October 11th, 2025 – Dubai, United Arab Emirates According to CoinMarketCap data, Bitcoin fell 8.9% over the past week to $111,452.76, while Ethereum declined 16.4% to $3,770.65 and BNB dropped 6.8% to $1,093.59. The sell-off came after U.S. President Donald Trump announced additional tariffs on Chinese exports and software controls, triggering what Coinglass described as “the largest liquidation event in crypto history,” with over $19 billion in leveraged positions wiped out and more than 1.6 million traders liquidated. Pepeto (PEPETO) has now raised $6,996,954.27 in its presale, offering tokens at…

Tag: Exchange

Bitget’s Q3 Transparency Report Highlights How UEX Vision Takes Shape Across Exchange, Wallet, and Onchain Ecosystem

This content is provided by a sponsor. Bitget, the world’s largest Universal Exchange (UEX), has released its Q3 2025 Transparency Report, highlighting a quarter defined by innovation, user growth, and stronger financial transparency. Marking its seventh anniversary, Bitget introduced UEX, a next-generation trading model that unifies spot, futures, staking, payments, and onchain access into one […] Source

HashKey Crypto Exchange Considers Hong Kong IPO This Year: Bloomberg

HashKey Group, the owner of Hong Kong’s top licensed crypto exchange, has reportedly filed for an initial public offering (IPO) in the city. According to a Friday Bloomberg report citing anonymous sources with knowledge of the matter, HashKey Group could be aiming for a listing in Hong Kong this year. The IPO could raise up to $500 million, according to the sources cited in the report. HashKey is Hong Kong’s top crypto exchange with a 24-hour volume of nearly $117 million at the time of writing, according to CoinGecko data.…

Bybit Becomes First Crypto Exchange With Complete UAE Regulatory Approval

Key Notes The exchange plans to establish a regional operations center in Abu Dhabi with over 500 employees across UAE locations. Bybit will offer regulated trading, brokerage, custody, and fiat conversion services to retail and institutional clients. The licensing marks part of Bybit’s broader Middle East expansion strategy including tokenized fund development. Bybit, a cryptocurrency exchange headquartered in the British Virgin Islands, says it has secured a Virtual Asset Platform Operator License from the Securities and Commodities Authority (SCA) of the United Arab Emirates (UAE). According to an Oct. 9…

Bybit Becomes First Crypto Exchange Fully Licensed by UAE’s SCA

More Volume, More Revenue, Better Traders: Crypto Derivatives with Shift Markets More Volume, More Revenue, Better Traders: Crypto Derivatives with Shift Markets More Volume, More Revenue, Better Traders: Crypto Derivatives with Shift Markets More Volume, More Revenue, Better Traders: Crypto Derivatives with Shift Markets More Volume, More Revenue, Better Traders: Crypto Derivatives with Shift Markets More Volume, More Revenue, Better Traders: Crypto Derivatives with Shift Markets Derivatives trading has rapidly overtaken spot trading as the driving force in crypto markets. In this exclusive webinar with Shift Markets, we explore the…

BurraPay Enters Into Agreement With Byte Federal for Crypto Exchange Services

This content is provided by a sponsor. PRESS RELEASE. BRANCHBURG, NEW JERSEY — October 9th, 2025 — BurraPay, the leading provider of cryptocurrency payment solutions for the regulated casino gaming industry, announced today that it has entered into an agreement with Byte Federal, a pioneering FinTech company that specializes in digital currency solutions. Based in […] Source

