In a recent development, US lawmakers have urged the US Department of Justice (DOJ) to initiate a criminal investigation into cryptocurrency exchange Binance (BNB) and stablecoin issuer Tether (USDT). The lawmakers, led by Senator Cynthia Lummis, reference a controversial Wall Street Journal (WSJ) report that alleges Hamas and its affiliate raised significant funds through cryptocurrencies. Binance And Tether Face Calls For Criminal Charges In a joint letter signed by Senator Lummis and Representative French Hill, the lawmakers express deep concern over reports indicating that “unregulated crypto intermediaries” outside the United…

Tag: finance

Fulcrom Finance expands to zkSync Era, unveils $100K reward pool

Fulcrom Finance, a perpetual trading protocol on Cronos, is expanding into the zkSync Era to further support its staking community. Following this announcement, the decentralized finance (defi) solution has announced a $100,000 reward pool to celebrate this milestone. Fulcrom Finance expands to zkSync Era On Oct. 5, Fulcrom Finance said it will expand into zkSync Era. The layer-2 protocol utilizes zero-knowledge (ZK) technology to enhance scalability, security, user experience, and community engagement while remaining decentralized. Fulcrom Finance also bridged 2.4 billion FUL from Cronos to zkSync Era at launch, making it one…

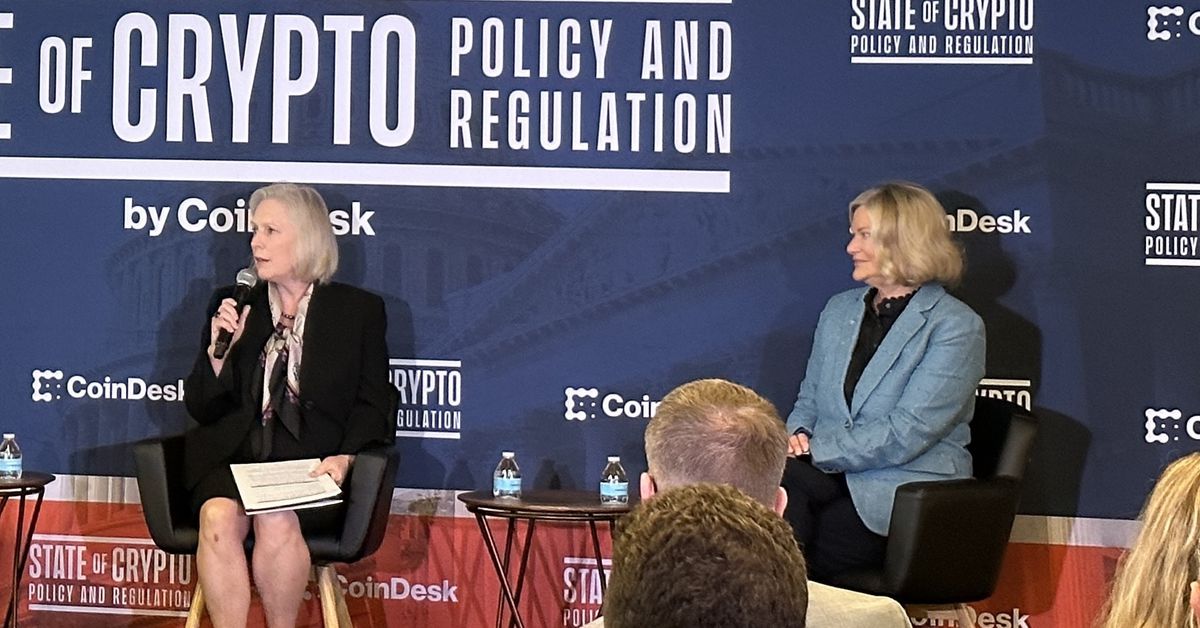

Despite U.S. House Gridlock, Senator Gillibrand Bullish on Stablecoin Bill, Illicit Finance Legislation

“As mainstream finance moves into this space, I think people in Congress are going to see we can’t have our head in the sand anymore,” Lummis said at the same event on Tuesday, suggesting that some lawmakers will be more comfortable with the representatives of traditional financial firms. “When they come into the room where the party’s happening,” she said of the TradFi people, “they bring a lot of people with them.” Source

