Because it’s a more familiar, regulated way to allocate capital into the crypto market. Check out Coinbase and MicroStrategy stocks in 2023 – they outperformed Bitcoin, and that’s no coincidence. These ETFs will open the floodgates for Registered Investment Advisors (RIAs), pension funds, and hedge funds to get in on the action. Plus, investment banks will start concocting new products based on these ETFs and the CBOE is awaiting approval to begin listing options on these new ETFs. Original

Tag: Ethereums

Ethereum’s Dencun Upgrade Goes Live, Devs Wait for Finalization on Testnet

The upgrade was pushed at 6:32 UTC, blockchain data shows, but did not reach consensus and was not finalized on the testnet. Developers expect the apparent issues to be fixed in the coming days. These likely occurred due to low participation and validators not upgrading parts of their software that would have helped with finalization. Source

Ethereum’s Vitalik Buterin Proposes Gas Limit Increase

Following Buterin’s Reddit comments on Wednesday, more users on X, the platform formerly known as Twitter, chimed in with words of support for the suggested increase. Jesse Pollak, the head of protocols at Coinbase and creator of the layer-2 blockchain Base, shared his support of the move and suggested the gas limit could even be increased even further, to 45 million. Source CryptoX Portal

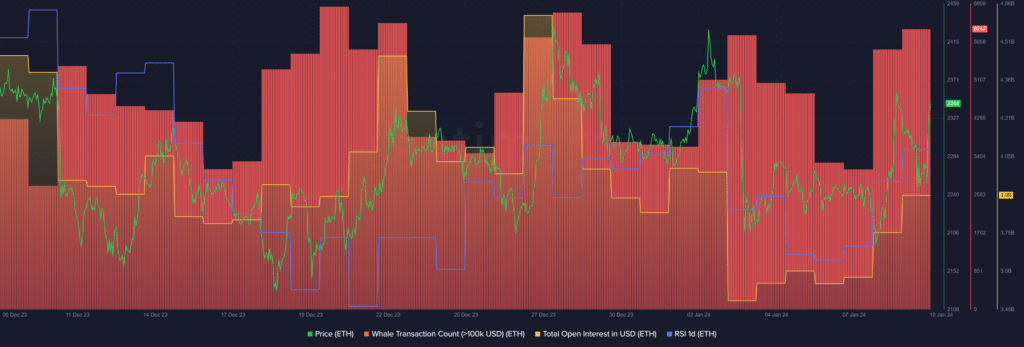

Ethereum’s price surges despite the market-wide chaos

The crypto market witnessed decline after false news about a Bitcoin (BTC) exchange-traded funds (ETF), but despite bearish sentiment in the market, Ethereum (ETH) posted gains. ETH gained 3% in the past 24 hours and is trading at $2,380 at the time of writing. The second-largest cryptocurrency even got close to the $2,400 mark as the hacked X account of the U.S. Securities and Exchange Commission announced the approval of a spot BTC ETF. ETH price, whale activity, open interest and RSI – Jan. 10 | Source: Santiment Ethereum’s market…

Vitalik Buterin Seeks to Simplify Ethereum’s Proof-of-Stake Model for Greater Efficiency, Proposes Three Changes

Buterin emphasized that these proposals provide credible ways to limit the number of signatures without compromising security or showing favoritism. Ethereum wants to make its proof-of-stake model simpler for better efficiency. Right now, validating transactions on the Ethereum blockchain is done by a large number of validator nodes, around 895,000 of them, and they generate about 28,000 signatures in each time slot. This huge number of signatures puts a strain on the network and makes it difficult to make improvements. As Vitalik Buterin, Ethereum co-founder, pointed out, having such a…

Solana Surges Nearly 83% in a Week As SOL’s Decentralized Exchange Volumes Now Rank Second After Ethereum’s

New data from decentralized finance (DeFi) tracker DeFiLlama reveals that surging altcoin Solana (SOL) is now the top traded digital asset on decentralized exchanges (DEXs) behind Ethereum (ETH). Solana’s trading DEX volume has soared by more than 25% in the past week for a total of $5.6 billion, catapulting it into the second highest traded digital asset on DEXs, according to DeFiLlama. On December 13th, Solana ranked just fourth by DEX trading volume. Ethereum is the top traded DEX asset with $8.89 billion in trading volume in the past week. Source:…

Ethereum’s dominance to persist despite Solana’s investor appeal, Coinbase says

Although investors ‘have been heavily’ allocating to Solana throughout 2023, Ethereum will still be the top smart contracts platform in 2024, Coinbase says. In a new report titled “2024 Crypto Market Outlook,” Coinbase noted that throughout 2023, net fund inflows to Solana-related (SOL) investment funds were second only to Bitcoin (BTC), surpassing Ethereum (ETH) and other multi-asset funds flows. Analysts at the U.S.-based crypto exchange attributed the surge in Solana investment to the network’s ability to handle high transaction volumes and low fees, which they say are necessary to support…

Ethereum’s Vitalik Buterin Wants to Transfer Some Layer-2 Functions Back to L1 via Enshrined zkEVM

Buterin believes the enshrined zkEVM method, which returnes functions to L1, is the next course of action as “light clients” get stronger. Ethereum co-founder Vitalik Buterin has made a case for taking some functions away from Layer-2 networks or rollups, back to the main Ethereum chain. This “enshrined zkEVM” (zero-knowledge Ethereum Virtual Machine) method is a direct opposite of his previous campaign years ago, which sought to transfer computational load from the main Ethereum chain to Layer-2 networks. Buterin previously touted major support for Layer-2 networks that bundle transactions for off-chain…

Ethereum’s Vitalik Buterin Writes on ‘Enshrinement’ of ZkEVMs into Main $ETH Blockchain

Buterin’s comments come as ether (ETH), the native cryptocurrency of the Ethereum blockchain, has lagged behind tokens from rival blockchains as digital-asset markets rallied this year. Ether has climbed by 84%, while Solana’s SOL has jumped more than eight-fold in price and Avalanche’s AVAX has tripled. Bitcoin, the biggest cryptocurrency, has gained 153%. Source

Ethereums Future: Will Ethereum Recover?

In this exploration, we tackle the critical question: Will Ethereum recover? We’ll look at Ethereums future and analyze ETH’s present market status, potential for resurgence, the anticipated impact of the progress on Ethereum 2.0, and share expert price predictions. Will Ethereum Recover? Analysis The question “Will Ethereum recover?” depends on numerous factors. As of November 2023, Ethereum has shown signs of rebounding from its 2022 lows, suggesting a potential bottoming out. Key developments like the transition to Proof-of-Stake and the introduction of EIP (Ethereum Improvement Proposal) 1559, launched all the…