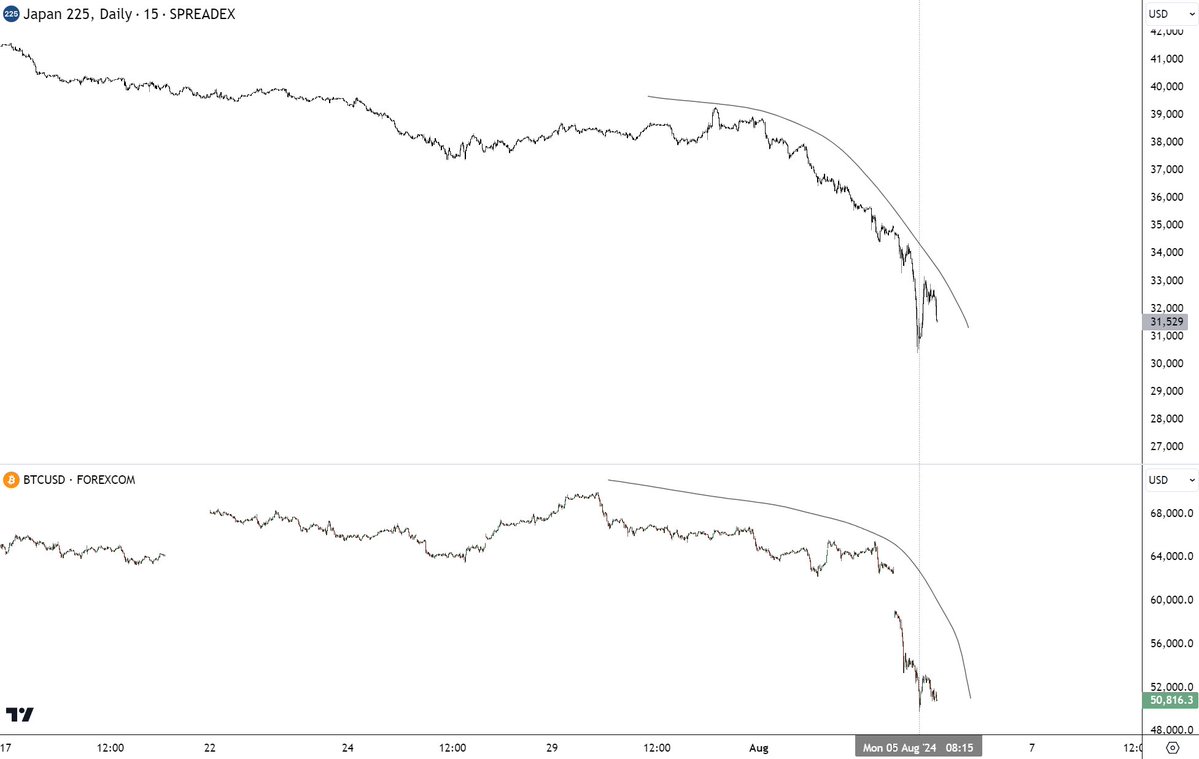

Bitcoin and crypto markets experienced a robust recovery Tuesday, with Bitcoin surging past the $56,000 mark and Ethereum breaking above $2,500, bouncing back from the “Block Monday.” Yesterday, Bitcoin plummeted over 15%, touching lows near $49,000, while Ethereum dropped by more than 20% to a low of $2,115. The recovery in Bitcoin and crypto paralleled a broader resurgence in global financial markets, driven by several key factors. #1 Nikkei Rebounds, Bitcoin Follows Japan’s primary stock index, the Nikkei 225, experienced a record-breaking recovery following its most significant drop since the…

Ethereum ETFs Scored $49M Inflows as ETH Plunged

ETH bounced over 18% in the past 24 hours to reverse losses from a steep fall on Monday, with some drawing eyes to the blockchain’s fundamentals. Source

Buying The Ethereum Dip? New Address Tied To Crypto Mogul Justin Sun Purchases 16,000 ETH

The cryptocurrency market has been rocked by a seismic sell-off over the past 24 hours, with the two largest digital assets, Bitcoin (BTC) and Ethereum (ETH), plummeting over 20% in value. At the epicenter of the chaos is one of the industry’s biggest names – Justin Sun, the founder of the TRON blockchain. On-chain data suggests that Sun may have used the pullback to scoop up millions of dollars worth of Ethereum at discounted prices. Market Meltdown Wipes Out $600 Billion According to a Fortune report, this market upheaval unfolded…

