The development bank established by the BRICS group of nations has issued its first “green” bonds in U.S. dollars (USD). Proceeds from the placement will be used to fund “green” projects supported under the banking institution’s sustainable financing policy. BRICS Development Bank Launches 3-year ‘Green’ Bonds The New Development Bank (NDB), founded by the BRICS bloc, has placed three-year “green” bonds on international capital markets in the amount of $1.25 billion, the bank announced in a press release on Thursday, quoted by the Tass news agency. The benchmark bond has…

Tag: finance

SafeMoon hacker agrees to return 80% of stolen funds: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week. This week in DeFi saw the hacker behind the $8.9 million SafeMoon exploit agree to return the majority of the stolen funds. According to the project’s developers, the hacker will return 80% while keeping the remaining 20%. United States crypto lender BlockFi was granted an additional 48-day extension to submit its exit plan by a New Jersey bankruptcy judge, exploring the potential…

Consensus Pitchfest 2023: Finance for the Unbanked

The Consensus Pitchfest 2023 gives a platform to firms that are leading game-changing innovations in crypto, creating more space for financial inclusion and empowerment globally. Source

Lending Protocol Maple Finance Announces New Pool for Non-US Investors

US individuals and business entities may not have access to the offering. Blockchain-based lender Maple Finance has introduced a United States Treasury pool designed specifically for non-US accredited investors. According to a blog post where it shared the announcement, the new cash management pool will allow investors to invest in one-month US Treasury bills (T-bill). However, US individuals and business entities may not have access to the offering. The post also confirms that the pool is structured in a special purpose vehicle (SPV) manner, with crypto hedge fund Room40 Capital…

Crypto Lender Maple Finance Opens U.S. Treasury Bill Pool for Cash Management

Maple’s new lending pool offers accredited investors, crypto firms and DAO treasuries a way to earn yield on their idle stablecoin holdings by investing in one-month U.S. Treasury bills. Source

Maple Finance launches pool for US Treasury yields

Crypto lender Maple Finance has rolled out a United States Treasury pool for non-U.S. accredited investors and entities. According to an Apr. 19 post, Maple Finance has launched a new Cash Management Pool for institutional Web3 investors to access U.S. Treasury Bills directly. The offering is not available to U.S. individuals or entities. The pool will source yield from one-month U.S. Treasury bills and reverse purchase agreements, less fees, to lenders, with crypto hedge fund Room40 Capital serving as the sole borrower via a special purpose vehicle (SPV). Maple developers…

Russia Developing Payment Gateways With Partners Like Turkey, Mulling Crypto Settlements – Finance Bitcoin News

Bank of Russia is building a system of gateways with foreign payment networks and is now working with Turkey in this field. Russia’s monetary authority would also allow the experimental use of cryptocurrencies in foreign economic activities, its head was quoted as saying. Russia’s Central Bank ‘Actively Working’ With Turkey on New Payment Gateways The Central Bank of Russia (CBR) is developing payment gateways with foreign payment systems and is actively working with Turkey in this area, Governor Elvira Nabiullina said at a meeting with lawmakers in the State Duma,…

Bank of England preparing for greater role of tokenization in finance, official says

Bank of England deputy governor Sir Jon Cunliffe spoke at the Innovative Finance Global Summit in London on April 17 about the development of tokenization. The UK’s central bank is currently exploring tokenization in bank money, non-bank money and central bank money and the ways tokenized assets will interact. Stablecoins, Cunliffe said, “offer the possibility of greater efficiency and functionality in payments,” but “it is extremely unlikely that any of the current offerings would meet the standards for robustness and uniformity we currently apply both to commercial bank money and…

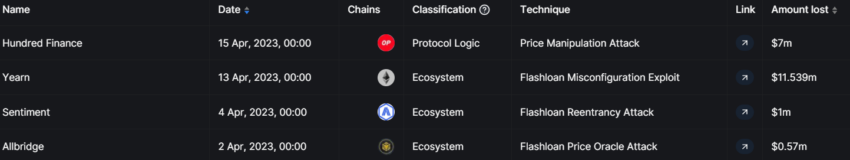

Lending Protocol Hundred Finance Loses $7M in Fresh DeFi Exploit

The hacker was able to withdraw more tokens than were initially deposited. There appears to be a rising case of DeFi exploits and multichain lending protocol Hundred Finance may be the latest victim. According to a recent announcement by the protocol, attackers found a loophole to successfully manipulate the exchange rate between ERC-20 tokens and hTOKENS. And as a result, the attacker has reportedly made away with no less than $7.4 million from the protocol. Meanwhile, it might be worth noting that this is the second time in as many…

DeFi lending protocol, Hundred Finance, hacked for $7.4m

Multichain lending protocol, Hundred Finance, was hacked on Ethereum’s layer-2 scaling solution, Optimism, resulting in a loss of approximately $7.4m. Hundred Finance hacked On April 15, the DeFi platform announced that it had contacted the hacker and collaborated with many security teams. The protocol also requested anyone with information to get in touch. Estimated current loss is ~7m USD. Once again we hope the hacker will reach out back to us and we will be able to find a joint solution to resolve this matter. 🙏 Thank you everyone for…