Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency. Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems. In two years of active…

Tag: ETH

Standard Chartered Is Building a Spot Bitcoin (BTC), Ether (ETH) Trading Desk: Bloomberg

“We have been working closely with our regulators to support demand from our institutional clients to trade Bitcoin and Ethereum, in line with our strategy to support clients across the wider digital asset ecosystem, from access and custody to tokenization and interoperability,” Standard Chartered said in an emailed statement, according to the report. Source

Mexican Cartels Using BTC, ETH, USDT, Other Tokens to Buy Fentanyl Precursors: U.S. Treasury

The cartels “are increasingly purchasing fentanyl precursor chemicals and manufacturing equipment” from China-based suppliers and paying in tokens including bitcoin (BTC), ether (ETH), monero (XMR), and tether (USDT) “among others,” according to an updated FinCEN advisory to alert U.S. financial firms about the network of criminal organizations producing the dangerous narcotic. Source

Ether (ETH) Price Volatility Expectations May Be Overrated

The spread between the forward-looking, 30-day implied volatility indexes for ether (ETH DVOL) and bitcoin (BTC DVOL) flipped positive in April on dominant crypto options exchange Deribit. Since then, it has risen to 17%, according to data tracked by Amberdata. Implied volatility estimates the degree of future price swings based on options prices. Source

Institutional Investors Unlikely to Be Put Off by Ether (ETH) ETF’s Lack of Staking, 21Shares’ Ophelia Snyder Says

“For example, there could be months when the unstaking period is six or nine days, and that range can be so wide, it changes your liquidity requirements,” Snyder said. “And it doesn’t just jump from nine to 22 days. It actually slowly extends and if you monitor these things, there are data inputs that you can use to manage that portfolio such that you’re doing the right things in terms of maximizing returns while minimizing the probability of a liquidity issue.” Source

XRP, LINK, ETH Stand Out Relative to BTC in Sector Rotation Analysis, DOGE Struggles

The graph comprises four quadrants: leading, weakening, lagging, and improving. The leading quadrant (top right) indicates strong relative strength and positive momentum, weakening (bottom right), strong relative strength but negative momentum. Lagging (bottom left) represents weak relative strength and negative momentum and improving indicates weak relative strength but positive momentum. Source

Ethereum Foundation Moves $64.4 Million Worth Of ETH, Is This A Dump?

The Ethereum Foundation is again in the news following its recent transaction involving millions of Ethereum (ETH) tokens. The non-profit organization’s Ethereum transactions are always significant, considering the impact they usually have on the second-largest crypto token. Ethereum Foundation Transfers $64.4 Million Worth Of ETH Crypto journalist Colin Wu revealed in an X (formerly Twitter) post that a wallet (0x8e…D052) linked to the Ethereum Foundation transferred 18,089 ETH ($64.4 million) to a new address (0x87…D812). On-chain data shows that the new address has yet to transfer these funds and that…

Ethereum Technical Analysis: ETH Faces Mixed Signals Amid Short-Term Downtrend

On June 17, 2024, ethereum is priced at $3,521, fluctuating between $3,495 and $3,645 over the past 24 hours. Ethereum On the 1-hour chart, ethereum’s (ETH) recent high is $3,652, and the low is $3,484. The trend has been bearish following the peak on June 21, characterized by increased selling volume. A potential entry point […] Source CryptoX Portal

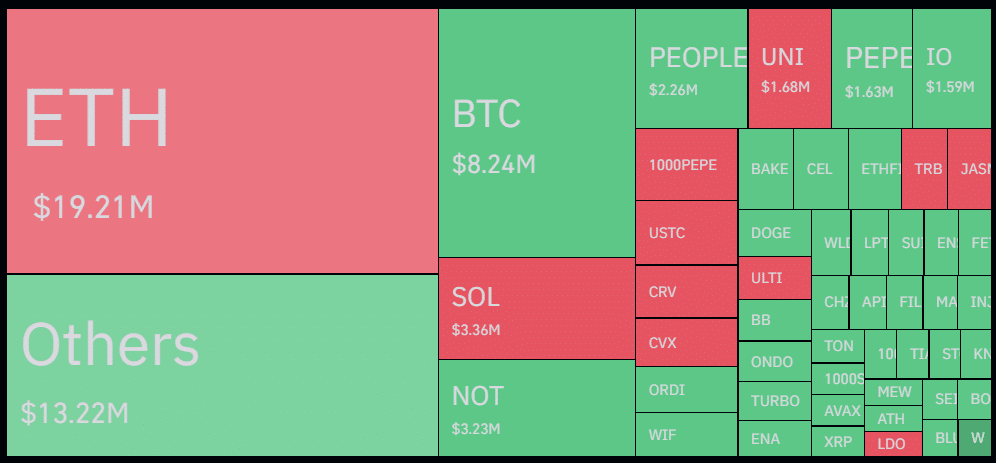

Crypto liquidations rally 78% with ETH leading the charts

Cryptocurrency liquidations have seen a sudden increase over the past day. Ethereum (ETH) is still leading the charts. According to data provided by Coinglass, the total crypto liquidations surged by 78.8% in the past 24 hours, surpassing the $75 million mark. The increase in liquidations came while the total cryptocurrency open interest recorded a 0.35% decline in the same timeframe — currently hovering at $66 million. Crypto liquidations map – June 17 | Source: Coinglass Per a crypto.news report on Jun. 16, the number of crypto liquidations plunged by 80%…

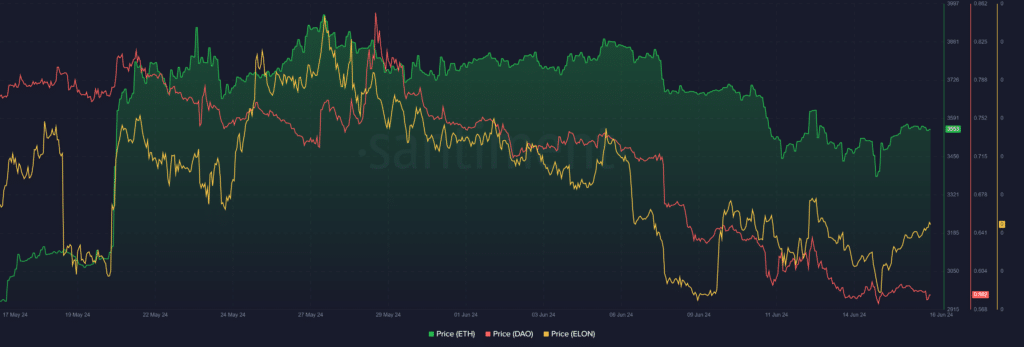

Top cryptocurrencies to watch this week: ETH, DAO, ELON

The cryptocurrency market experienced a predominantly bearish trend last week. Bitcoin (BTC), the leading asset, saw its price decline by 4%. Most major tokens followed suit with quite similar movements, although a few lesser-known cryptocurrencies managed to defy the downturn. Amid widespread market pressure, the global cryptocurrency market cap decreased by $120 million, representing a 4.7% decline. It dropped from $2.54 billion at the start of the week to $2.42 billion by the week’s end. Here are our picks for some of the top cryptocurrencies to watch this week, based…