The cryptocurrency market continued its recovery in the past week as the total crypto market capitalization breached the $3 trillion mark for the first time since the beginning of March. Bitcoin (BTC) rose to an over two-month high of $97,300 last seen at the end of February, before the “Liberation Day” tariffs announcement in the US, bolstering analyst predictions for a rally driven by “structural” institutional and exchange-traded fund (ETF) inflows into the world’s first cryptocurrency. Risk appetite continued rising among crypto investors, as Chinese state-linked news outlets indicated that…

Tag: finance

Australia’s finance watchdog to crack down on dormant crypto exchanges

Australia’s financial intelligence agency has told inactive registered crypto exchanges to withdraw their registrations or risk having them canceled over fears that the dormant firms could be used for scams. There are currently 427 crypto exchanges registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC), but the agency said on April 29 that it suspects a significant number are inactive and possibly vulnerable to being bought and co-opted by criminals. The agency is contacting any so-called digital currency exchanges (DCEs) that appear to no longer be trading, and AUSTRAC…

Crypto firms launch Wall Street-style funds: Finance Redefined

Cryptocurrency firms and centralized exchanges are launching more traditional investment offerings, bridging the divide between traditional financial and digital assets. With investors seeking more flexible product offerings under one platform, the “line is blurring” between traditional finance (TradFi) and the cryptocurrency space, as the two financial paradigms signal a “growing synergy,” according to Gracy Chen, CEO of Bitget, the world’s sixth-largest crypto exchange. In the wider crypto space, Securitize partnered with Mantle protocol to launch an institutional fund that will generate yield on a basket of diverse cryptocurrencies, similar to…

Ethical finance must guide crypto’s evolution

Opinion by: Daniel Ahmed, co-founder of Fasset and founding member of the Own Foundation Crypto was born from a vision to decentralize power, democratize finance and build systems where equity prevails over exploitation. Somewhere along the way, however, the movement lost its moral compass. As speculation surged, purpose dwindled. We must return crypto to its decentralized roots, a technological revolution built on long-term value, inclusivity and ethics rather than cyclical, speculative gains. The industry should take inspiration from emerging regions and how ethical financial investing can help to repair some…

Russian Ministry of Finance and Central Bank to Launch Elite-Only Crypto Exchange

A bold crypto revolution is underway as Russia launches a regulated crypto exchange for elite investors, dragging digital assets into legality, led by the Finance Ministry and the central bank. Russian Central Bank and Finance Ministry Aim to Drag Crypto out of the Shadows Russian Finance Minister Anton Siluanov announced at a recent Ministry of […] Source

Russia’s central bank, finance ministry to launch crypto exchange

Russia’s finance ministry and central bank are reportedly planning to launch a crypto exchange for qualified investors under an experimental legal regime. The platform will be aimed at “super-qualified investors,” Finance Minister Anton Siluanov said during a ministry meeting, according to April 23 reports from Russian media group RBC and Russian news agency Interfax. “Together with the central bank, we will launch a crypto exchange for super-qualified investors. Crypto assets will be legalized, and crypto operations will be brought out of the shadows,” he said in a statement translated from…

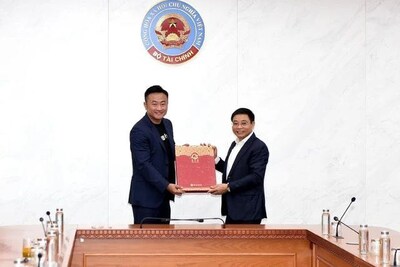

Bybit’s CEO Meets with Vietnam’s Minister of Finance to Support Regulatory Sandbox and Strengthen Crypto Compliance

DUBAI, UAE, April 19, 2025 /CNW/ — Ben Zhou, Co-founder and CEO of Bybit, one of the world’s second-largest cryptocurrency exchanges by trading volume, met with H.E. Nguyen Van Thang, Minister of Finance of Vietnam, to express Bybit’s strong support for the country’s regulatory sandbox initiative and its vision to build a safe, transparent, and innovation-friendly digital asset ecosystem. Hosted at the Ministry of Finance headquarters, the meeting centered on Vietnam’s efforts to establish a comprehensive legal framework for crypto assets. Minister Nguyen Van Thang outlined the Government’s plan to…

Crypto, DeFi may widen wealth gap, destabilize finance: BIS report

The growing adoption of cryptocurrencies may pose risks to the traditional financial system and exacerbate wealth inequality, according to the Bank for International Settlements (BIS). In an April 15 report, the BIS warned that the number of investors and amount of capital in crypto and decentralized finance (DeFi) have “reached a critical mass,” with investor protection becoming a “significant concern for regulators.” The size of the crypto market signals that authorities should be worried about the “stability of crypto over and above the role it may have for TradFi and…

Decentralized finance gains ground in Yemen amid US sanctions

Locals in Yemen have turned to decentralized finance as a way to navigate sanctions imposed by the United States that have cut off access to traditional banking services. According to blockchain intelligence firm TRM Labs, some Yemenis are increasingly using DeFi protocols to send and receive funds, manage remittances, and bypass disruptions to local financial services. Over 63% of Yemen’s crypto-related web traffic is now tied to DeFi platforms, while global centralized exchanges account for just 18%, according to TRM’s data. The trend follows several rounds of US sanctions targeting…

Mantra exposes crypto liquidity problems, and Coinbase is bearish: Finance Redefined

Crypto investor sentiment took another significant hit this week after Mantra’s OM token collapsed by over 90% within hours on Sunday, April 13, triggering knee-jerk comparisons to previous black swan events such as the Terra-Luna collapse. Elsewhere, Coinbase’s report for institutional investors added to concerns by highlighting that cryptocurrencies may be in a bear market until a recovery occurs in the third quarter of 2025. Mantra OM token crash exposes “critical” liquidity issues in crypto Mantra’s recent token collapse highlights an issue within the crypto industry of fluctuating weekend liquidity…