Founders Fund, a venture capital (VC) firm founded by the billionaire Peter Thiel, is believed to have acquired bitcoin and ethereum worth $200 million sometime in the second half of 2023. The VC firm reportedly began purchasing bitcoin when its price was still under $30,000. Founders Fund’s Renewed Interest in Crypto In the latter half […] Source CryptoX Portal

Tag: Firm

Ripple-Owned Crypto Custody Firm Metaco’s CEO and Head of Product Depart

A Ripple spokesperson confirmed CEO Adrien Treccani and Chief Product Officer Peter DeMeo were gone and said: “We appreciate the strong and industry-leading custody business that Adrien and his team built, as well as his leadership in integrating the custody team and solution with Ripple following the acquisition last year. Custody remains integral to Ripple’s growing business as we continue to provide best-in-class enterprise crypto solutions for our customers around the world.” Source

Bitmain-backed Bitcoin mining firm BitFuFu eyes going public via SPAC deal

Crypto mining company BitFuFu plans to go public on the Nasdaq stock exchange via a SPAC deal with Arisz Acquisition Corp. According to documents filed with the U.S. Securities and Exchange Commission (SEC), BitFuFu plans to go public under the ticker symbol “FUFU” once the merger with Arisz Acquisition Corp is finalized. The merger is anticipated to receive approval from Arisz’s board by Feb. 24, the document reads. Following the merger, BitFuFu will issue a total of 150,000,000 ordinary shares to Arisz shareholders at $10 per share. According to the…

Crypto Firm Bakkt Warns It Might Not Be Able to Remain in Business

The company, backed by the owner of the NYSE, was introduced in 2018 with the initial goal of helping Starbucks customers buy coffee with bitcoin. Source

Ethereum and Bitcoin firm, Rebel Satoshi at new highs

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. The recent approval of Bitcoin exchange-traded funds has been trending, even impacting Ethereum. Amid this, analysts are bullish on Rebel Satoshi (RBLZ) once it officially launches. Will the SEC approve spot Ethereum ETF in May 2024? A few companies have applied to the Securities and Exchange Commission (SEC) for a spot Ethereum ETF, but so far, they have yet to be approved. A researcher from Standard Chartered thinks that…

Celsius to Distribute $3B Crypto to Creditors as Firm Emerges From Bankruptcy

“When we were appointed in June 2022, everyone assumed Celsius would disappear completely like the other crypto lenders that were filing bankruptcy around the same time,” said David Barse and Alan Carr, members of the special board committee that steered the bankruptcy, in a statement. Source

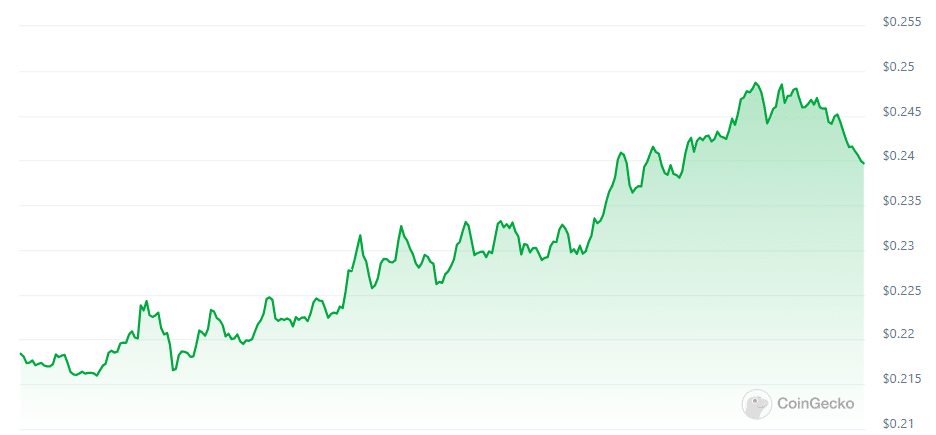

‘Chinese Ethereum’ Conflux jumps 13% following strategic deal with venture firm

Conflux Network’s CFX token gained over 13% amid a ‘strategic partnership’ agreement with Asia-based venture studio BlockBooster. In an X thread, Conflux Network said the latest deal with the Asia-based venture studio will focus on identifying “web3 incubation opportunities within the Conflux ecosystem,” as the project wants to facilitate “major events for Conflux builders.” While no other details have been released, the news was enough to impact the CFX token, which gained over 13% surging to $0.24, according to CoinGecko data. BlockBooster, commenting on the agreement, expressed its intent to…

Cash Handling Firm Brink’s Invests in Crypto Custodian BitGo

“As much of our industry, and the financial services industry writ large, prepares for the digital tokenization of potentially a lot of assets, it was very strategic on their behalf to reach out to us,” said BitGo VP Baylor Myers in an interview. “I think Brink’s is going to continue to allocate resources to its office of digital assets.” Source