Marinade and Orca Finance ban UK user access amid FCA regulatory concerns

Solana DeFi platforms Marinade Finance and Orca Finance restrict access for UK users due to FCA regulatory guidelines. Marinade Finance and Orca Finance, leading platforms in Solana’s decentralized finance (DeFi) ecosystem, have implemented geo-restrictions for users in the United Kingdom, citing the need for regulatory compliance. According to the site, the restrictions are related to the latest Financial Conduct Authority (FCA) mandates. While the platform’s landing page for UK visitors displays an advisory notice, it also assures users that existing assets can be withdrawn and managed via their software development…

Finance Author Believes Bitcoin Is Headed To $135,000

The crypto community is buzzing with excitement after a renowned finance author predicts an impending Bullish outcome for Bitcoin. The words of the respected financial figure have raised questions and discussions across the crypto community. Rich Dad Poor Dad Author Sees Bitcoin Rising Japanese-American entrepreneur and author of the famous Rich Dad Poor Dad book, Robert T. Kiyosaki recently stated in an X (formerly Twitter) post on Thursday, that Bitcoin was poised to reach $135,000 after hitting a $30,000 mark at one point on Friday following rumors of BlackRock’s Bitcoin…

Busy week for Uniswap, and Platypus recovers 90% of hacked funds: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. The past week in DeFi was dominated by developments in the popular decentralized exchange platform Uniswap after it announced a 0.15% swap fee starting on Oct. 17, and an open-source hook on Uniswap generated controversy due to Know Your Customer (KYC) checks. In other major DeFi developments, Platypus Finance managed to recover 90% of the funds it lost to an Oct. 12…

Lido Finance to stop Solana support while Cardano prices fall, new project unveils staking program

Lido Finance, the liquidity staking platform, has stopped its Solana liquid staking service after voters supported the proposal. At the same time, the price of Cardano has dropped, causing panic among investors. A new project has appeared, offering unique rewards for staking. Everlodge will allow holders of its native token, ELDG, to stake for passive income. Everlodge unveils staking program Everlodge is developing a marketplace allowing people to invest in luxury properties like hotels, vacation homes, and villas with little capital. The Everlodge marketplace merges fractional ownership of vacation homes with non-fungible token…

Lido Finance Fees Exploding, Should Comparatively Low Revenue Be A Concern?

The total amount of Ethereum (ETH) staked on Lido Finance, one of the many liquidity staking protocols available, has risen steadily over the past few years. Surprisingly, revenue accrued by the platform (compared to staking rewards distributed) remains comparatively low. Lido Finance Revenue Isn’t Growing As Fast As Expected Looking at Token Terminal data shared on October 19, the blockchain analytic platform observed that while staking rewards paid, counted as “fees” by Lido Finance grew from less than $10 million in early 2021 to over $60 million in June 2023, revenue has…

The Rise and Challenge of Lido Finance in the World of DeFi

PEAK LIDO? As Ethereum transitioned over the past year to a fully functional proof-of-stake blockchain, market observers chronicled the staggering rise of Lido Finance, which effectively allows investors to stake their ether (ETH) – and thus earn rewards, yield – while also getting a token, stETH, that they can trade in the meantime. For many, that combination proved more attractive than the technically cumbersome job of setting up a validator and locking up ETH into the main blockchain. The problem now is that Lido has become too popular – bumping…

Platypus Finance recovers 90% of assets lost in exploit

Decentralized finance (DeFi) protocol Platypus Finance said it had recovered 90% of assets that were stolen in a security breach last week. According to the Oct. 17 announcement, the protocol’s net loss was limited to 18,000 AVAX (AVAX) worth $167,400 at the time of publication. As the hacker voluntarily returned the funds, Platypus Finance stated it “will guarantee that no legal action will be pursued.” It also hinted that withdrawal information regarding users’ assets will soon be posted. On Oct. 12, the automated market maker running on the Avalanche blockchain…