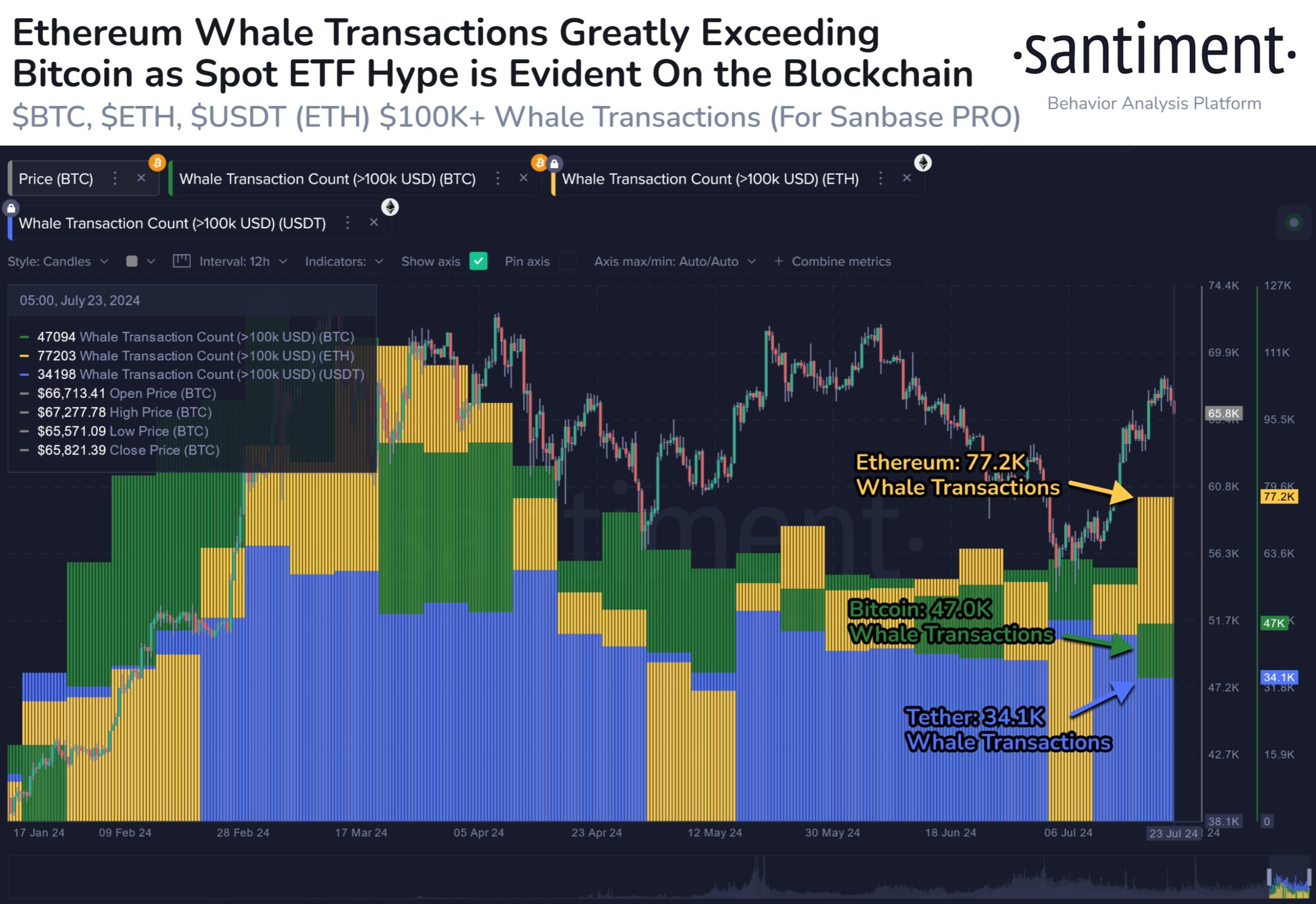

On-chain data shows whale activity on the Ethereum blockchain has been quite high recently due to the excitement around the spot exchange-traded funds (ETFs). Ethereum Whales Showing Significantly Higher Activity Than Bitcoin Ones According to data from the on-chain analytics firm Santiment, Ethereum whales have been displaying considerable activity recently. The indicator of relevance here is the “Whale Transaction Count,” which keeps track of the total amount of transfers happening on any given network carrying a value of at least $100,000. Related Reading Transfers exceeding this amount are generally associated…

Tag: ETH

XRP Maintains Support: Can It Rise Amid BTC and ETH Declines?

