Decentralized finance (DeFi) gave birth to a wide range of financial services that aim to challenge what traditional finance (TradFi) offers. However, the user experience persists as a major issue hindering the widespread adoption of DeFi apps and solutions. For years, the DeFi ecosystem has been seeking an entry point that can onboard the next wave of users to decentralized apps. One potential solution is a financial technology (fintech) app that’s catered toward TradFi users and also offers easy-to-use DeFi functionality. This way, users can realize that self-custody, a practice…

Tag: finance

Uniswap outperforms Coinbase in spot volumes, Maple Finance returns to Solana, Borroe attracts investor interest

Uniswap’s (UNI) spot volume has been rising since early 2023. It exceeded Coinbase’s at some point, highlighting the platform’s increasing popularity. Elsewhere, Solana (SOL) appears to be recovering after Maple Finance resumed operations on its network. Meanwhile, Borroe (ROE) early presale investors are already in green. Uniswap spot volume rising Uniswap is popular and is among several projects that are setting the pace in decentralized finance (defi). UNI prices have been under pressure, especially in the second half of August 2023. Since Aug. 17, prices are down by over 27%. Even so,…

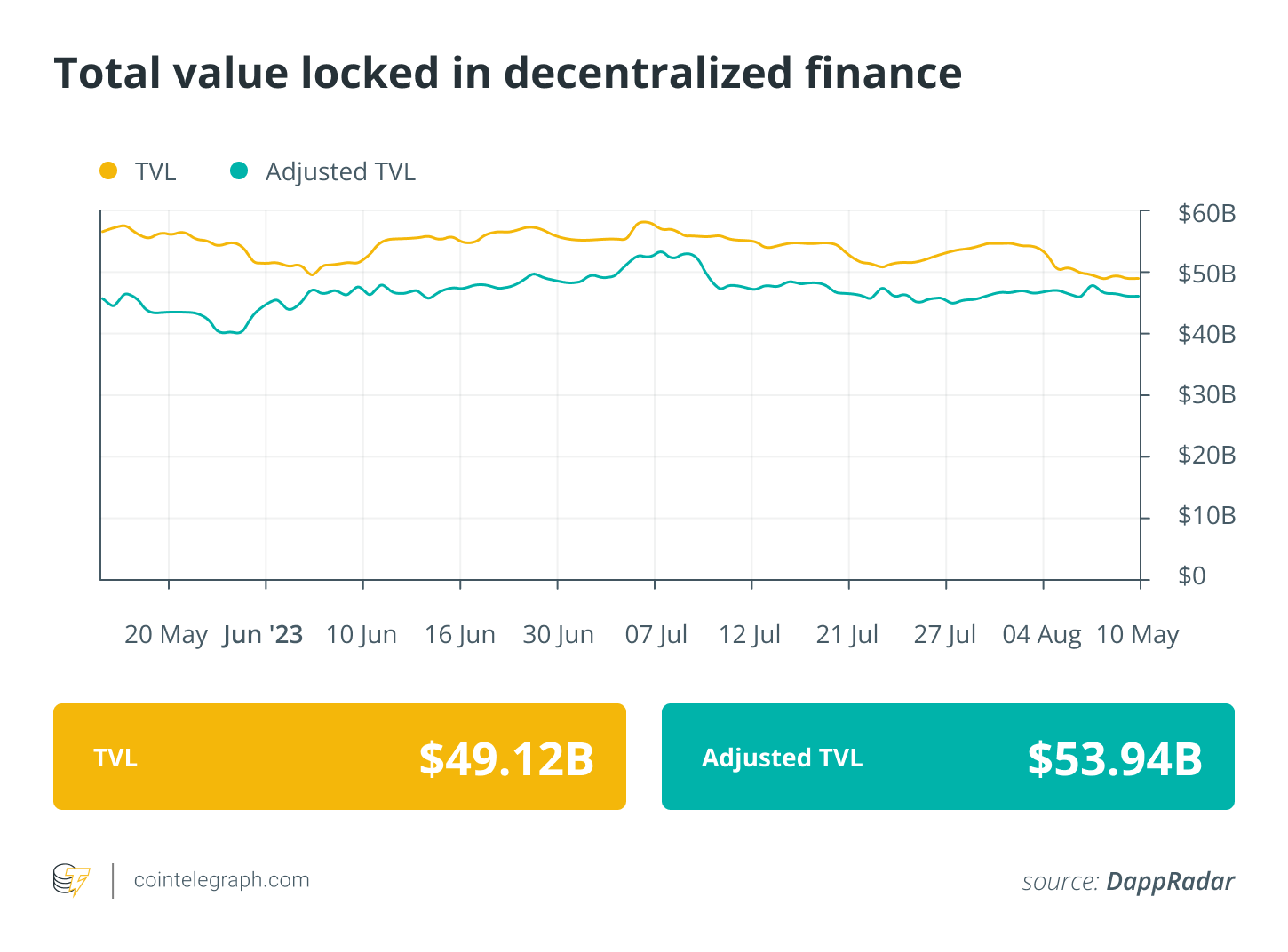

Balancer protocol exploited for $900K as DeFi hacks mount: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. In this week’s newsletter, Ethereum staking services have agreed upon a 22% limit on all validators to ensure fair markets. August proved to be another costly month for DeFi as several protocols were collectively exploited for $16 million. In separate exploit news, Balancer protocol lost nearly $900,000 due to a vulnerability flagged months ago. Shibarium’s second launch proved more stable as the…

