The U.S. Federal Reserve Board has rejected the attempt of Custodia Bank to become member of the Federal Reserve System. According to the decision announced Friday, the application submitted by the digital asset bank is inconsistent with legal requirements. Federal Reserve Board Says Business Model Proposed by Custodia Bank Presents Risks Crypto bank Custodia has been denied membership in the United States Federal Reserve System. In an announcement dated Jan. 27, the Federal Reserve Board explained that the application, as submitted by the company, is “inconsistent with the required factors…

Tag: finance

CZ predicts ‘existential implications’ for anti-crypto traditional finance

As traditional institutions proactively reduce exposure to cryptocurrencies as a reaction to ecosystem collapses in 2022, Binance CEO Changpeng ‘CZ’ Zhao believes this move could potentially have a negative impact on such traditional financial players. The collapse of major crypto platforms, such as FTX and Terraform Labs, not only reduced trust among investors but also forced the traditional market to reevaluate their strategies for stepping into the crypto ecosystem. While the reluctance of traditional players stands as a deterrent to crypto’s adoption in the short term, CZ argues that the…

TradFi and DeFi come together at Davos 2023: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Traditional finance, or TradFi, continues to explore the world of cryptocurrencies and blockchain technology, with the World Economic Forum holding more workshops and sessions for the sector in 2023. Layer-1 blockchain protocol, Injective, has launched a $150 million ecosystem fund to support developers building on the Cosmos network. The Mango Markets saga took another turn this past week, as the company filed a lawsuit…

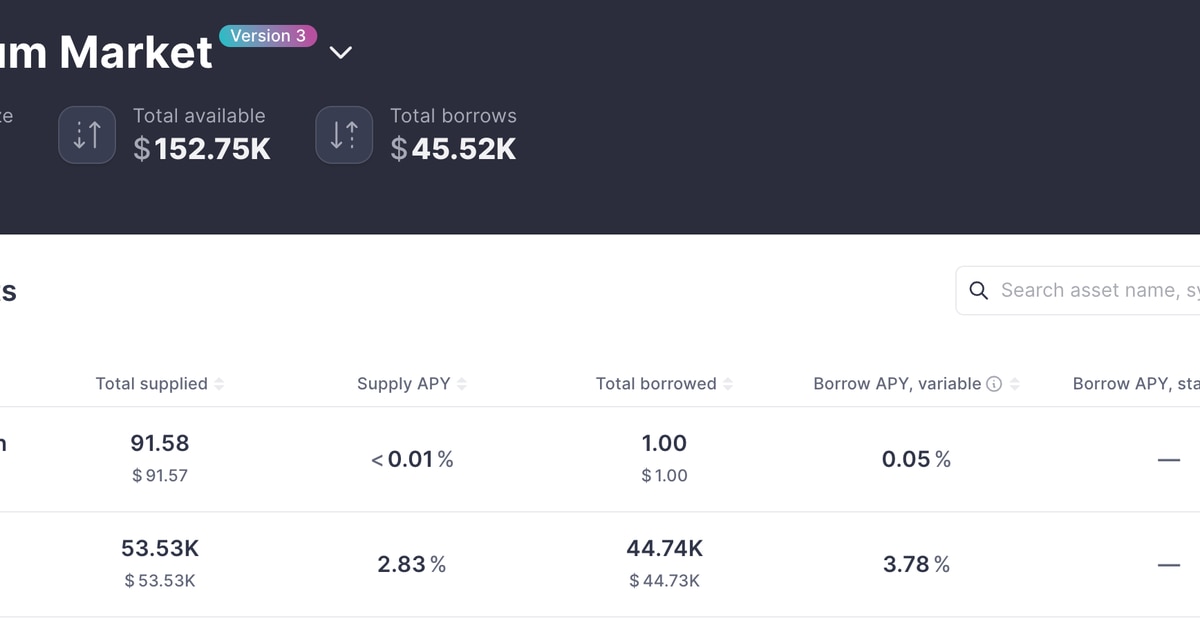

Decentralized Finance Lender Aave Deploys V3 on Ethereum Blockchain

High Efficiency Mode, also called eMode, allows users to capitalize on the highest borrowing power out of their collateral for correlated assets. Users can now leverage larger amounts of assets like wstETH (wrapped staked ethereum) and stake it on the Ethereum blockchain for rewards. Source link