XRP price extended gains above the $0.6220 zone. The price tested the $0.6330 zone before there was a pullback amid declines in BTC and ETH. XRP price started a downside correction from the $0.6330 zone. The price is now trading near $0.600 and the 100-hourly Simple Moving Average. There is a connecting bullish trend line forming with support at $0.5920 on the hourly chart of the XRP/USD pair (data source from Kraken). The pair could start another increase if it stays above the $0.590 support zone. XRP Price Holds Uptrend…

Ethereum Whales Take Over, ETH Stuck Below $3,500: What’s Going On?

Ethereum prices are stable at spot rates, moving horizontally even after the United States Securities and Exchange Commission (SEC) approved the list and trading of spot Ethereum ETFs on July 23. Ethereum is trending below the crucial resistances at $3,500 and $3,700 at press time. However, buyers have kept prices above $3,300 as price action moves horizontally. Though there are expectations of volatility, reading from options data, now that spot Ethereum ETFs are available for trading, one analyst picked out a critical development that might affect the BTC-ETH dynamic. Ethereum…

Forget $10,000, Crypto Analyst Says Spot Ethereum ETFs Will Drive ETH To $14,000

The long-awaited Ethereum ETFs have finally hit the market, marking a significant milestone for Ethereum and other altcoins. Industry experts and enthusiasts are looking at how the effects could play out on Ethereum’s price action in the coming months. Renowned crypto analyst Doctor Profit has made a bold prediction. According to him, Ethereum’s value is set to break through the $10,000 barrier, with the potential to reach a peak of $14,000. The catalyst for this anticipated surge is none other than the Ethereum ETFs, which are expected to act as…