How AI analysis can change finance and crypto trading

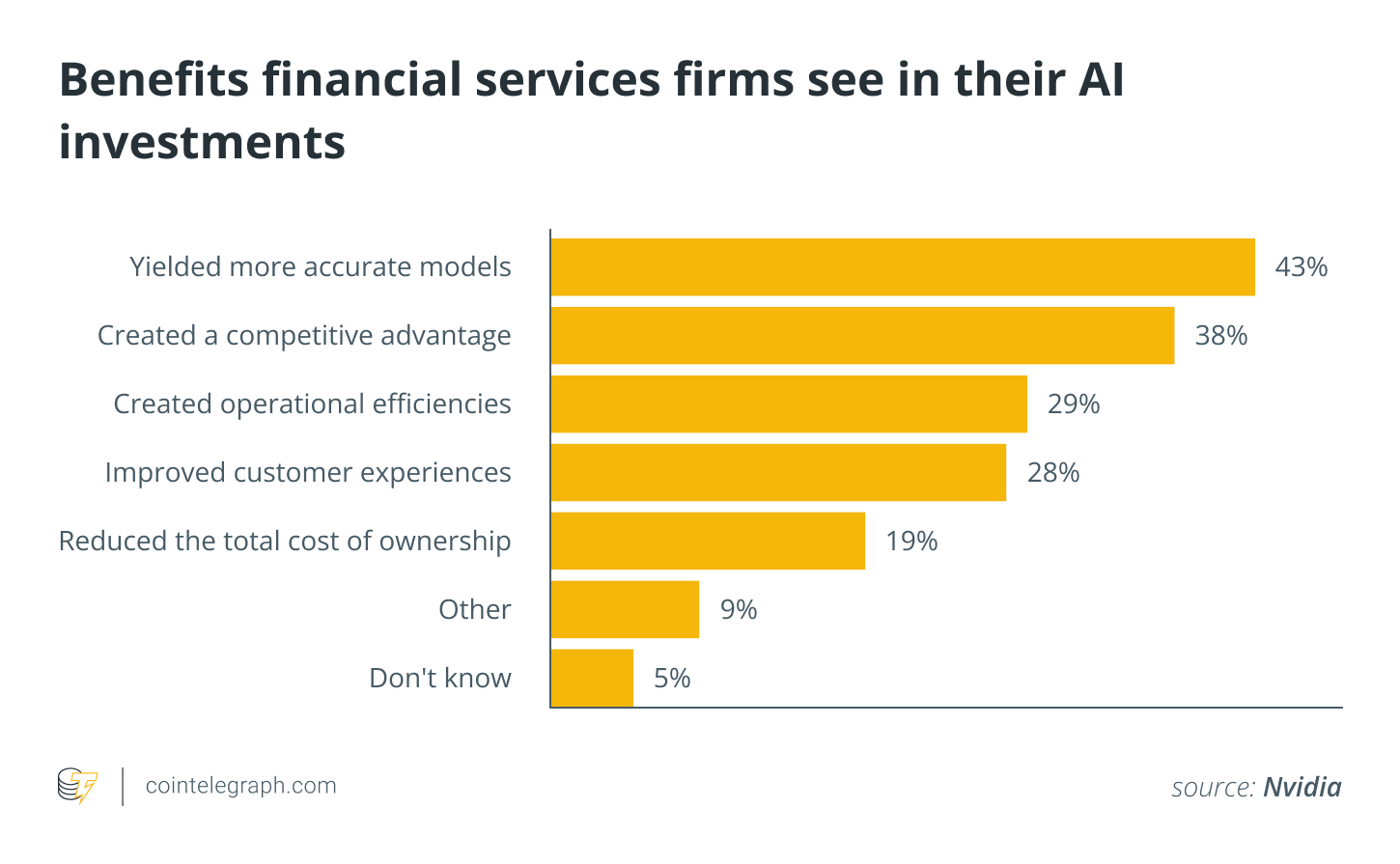

As artificial intelligence (AI) and its various subsets — such as machine learning (ML) — become more complex and developed, their presence within the financial realm has increased drastically. According to a 2022 report by Nvidia, over 75% of companies operating in the financial sector apply machine or deep learning to optimize their internal operations. Moreover, the study notes that 91% of financial firms are now driving critical business outcomes with investments in AI, with many of the surveyed companies stating that the burgeoning technology has helped them yield more…

