South Korea’s stance on cryptocurrency ETFs remains unchanged despite the U.S. giving the green light to a Bitcoin spot ETF. The South Korean government continues to disallow the launch of cryptocurrency ETFs, adhering to its long-standing policy of not recognizing digital currencies as financial assets. Since 2017, financial institutions in the country have been barred from investing in cryptocurrencies. Local sources have reported that the Financial Services Commission (FSC) of South Korea reaffirms the government’s commitment to financial market stability and investor protection. The FSC official highlighted that there has…

Tag: Firm

Cathie Wood’s Investment Firm Sells $25M of COIN Stock

ARK’s ETFs have a target weighting whereby no individual holding exceeds 10% of the fund’s total value. Having more than doubled in price in the last three months of 2023, COIN has consistently held above that threshold in both ARKK and ARKW, leading to regular sales of the crypto exchange’s stock by Cathie Wood’s firm. Source

Bitcoin mining firm CleanSpark to launch in-house crypto trading

CleanSpark, the third-largest public Bitcoin mining firm in the U.S., is set to establish its own trading desk in 2024, aiming to optimize the profitability of its substantial Bitcoin assets. In an interview with Bloomberg, Zachary Bradford, the CEO of CleanSpark, expressed the strategic decision to manage their Bitcoin transactions internally. Given their considerable Bitcoin holdings, he emphasized the financial prudence of this approach. This initiative aligns with the recent practices adopted by other Bitcoin mining companies. For instance, Marathon Digital Holdings has sold Bitcoin call options to generate revenue,…

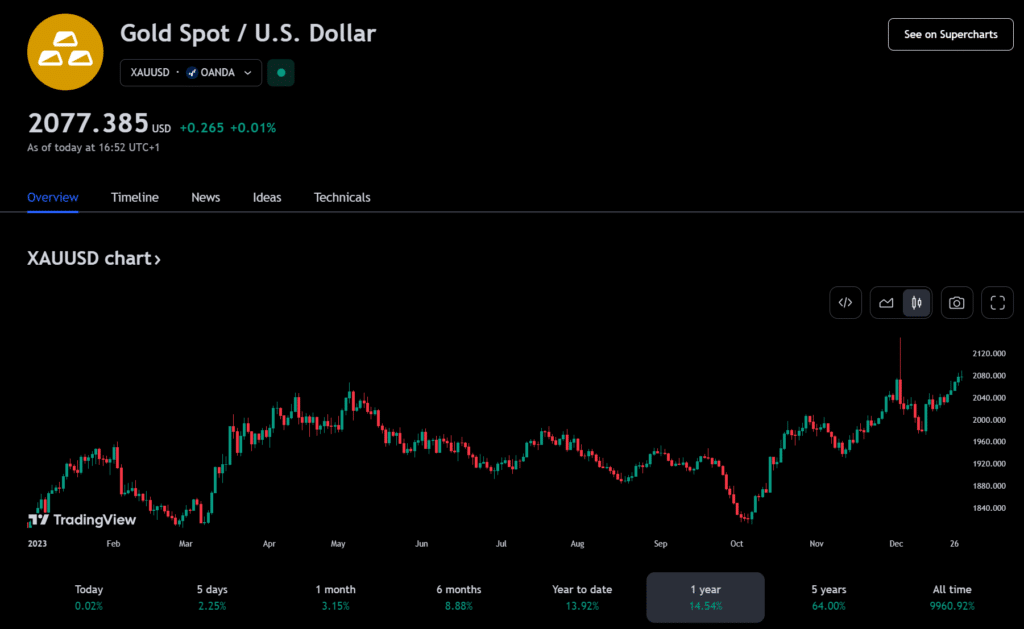

Hong Kong firm mulls tokenizing 3-ton gold vault amid local ETF boon

Value Partners, a Hong Kong-listed company, is set on issuing blockchain tokens backed by physical gold and filing applications for crypto-related ETFs. According to local media Hong Kong Commercial Daily, the firm plans to tokenize its three tons of gold bars worth an estimated $201 million at current prices. Value Partners already offers the only Hong Kong gold ETF backed by physical gold and believes digitizing its precious metal with blockchain technology will only improve accessibility for investors. The move comes after gold hit its all-time high and traded at…

Crypto Trading Firm Expects Bitcoin To Crash To $36,000, Here’s Why

A recent market update by the trading firm QCP Capital has provided insights into how Bitcoin’s price would react if a Spot Bitcoin ETF gets approved in January. The firm predicts that there could be a major retracement before any move to the upside. Bitcoin Could Retrace To $36,000 QCP Capital predicts that Bitcoin could retrace to around $36,000 before an uptrend resumes. At the same time, they expect Bitcoin to face a topside resistance between the $45,000 and $48,500 region. These projections are based on what they expect to…

Bitcoin firm above $40K, Michael Saylor says bull run imminent

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. The Bitcoin price is pushing ahead, up 2.22% in the last day. Currently, it is trading at $43.7K, with Bitcoin Key Opinion Leader and MicroStrategy co-founder Michael Saylor predicting that the next bull run is near. Meanwhile, a new crypto mining project, Bitcoin Minetrix, is also gathering pace. Its presale has raised over $5.6 million. Spot Bitcoin ETFs and halving will kickstart 2024 bull run In a recent conversation…

Shiba Inu Working With Web3 Domain Firm D3 to Soon Offer ‘.shib’ Domain

“Our partnership with D3 allows us to scale outside of the existing ShibArmy and give over 5 billion Internet users direct access to the SHIB ecosystem,” said Shytoshi Kusama, Lead Developer of Shiba Inu. “Bringing real domains to SHIB is a big deal, expanding our vision for digital identities within our decentralized ecosystem while driving long-term revenue generation within the ecosystem.” Source

US court approves settlement against Binance, firm to pay $2.7B to CFTC

A United States court has entered an order against crypto exchange Binance and its former CEO, Changpeng “CZ” Zhao, that will see Binance pay $2.7 billion and CZ pay $150 million to the Commodity Futures Trading Commission (CFTC). In a Dec. 18 statement, the CFTC announced that the U.S. District Court for the Northern District of Illinois had approved the previously announced settlement and concluded the enforcement action first issued by the CFTC in November. “The court finds Zhao and Binance violated the Commodity Exchange Act (CEA) and CFTC regulations,…

Sanctioned mining firm BitRiver sees crypto interest surge among Russian oil majors

Russian Bitcoin mining firm BitRiver says the country can become a leader in the global industrial crypto just within a few years. According to BitRiver CEO Igor Runets, Russia has enough resources to become a global leader in crypto mining using associated petroleum gas (APG) as other countries such as the U.S., Canada, Kazakhstan and others have also successfully piloted this method of mining, Russian media outlet RBC reports. Runets revealed that BitRiver’s operational data centers powered by APG currently account for at least 50% of the entire mining market…

Crypto Firm SafeMoon Files for Chapter 7 Bankruptcy, SFM Plunges 42%

The firm’s executives were arrested last month on multiple charges. Source