Russia Mulls Gold-backed Stablecoin, Lawmaker Confirms After Iran Visit – Finance Bitcoin News

Russia may issue a stablecoin backed by gold to use in international settlements, a high-ranking member of the Russian parliament has admitted. The matter has been discussed during a recent visit to Iran where officials have also signaled interest in such an initiative. Iran and Russia Talk Stablecoin Payments for Bilateral Trade Settlements The Russian Federation is considering the creation of a stablecoin backed by gold that can be employed for cross-border settlements, including with Iran, the chairman of the Financial Market Committee at the lower house of Russian parliament,…

88x Finance partners with Axelar Network for cross-chain yield aggregator

The crypto bear market may be lasting longer than expected, but some Web3 startups see it as the perfect opportunity to build solutions and infrastructure that will welcome users and institutions when the next wave of adoption arrives. Cross-chain yield aggregator 88x Finance claims that the emergence of general message passing and true composability between blockchains is an opportunity to provide services both to retail and professional investors. Roughly six months after starting to build the platform, the protocol is now participating in the Axelar Ecosystem Startup Funding Program, a…

‘Prohibitive’ Capital Rules for Banks Holding Crypto Win Support in EU Parliament – Finance Bitcoin News

Lawmakers in the European Union have backed legislation imposing new capital requirements for financial institutions, including strict rules meant to cover crypto-related risks. The latter concern banks keeping digital assets and are expected to enter into force in January, 2025. EU Legislators Approve Draft Law Implementing the Basel III Capital Regulations for Banks Members of the European Parliament’s Committee on Economic and Monetary Affairs (ECON) supported a bill on Tuesday designed to enforce the latest global bank capital rules. Reuters noted in a report that the lawmakers have also incorporated…

MakerDAO Passes Proposal To Deploy $100 Million USDC In Yearn Finance Vault

In the hopes of generating yield while offering users what its best known for, MakerDAO, the issuer of the Ethereum-based stablecoin, DAI, has approved a proposal to deploy $100 million of Circle’s USD Coin (USDC) in a Yearn Finance yield-generating account called a “vault.” The proposal, submitted on January 9, aims to look for a way MakerDAO could split its treasury allocations and earn yield. MakerDAO To Generate Yields From Yearn Finance Vault Following the approval of the MIP92 (Maker Improvement Proposal 92), MakerDAO plans to begin depositing $100 million…

How Crypto Regulation Could Stimulate Regenerative Finance (ReFi) Adoption

The carbon-offset industry, which has exceeded $270 billion annually, is increasingly coming under scrutiny due to the perception that a lot of it leads to greenwashing, and that many offsets are generated and retired with insufficient transparency. Dozens, if not hundreds, of ReFi projects have been born in the past few years designed to leverage crypto rails to solve the coordination and transparency problems among the different stakeholders such as project developers, investors and demand partners such as corporations, governments and end users of voluntary offsets. Original Source adoptionCryptoFinanceReFiregenerativeRegulationStimulate CryptoX…

Smart Contracts without Admin Rights Are Crucial for Trustless Decentralized Finance

The primary objective of decentralized finance is to create a world where no trust is needed. When people think of decentralized finance, they automatically assume there are no risks. After all, intermediaries don’t exist, and everything is trustless. However, smart contracts can still contain admin rights, which puts all users at risk. Ensuring these “admin keys” no longer exist is the next major frontier to conquer. DeFi Smart Contracts and Admin Rights On the surface, a smart contract is a code facilitating automation and decentralization. Users interact with the code…