Islamic finance and Web3 take stage at Istanbul Blockchain Week

Being one flight away from both Dubai and London, Istanbul is the “financial capital” of Turkey and a popular destination for events and organizations. Its convenient location also helps organizers customize their events to align with the specific needs of Eastern or Western cultures — which felt like the case at Istanbul Blockchain Week 2023. IBW 2023 saw thousands of local and international enthusiasts join the conversation on crypto, blockchain and Web3 on Aug. 22 and 23 at the Hilton Istanbul Bomonti. Tailored to reflect the various discussions across the…

Multichain $1.5B hack investigation, Shibarium eyes relaunch, Base, Optimism join hands: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. The past week in DeFi saw developers behind Base and Optimism protocols join hands to develop a revenue and governance sharing framework. The $1.5-billion Multichain hack has seen some new evidence — read our detailed investigation to learn about every aspect of the exploit and the plight of the victims thereafter. Blockchain security provider Quantstamp introduced a new DeFi tool to detect…

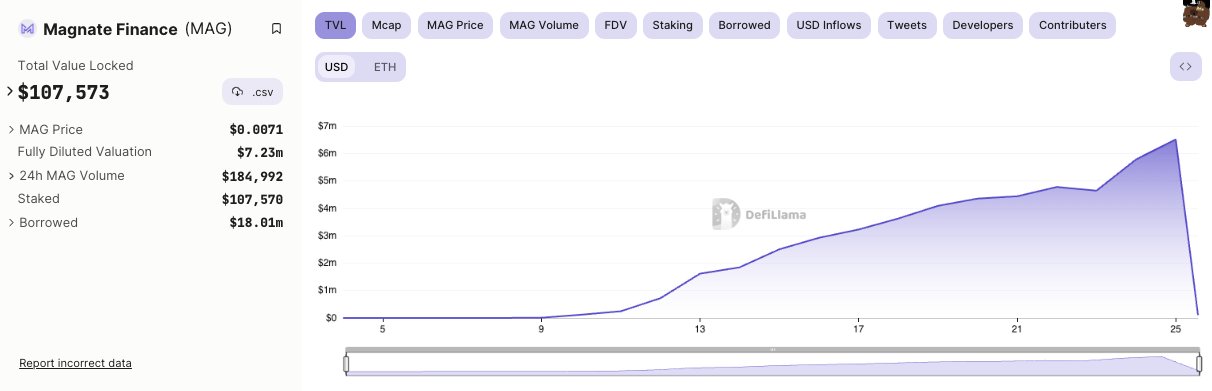

Magnate Finance on Base rug pulls users of $6.5M, as predicted by on-chain sleuth

Magnate Finance, a lending/borrowing platform on Coinbase’s layer 2 protocol Base, has rug-pulled its users of $6.5 million, hours after on-chain sleuths like ZachXBT warned about the possibility of an exit scam due to several actions of the founders of the project. Earlier on Aug. 25, the Magnate Finance protocol deleted its Telegram group and took its website offline, raising concerns among users of a possible exit scam. Magnate Finance also deleted their X account and removed all possible social media presence. ZachXBT had notified that the Magnate Finance deployer…

Magnate Finance on Base rug-pulls users of $6.5M, as predicted by on-chain sleuth

Magnate Finance, a lending and borrowing platform on Coinbase’s layer-2 protocol, Base, has rug-pulled its users of $6.5 million hours after on-chain sleuths like ZachXBT warned about the possibility of an exit scam due to several actions of the founders of the project. Earlier on Aug. 25, the Magnate Finance protocol deleted its Telegram group and took its website offline, raising concerns among users of a possible exit scam. Magnate Finance also deleted its X account and removed all possible social media presence. ZachXBT had notified that the Magnate Finance…

Num Finance launches Colombian peso stablecoin on Polygon

Argentina-based Num Finance has announced it has gone live with a n stablecoin pegged to the Colombian peso, the company announced Aug. 24 in an X post. The stablecoin — called nCOP — is an overcollateralized, Polygon-based stablecoin and is aimed at the remittance market. Colombia receives over $6.5 billion a year in remittances, Num stated in a blog post. Remittances are one of the key use cases for stablecoin. The nCOP logo. Source: Num Finance The nCOP incorporates the “Num yield feature,” which allows user rewards to be paid…

DeFi Yield Platform Pendle Finance Now Offers Real-World Asset Product

“Yes, RWA is already in DeFi, and now Pendle is able to offer a suite of tools that lets you properly hedge or manage these yields. Interest rate derivatives, swaps, fixed income…all these products that TradFi institutions love, they’re already here,” Lee added. Source