California-based venture capital firm Pantera Capital has reportedly won another bid for discounted SOL tokens from a collapsed exchange. Pantera Capital, a Menlo Park-headquartered crypto venture capital firm, has won another pack of discounted Solana’s SOL tokens in an auction organized by the administrators managing the bankruptcy case of the collapsed FTX crypto exchange. According to a Bloomberg report, the firm won 2,000 SOL tokens (currently valued at ~$288,000 at market price) earlier this week. Although it remains unclear at what discount the firm won the tokens, the sources claim…

Tag: FTX

FTX Co-Founder Sam Bankman-Fried’s Civil Liability Released In Settlement With Investors

According to a recent Bloomberg report, a group of investors and customers of cryptocurrency exchange FTX have agreed to drop their claims against co-founder Sam Bankman-Fried. In exchange, Bankman-Fried has agreed to cooperate with the plaintiffs in the ongoing lawsuits against other defendants related to the collapse of FTX. Sam Bankman-Fried And Insiders Settle Per the report, if approved by a judge, this agreement would release Bankman-Fried from civil liability just weeks after being sentenced to 25 years in prison for fraud stemming from allegations of stealing billions of dollars…

FTX looking to sell off Solana holdings via blind auction

Two sources familiar with the matter say that the defunct cryptocurrency exchange FTX is looking to auction off the remainder of its Solana (SOL) token holdings. Speaking to Bloomberg, the sources revealed that a “blind auction” is set to be held this week with an April 24 deadline. The result is slated to be announced the following day. The development follows a report from FTX stating that it sold approximately $307.6 million worth of SOL and ZBC tokens in March. On April 5, the firm sold $1.9 billion worth of…

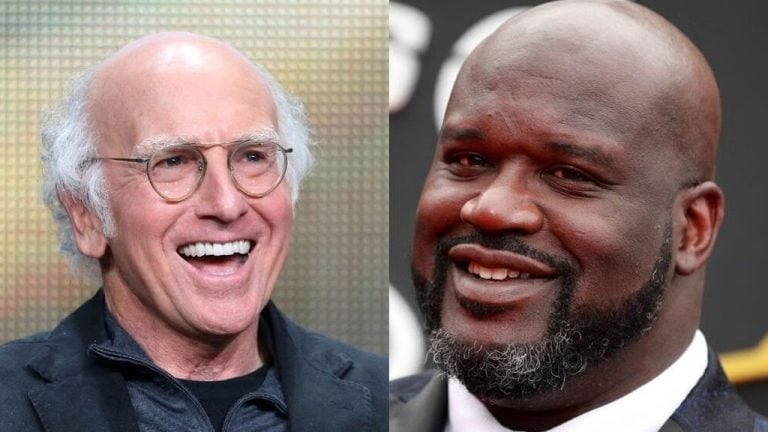

Sam Bankman-Fried Agrees to Help FTX Investors Go After Celeb Promoters

Several of the smaller celebrity promoters – including finance Youtubers Andrei Jikh, Graham Stephan, Jaspreet Singh, Tom Nash, Brian Jung and Jeremy Lefebvre – have also settled, contributing to a common fund of $1.4 million to fund the lawsuit, according to court documents. Source

FTX Estate Plans Auction for Locked Solana Tokens

Bankrupt cryptocurrency exchange FTX is preparing to offload more of its locked Solana (SOL) tokens through an auction, diverging from its previous method of selling at a set price, as announced by Mike Cagney of Figure Markets. This decision follows FTX’s recent sales of SOL tokens, amounting to approximately $1.9 billion and $2.6 billion in […] Source BitcoincryptoexchangeExchanges CryptoX Portal

FTX Founder Bankman-Fried Agrees to Settlement, Aids Legal Action Against Celebrities

In a significant turn of events, former FTX CEO Sam Bankman-Fried has agreed to a settlement with investors, providing crucial cooperation in ongoing lawsuits against high-profile celebrities. The settlement, pending court approval, could mark a pivotal moment in the extensive legal battles following the crypto exchange’s colossal collapse. Former Crypto Tycoon and Now Convicted Inmate […] Source BitcoincryptoexchangeExchanges CryptoX Portal

DOJ considering new law firm as monitor for Binance amid FTX ties

The DOJ is reconsidering its decision to appoint Sullivan & Cromwell as Binance’s independent monitor because of its relationship with FTX. According to Bloomberg, the law firm was on the verge of being named to oversee Binance’s compliance with a settlement that included a $4.3 billion penalty for breaching U.S. anti-money laundering laws and sanctions regulations. The role was part of an agreement with both the Justice Department and the Treasury’s Financial Crimes Enforcement Network (FinCEN). However, the decision has been stalled due to concerns over Sullivan & Cromwell’s previous…

FTX Co-Founder Sam Bankman-Fried Appeals 25-Year Conviction And Makes Unusual Request

In a dramatic turn of events, Sam Bankman-Fried, the founder of the now-defunct cryptocurrency exchange FTX, has been sentenced to 25 years in prison for defrauding users. The judgment was handed down by US District Judge Lewis Kaplan during a hearing in a Lower Manhattan federal courtroom on March 28. Bankman-Fried, who had publicly announced plans to appeal the conviction, has now officially filed an objection to the decision. ‘Remorse And Empathy’ For FTX Customers During the sentencing hearing, US District Judge Lewis Kaplan leveled serious accusations against Bankman-Fried, including…

FTX Founder Sam Bankman-Fried Appeals Fraud Conviction

Though Kaplan ordered Bankman-Fried be remanded to a low or medium-security prison near his parents in Northern California, citing his autism as a risk factor for him in a maximum security facility, Bankman-Fried has surprisingly asked to be kept in the notorious Manhattan Detention Center during his appeal process. Source

Judge to Sentence Former FTX Executive Ryan Salame in Late May

Initially scheduled for May 1, the sentencing of Ryan Salame, former co-chief executive of FTX Digital Markets, has been deferred to May 28, 2024, in front of Judge Lewis Kaplan. Ryan Salame, Once FTX’s Co-Leader, Slated for May Sentencing Per the judicial records, Ryan Salame, once the co-chief executive at FTX Digital Markets, is slated […] Source CryptoX Portal