Bitcoin (BTC) & Ethereum (ETH) Investors Dump BTC & ETH For New Cryptocurrency To Regain Market Profits

In a striking shift in the cryptocurrency landscape, traditional investors in Bitcoin (BTC) and Ethereum (ETH) are increasingly reallocating their assets into newer, high-potential tokens. This article explores why investors are pivoting away from established giants like BTC and ETH and why Mpeppe (MPEPE) has emerged as a compelling alternative. The Shift from Bitcoin (BTC) and Ethereum (ETH) Traditional Titans Under Pressure Bitcoin (BTC) and Ethereum (ETH) have long been the cornerstones of the cryptocurrency world. Bitcoin (BTC), often referred to as “digital gold,” has established itself as a foundational…

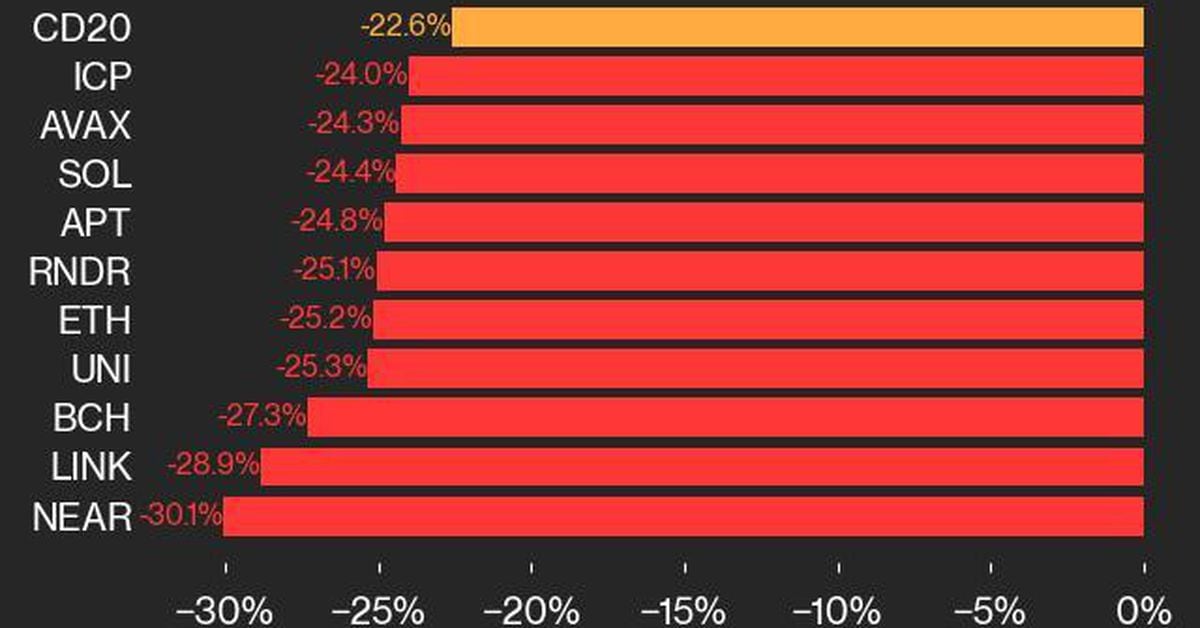

Bitcoin Price (BTC) Dropped 19.6% while Ether Price (ETH) Fell 25.2% in Market Rout

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Crypto Futures Witness $840M in Liquidations as Bitcoin (BTC) Prices Nosedive, Ether (ETH) Records Biggest Fall Since 2021

The liquidations came as bitcoin (BTC) slid more than 11% in the past 24 hours, while ether plunged as much as 25% before slightly recovering. TradingView data shows this was the worst single-day price fall for ETH since May 2021, when prices dumped from over $3,500 to $1,700. TradingView’s daily candle shows performance for UTC 00:00 to 23:59. Source

Ether Slides 20% as Jump Trading Moves $46M in ETH to Centralized Exchanges

“The reason for the crazy crypto sell-off seems to be Jump Trading, who are either getting margin called in the traditional markets and need liquidity over the weekend, or they are exiting the crypto business due to regulatory reasons (Terra Luna related),” Dr. Julian Hosp, CEO and co-founder of decentralized platform Cake Group said on X. Source