“Receivables financing is one of the oldest commercial finance products,” and AQRU hopes to get a “first-mover advantage” by bringing this traditional investment strategy to crypto investors who are seeking conservative investments to earn a yield, Phil Blows, chief executive of AQRU, told CoinDesk in an interview. Source

Tag: finance

Blockstream raises $125M to finance expanded Bitcoin mining operations

Digital asset infrastructure company Blockstream has raised $125 million to finance its Bitcoin (BTC) mining colocation services, underscoring heightened demand for its institutional hosting services amid the bear market. The $125 million raise was financed by convertible note and a secured loan, Blockstream announced on Jan. 24. Venture capital firm Kingsway Capital led the convertible note raise, with additional participation from Fulgur Ventures. Cohen & Cohen Capital Markets, part of J.V.B. Financial Group, advised Blockstream on the deal. The funding will enable Blockstream to expand mining capacity for institutional hosting…

Singapore Regulator Advocates ‘One Regulatory System’ for Crypto and Traditional Finance – Regulation Bitcoin News

Singapore’s senior minister and the chairman of the central bank, the Monetary Authority of Singapore (MAS), says there should be just “one regulatory system” for both crypto and traditional finance. In addition, he stressed that regulators should provide “ultra clarity as to what’s an unregulated market,” so investors are aware that they go in at their own risk. ‘One Regulatory System’ Tharman Shanmugaratnam, Singapore’s senior minister who is also the chairman of the country’s central bank, the Monetary Authority of Singapore (MAS), talked about cryptocurrency regulation during a panel discussion…

MakerDAO Approves Deployment of $100M USDC on DeFi Protocol Yearn Finance

The move may also boost Yearn’s dwindling user activity. The protocol’s total value locked, a popular indicator to show the worth of assets deployed on a DeFi protocol, has dropped to $442 million from an all-time high of $6.9 billion in December 2021, according to data from DefiLlama. Source

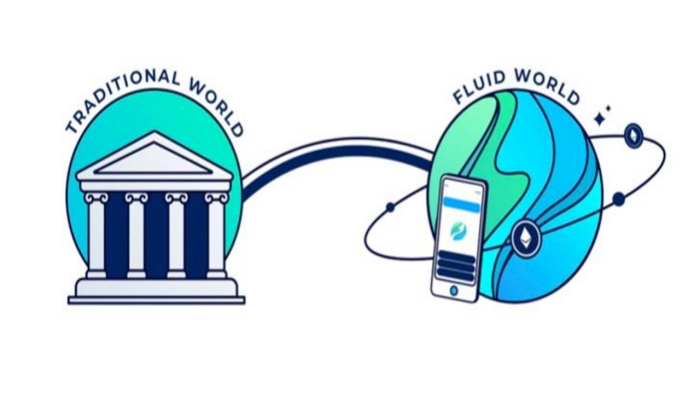

Fluid Finance Proposes to Integrate the DAI Decentralized Stablecoin Directly Into the Traditional Financial System – Press release Bitcoin News

press release PRESS RELEASE. Fluid Finance submitted a proposal to integrate the DAI decentralized stablecoin directly into the traditional financial system. It would be the first time that a stablecoin could be purchased directly from a bank account. Jessica Walker at Fluid said: “One of the problems with crypto is the lack of connection to the real world. Fluid solves that by integrating Dai directly into our accounts. Users can buy Dai directly from us using dollars, euros, pounds and dozens of other currencies. Dai holders can also now buy…

China-backed Blockchain Project Proposes SWIFT Alternative for Stablecoins and CBDCs – Finance Bitcoin News

The company developing China’s blockchain network wants to create a system for international settlements with stablecoins and state-issued digital currencies. The plan is to establish a platform facilitating the use of these two fiat-based digital assets in foreign trade. Company Behind China’s Blockchain Push Aims to Make Stablecoins and State Coins Interoperable Hong Kong-based Red Date Technology, the designer of China’s state-backed Blockchain-based Service Network (BSN), has launched a new project to implement both stablecoins and central bank digital currencies (CBDCs) in cross-border payments. The initiative was announced this week…

Role Of Gamification In The Finance And Gaming Industry

It is challenging to make gaming and financial services intriguing. Fintech and gaming, like businesses in many industries, are attempting to increase user engagement through modern technologies. Banks and gaming businesses are aware of the need to develop new methods of engagement with their clientele to remain competitive and foster loyalty in a field that is becoming increasingly competitive. Could gamification be the key to achieving more engagement? It remains an unsettling question because today’s consumers are seldom far from their smartphones and seamlessly switch between digital platforms. But what…

IMF Division Chief and Deputy Managing Director Call for Swift Regulatory Action to Avoid Crypto Contagion to Legacy Finance – Regulation Bitcoin News

An International Monetary Fund (IMF) division chief and deputy managing director are calling for more action to be taken in the regulatory aspect to avoid crypto’s ups and downs affecting banks and traditional financial institutions. Nobuyasu Sugimoto, deputy division chief of the financial supervision and regulation division of the IMF, and Bo Li, deputy managing director at the IMF, believe that, given the growing links between legacy finance and crypto, cryptocurrency’s volatility might bring systemic risks to the existing markets. IMF Blog Post Calls for Containing Future Crypto Contagion The…

DeFi should complement TradFi, not attack it: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Following FTX’s demise, the DeFi space is up for a complete remodel as crypto users demand better security and compliance practices. SushiSwap’s roadmap for the coming year includes the development of a decentralized exchange (DEX) aggregator, a decentralized incubator and “several stealth projects.” All these projects combined can grow its market share 10x, said the CEO. The co-founder and CEO of Ava Labs spoke…

Silvergate Capital Incurs Loss of $1 Billion in Q4 of 2022 – Finance Bitcoin News

Silvergate Capital Corporation, the parent firm of the crypto-focused bank Silvergate Bank, has attributed the $1 billion loss it incurred in the fourth quarter of 2022 to the confidence crisis that permeates the entire crypto ecosystem. While Silvergate has taken steps to help it navigate the current environment, according to the CEO Alan Lane, the firm remains “focused on providing value-added services for [its] core institutional customers.” Confidence Crisis Less than a month after Silvergate Bank reported a massive drop in customer deposits, the crypto-focused financial institution’s parent firm, Silvergate…