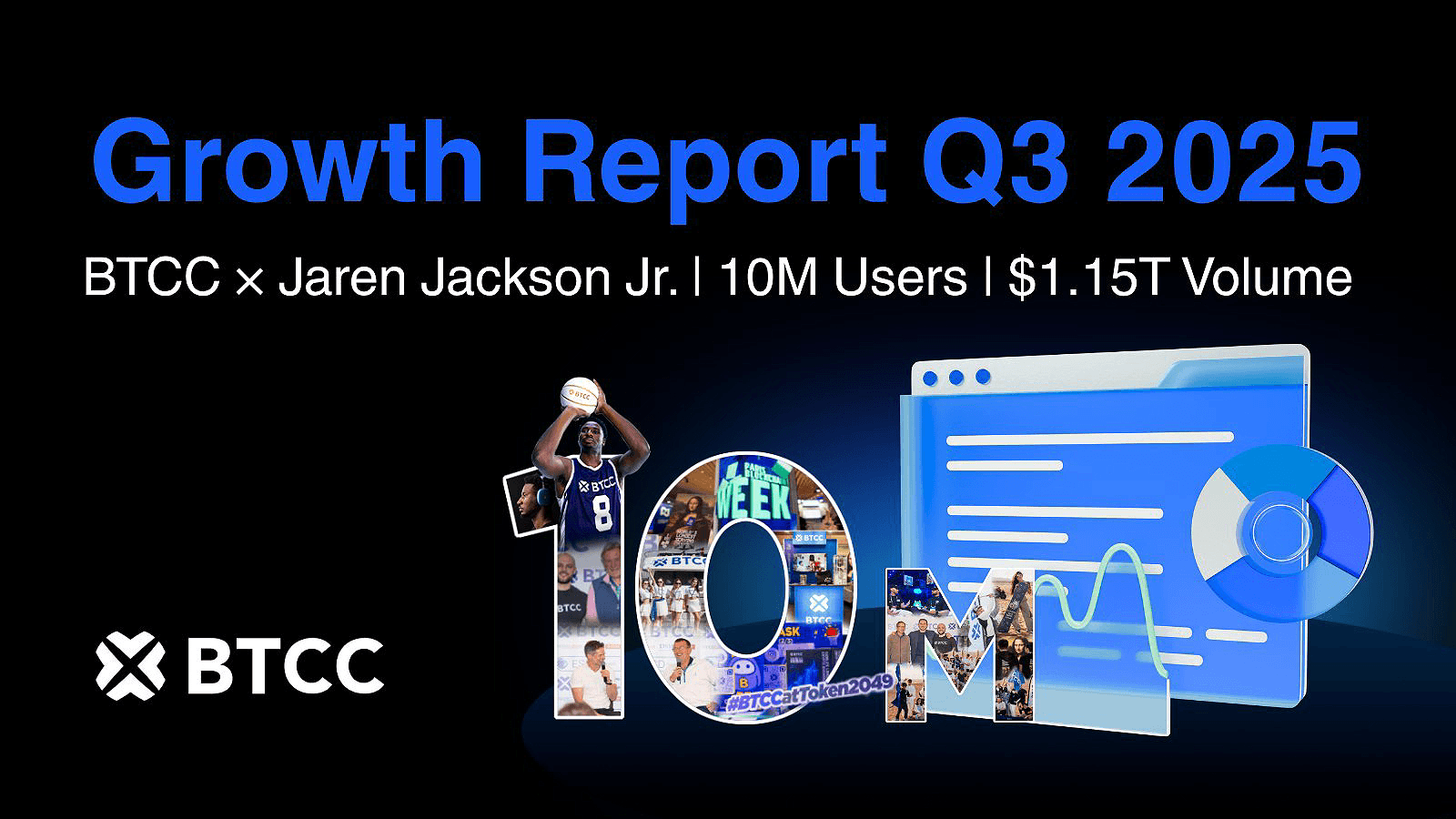

BTCC Exchange Achieves Major 10M User Milestone With $1.15 Trillion Q3 Trading Volume as Platform Accelerates Global Growth

This content is provided by a sponsor. PRESS RELEASE. VILNIUS, Lithuania, October 9, 2025 – BTCC, the world’s longest-serving cryptocurrency exchange, today announced it has surpassed 10.16 million registered users globally and achieved a record $1.15 trillion in trading volume during Q3 2025. These figures mark significant growth milestones for the platform. The exchange’s Q3 […] Source

BTCC Exchange Hits 10M Users and $1.15T Q3 Trading Volume, Accelerating Global Expansion

October 9th, 2025 – VILNIUS, Lithuania BTCC, the world’s longest-serving cryptocurrency exchange, today announced it has surpassed 10.16 million registered users globally and achieved a record $1.15 trillion in trading volume during Q3 2025. These figures mark significant growth milestones for the platform. The exchange’s Q3 performance represents substantial growth, with trading volume up 20% compared to Q2 2025’s $957 billion. The user base expanded from 9.1 million in Q2 to 10.16 million by the end of Q3. This landmark quarter was highlighted by a strategic global brand ambassador partnership…

Coinbase Integrates Decentralized Exchange Trading into Mobile App – SuperCryptoNews

Cryptocurrency exchange Coinbase has officially launched decentralized exchange (DEX) trading directly within its mobile app for most U.S. users, marking a significant step in the platform’s move to blend centralized and decentralized finance (DeFi). The new feature allows customers to access millions of on-chain assets, often moments after they launch. The full rollout was confirmed in a company announcement on Wednesday, granting users across the United States (excluding New York) the ability to execute non-custodial token swaps directly through an integrated self-custodial wallet. “Explore millions of assets, moments after they…

Crypto Exchange Gemini Expands Offering in Australia

US crypto exchange Gemini is set to expand its offerings in Australia with the launch of a new locally registered entity, and is taking a wait-and-see approach to recent draft laws expected to broaden oversight of the crypto sector. Gemini’s head of Asia Pacific, Saad Ahmed, told Cointelegraph that Australia’s crypto penetration is “quite significant, somewhere in the range of 23 to 25%” which leaves the exchange with “headroom for growth.” On Thursday, the exchange said it created a local entity registered with the Australian Transaction Reports and Analysis Centre…