KULR Technology Group Inc. acquired 118.6 bitcoin for approximately $13 million, increasing its corporate treasury holdings. The purchase price averaged roughly $107,861 per bitcoin, the company stated Monday. This brings KULR’s total bitcoin holdings to 920 BTC. Those 920 BTC represent a total investment of about $91 million, acquired at an average price of $98,760 […] Original

Tag: Firm

Bitcoin’s Price Blasts Higher With $81M in Shorts Burned—Fed Cut Bets Hold Firm

Bitcoin is cruising at $108,610, seeing an increase of over 2% in the past 24 hours; meanwhile, the whole digital currency market value rests at $3.38 trillion. This price climb occurs a single week before the Federal Open Market Committee (FOMC) gathering, which is slated for June 18. Bitcoin Defies Credit Downgrade—Expert Says Confidence Is […] Original

Europe’s first Bitcoin Treasury firm plans to raise $340m to buy more BTC

Adam Back-supported Bitcoin Treasury firm, Blockchain Group, wants to raise $340 million through ‘ATM-type’ shares as a way to raise capital with the intention of boosting its BTC holdings. In a recent press release, the Paris-based company declared that it will be partnering with asset manager TOBAM to raise capital to boost its Bitcoin (BTC) Treasury. By allowing TOBAM to subscribe to ordinary shares issued by Blockchain Group, the firm hopes to raise a total revenue of $340 million which they will use to boost its BTC holdings. “The Program…

Chainlink Bullish Signal Stands Firm, But Bitcoin Is Calling The Shots

CRYPTOWZRD noted in a recent update on X that Chainlink ended the session with a bullish close, hinting at potential further gains ahead. However, the analyst emphasized that Bitcoin will ultimately dictate the move. Keeping a close eye on the intraday chart, the expert mentioned that an early pullback could present a scalp opportunity, as long as Bitcoin aligns with the bullish outlook. Breakout Likely With Strong Daily Candles Breaking down his latest analysis, the trader explained that LINK’s daily candle officially closed bullish, marking a key technical point in…

Watch Out For These Levels If Bitcoin Price Returns To $100K: Blockchain Firm

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies. Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking”…

Bitcoin (BTC) Stays Firm as Trump-Musk Feud Escalates Over 2025 Budget Politics

Bitcoin held firm above $105,000 on Saturday despite an unusually combative and personal escalation in the Trump-Musk feud that could rattle traditional markets next week. On Saturday, in a phone interview with NBC News, President Trump warned that there would be “serious consequences” if Elon Musk financially backed Democratic candidates running against Republicans who support the GOP’s budget bill. “If he does, he’ll have to pay the consequences for that,” Trump said, adding later, “He’ll have to pay very serious consequences if he does that.” Trump, who has often boasted…

USDC Issuer Circle Prices NYSE IPO at $31 Per Share, Valuing Stablecoin Firm at $6.2 Billion

Circle priced its initial public offering (IPO) on Wednesday at $31 per share, above the expected range of $24 to $26. The company sold around 34 million shares in the offering for a valuation of $1.1 billion. Bloomberg pegs the total amount raised in the IPO at $6.2 billion. Circle initially planned to offer just 24 million Class A shares, with 9.6 million coming from the firm itself and the remainder from early stakeholders. But as demand soared, the offering ballooned to more than 10 times the original amount. The…

Holdings Firm Aims To Boost Its Treasury

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn. Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer…

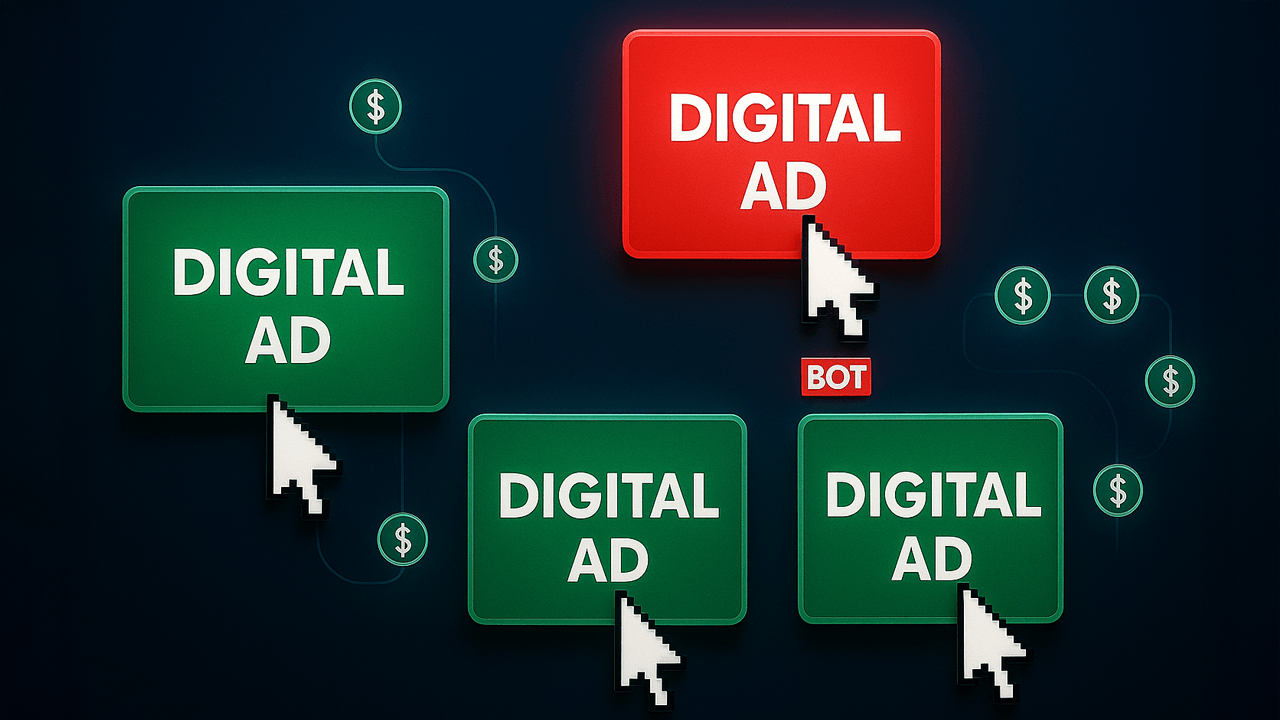

Blockchain Firm Veraviews Launches Fraud-Focused UAE Ad Exchange

Blockchain-powered advertising firm Veraviews has launched the UAE’s first domestically developed advertising exchange and supply-side platform. Veraviews SSP Targets UAE Ad Transparency The Dubai-based blockchain company Veraviews introduced the Ad Exchange and SSP under the United Arab Emirates (UAE) Ministry of Economy’s NextgenFDI initiative. The platform connects advertisers directly with UAE publishers to sell digital […] Source

Blockchain Firm Buys $68M in Bitcoin

Key Notes Blockchain Group bought 624 BTC for $68 million, raising its total to 1,471 BTC. The firm reports a BTC yield of 1,097.6% YTD and 47.9% QTD. Institutional interest in Bitcoin continues to rise, with firms like Metaplanet and Coinbase joining in. . Blockchain Group, a cryptocurrency firm based in Paris, has expanded its Bitcoin BTC $105 444 24h volatility: 1.2% Market cap: $2.10 T Vol. 24h: $24.41 B holdings by purchasing an additional $68 million worth of the cryptocurrency. The company joins a growing number of organizations that…