Investment Firm With $1B in Assets Looks to Invest in BTC Mining With Fabiano Consulting

“Fabiano Consulting will provide valuable expertise in evaluating new potential investments in the fast expanding bitcoin mining industry while exploring opportunities to develop trading, treasury and financing solutions within Deus X’s existing portfolio businesses, such as Alpha Lab 40,” according to the statement. Source

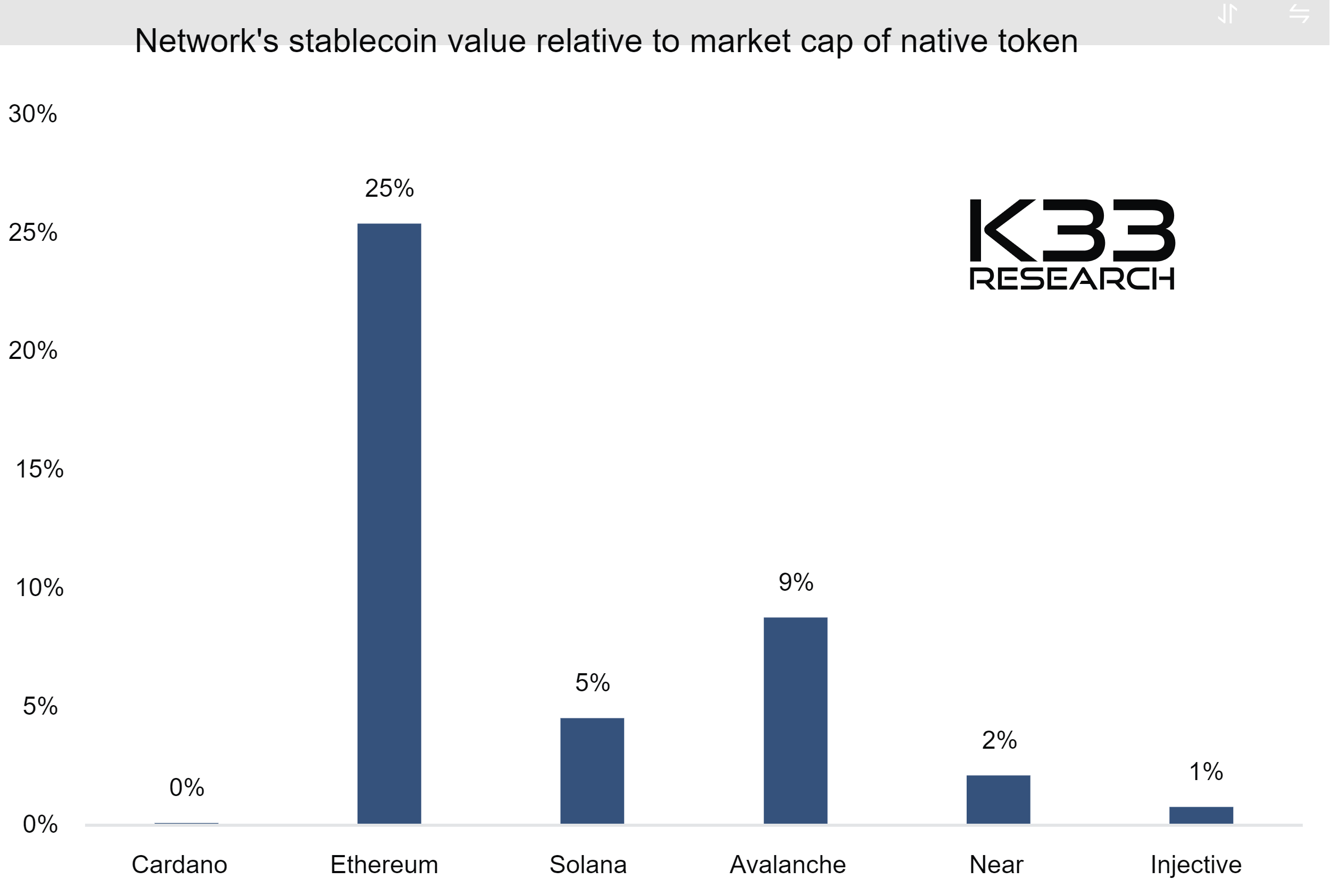

Crypto Research Firm Says ‘Sell All Your Cardano (ADA)’

K33 Research, a prominent entity in the cryptocurrency research sector, has released a scathing report on Cardano (ADA), sparking widespread discussion in the crypto community. The report bluntly advises investors to divest from Cardano, citing a lack of meaningful use for its native token, ADA. Sell All ADA Now? In a detailed examination, K33 Research asserts that the Cardano network suffers from a significant lack of practical application, which is essential for the inherent value of its native token. The report states, “A smart contract network needs meaningful use for…