Robert Kiyosaki forecasts significant rises in asset prices, including gold, silver, and bitcoin by August 2025 if Donald Trump is re-elected. The U.S. SEC has approved spot ethereum ETFs, with Blackrock’s Ishares ethereum Trust ETF launching on Nasdaq on July 23, 2024. In Nigeria, the central bank sold dollars to Bureaux de Change to stabilize […] Source CryptoX Portal

Tag: ETH

Trump at Bitcoin 2024, Biden withdraws, ETH ETFs launch, Mt. Gox repayments | Weekly Recap

Last week in crypto, Republican presidential candidate Donald Trump spoke at the Bitcoin 2024 conference; spot Ethereum ETFs began trading, but ended the week with net outflows; exchanges and creditors confirmed Mt. Gox repayments. In case you missed them, here… Source CryptoX Portal

Grayscale ETH ETF outflows surpass $1b mark since launch

Grayscale’s Ethereum ETF (ETHE) experienced another day of significant net outflows totaling approximately $346 million on July 25. Per Farside data, the latest outflow brings the fund’s losses to $1.1 billion over the past three trading days following its recent conversion. Since its conversion, Grayscale’s Ethereum ETF’s (ETHE) assets under management have decreased sharply from over $9 billion to $7.4 billion. This significant drop coincides with the introduction of US spot Ethereum ETFs. On the other hand, BlackRock’s iShares Ethereum Trust (ETHA) led the inflow charts on the same day,…

Why Is ETH Price Struggling Despite The Spot Ethereum ETFs Launch?

Post the Spot Ethereum ETFs launch, the ETH price has continued to struggle unexpectedly, proving that the launch of the Spot ETFs were a ‘sell the news’ event. So far, the second-largest cryptocurrency by market cap has lost around 10% of its value since the Spot Ethereum ETFs trading began on Tuesday, July 23, and could see further decline from here, according to an analysis from Matrixport. Spot Ethereum ETFs Triggers Selling Following the launch of the Spot Ethereum ETFs, there was a lot of excitement in the market, especially…

Bitcoin Price Outperforms Broader Crypto Market, Ether (ETH) Price Drop Mirrors Bitcoin (BTC) ETF Launch

Outflows from the Grayscale Bitcoin Trust (GBTC), the world’s largest bitcoin fund at the time, which converted from a closed-end structure into an ETF that allowed redemptions for the first time in 10 years, weighed on bitcoin’s price over the first weeks. Later, inflows to rival funds overcame the negative trend, propelling BTC to an all-time high in March. Original

More demand for BTC than ETH for now

BlackRock’s head of digital assets, Robert Mitchnick, said Bitcoin ETFs currently draw more investor demand than Ethereum funds. The Bitcoin 2024 conference in Nashville, which is expected to attract 20,000 crypto enthusiasts, comes as exchange-traded funds now offer exposure to the largest cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH). Spot ETH ETFs are the new market entrants, but spot BTC ETFs have traded since January and amassed over $60 billion in assets under management, per SoSoValue. Mitchnick remarked that it’s still early, and flows have yet to indicate whether investors will…

Whale With Ethereum Foundation Link Transfers 92,500 ETH Worth $288M

According to onchain data, a significant whale holding over 92,500 ether moved the funds to an unidentified wallet. Arkham Intelligence data suggests the funds may have been linked to the Ethereum Foundation, though this is not confirmed. Originally, the funds were transferred to a mysterious wallet on Sept. 1, 2015. Significant Ether Transfer Worth $288M […] Source CryptoX Portal

Ethereum Whales Rapidly Accumulate ETH Amid Price Decline

Ethereum whales have been busy in the market, as on-chain data shows that these investors have been heavily accumulating the second-largest crypto token by market cap. This comes amid a price decline in ETH’s price, with history suggesting that the crypto token might suffer more price declines in the short term. Whales Accumulate More ETH Data from the market intelligence platform IntoTheBlock shows that Ethereum Whales bought 297,670 ETH ($1 billion) on July 24. The previous day, these whales also bought almost 400,000 ETH. Further data shows an increase of…

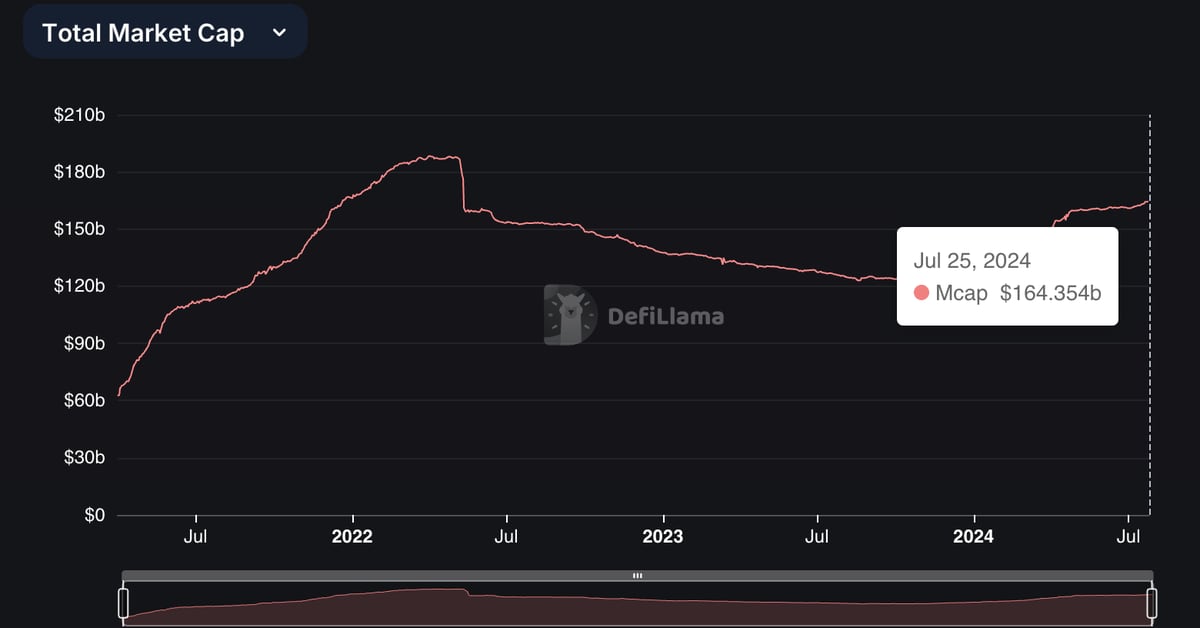

Stablecoin Market Cap Jumps to $164B After Months of Stagnation; BTC, ETH Nurse Losses

The expansion “indicates growing investor optimism, underpinning a bullish outlook,” Wintermute said in a note shared with CoinDesk. “The increase in stablecoin supply indicates that money is being deposited into on-chain ecosystems to generate economic activity, either through direct on-chain purchases that can catalyze price appreciation or yield-generation strategies that could improve [market] liquidity. This activity ultimately fosters positive on-chain growth.” Source

CME’s Ether Futures Record Highest Ever Open Interest of 383K ETH ($1.4B) After ETF Debut

The so-called open interest or the number of active bets in standard ether futures rose to a record of 7,661 contracts, equaling 383,650 ETH and $1.4 billion in notional terms, the exchange said in an email to CoinDesk. The previous peak of 7,550 contracts was set one month ago. The standard contract is sized at 50 ETH. Source