ETH ETF Trading Volume Above $600M in First Half Day

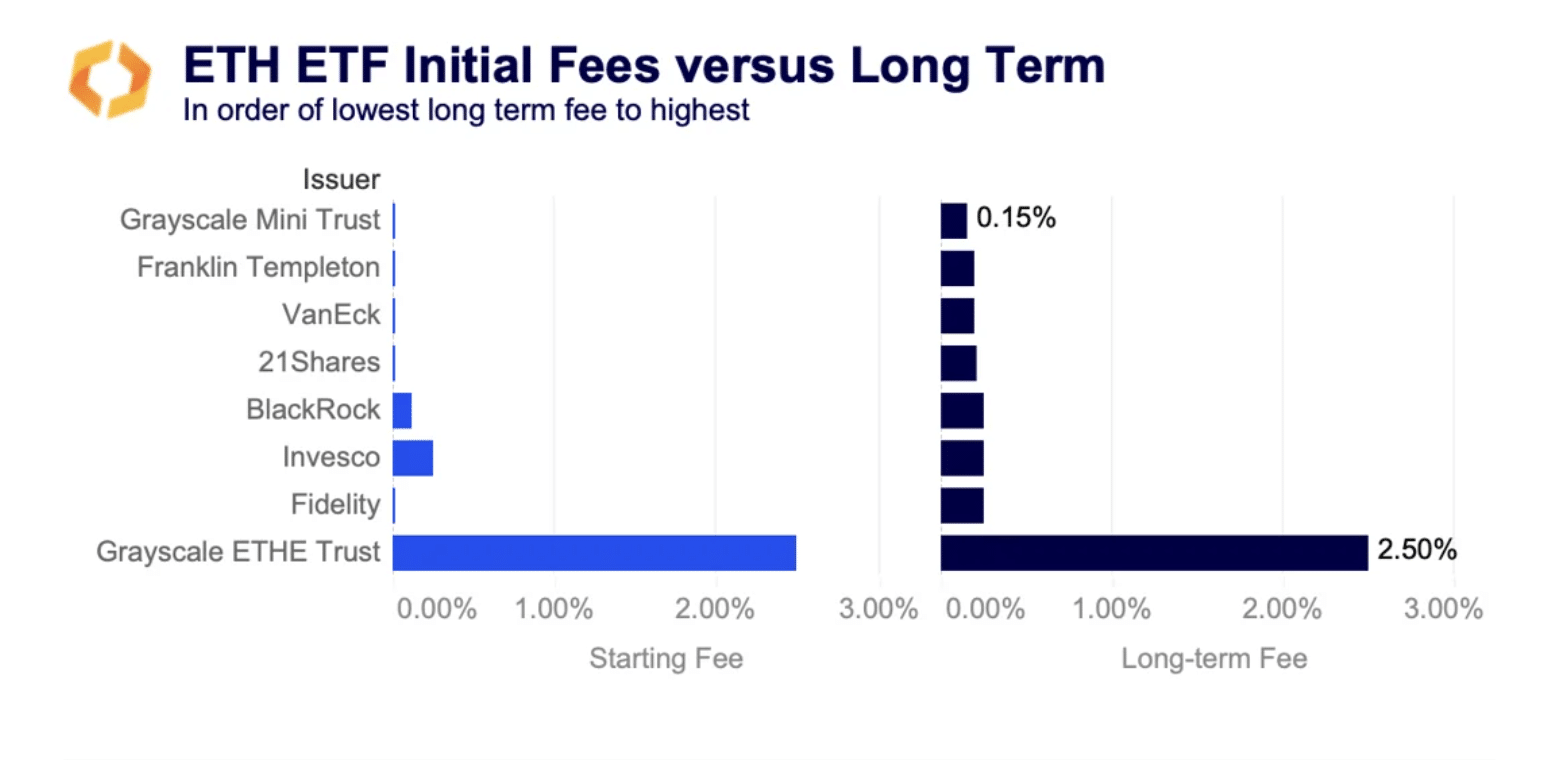

“We assume $ETHE volume is mostly outflows,” Bloomberg Intelligence senior ETF analyst Eric Balchunas wrote in a post on X. Grayscale’s ETHE, in similar fashion to its Bitcoin Trust (GBTC), entered the race with over $9 billion in assets, thus giving rise to the idea that much of its volume is due to outflows. Source

Single Entity Risk Questioned as Coinbase Dominates ETH and BTC ETF Reserve Storage

The day before the spot ether exchange-traded funds (ETFs) were introduced, Coinbase posted on X to clarify its position regarding spot BTC and ETH ETFs. The company mentioned that it holds assets for ten out of 11 spot bitcoin ETFs and eight out of nine ether ETFs. Gabor Gurbacs, founder of Pointsville and former strategy […] Source CryptoX Portal

ETH ETFs: What We’re Watching For

ETH ETFs finally make their debut in the U.S. this week. How will the market react and will Ethereum as a development ecosystem benefit? George Kaloudis raises the questions we’re looking forward to answering. Source

Is the Eth ETF launch a “sell the news” scenario?

Spot Ethereum Exchange-Traded Funds are set to debut on July 23, following the SEC’s rule change over two months ago. According to a report by Kaiko, the initial inflows to these Exchange-Traded Funds (ETFs) will most likely affect Ethereum’s (ETH) price. However, whether the effect will be positive or negative is still up for grabs. “The launch of the futures based ETH ETFs in the US late last year was met with underwhelming demand, said Will Cai, head of indices at Kaiko. “All eyes are on the spot ETFs’ launch…

Ether (ETH) ETFs Approved by SEC, Bringing Popular Funds to Second-Largest Cryptocurrency

The approval and beginning of trading of the spot bitcoin ETFs in January, which became the most successful launch in the history of exchange-traded products in terms of the speed of money rushing into them, pushed the price of the largest cryptocurrency up to new all-time highs after surging more than 58% within just two months. Source

Ether (ETH) ETFs Could See Underwhelming Demand, Wintermute and Kaiko Predict

Wintermute, a major market maker, sees ether ETFs collecting $4 billion, at most, of inflows from investors over the next year. That’s below the $4.5 billion to $6.5 billion expected by most analysts – and that latter number is already roughly 62% less than the $17 billion that bitcoin ETFs have so far collected since they began trading in the U.S. six months ago. Source