Former Alameda Research CEO Caroline Ellison and former FTX executives Gary Wang and Nishad Singh will be barred from assuming company leadership roles for eight to 10 years following a court judgment. In a Friday notice, the US Securities and Exchange Commission said that it had obtained final consent judgments against Ellison, Wang and Singh for their roles in the misuse of investor funds at FTX from 2019 to 2022. The former Alameda CEO consented to a 10-year officer-and-director bar, while Wang and Singh consented to eight-year officer-and-director bars each.…

Tag: FTX

Realized Bitcoin Losses Rise To FTX Crash Levels: Glassnode

Bitcoin has taken a slide back to its April level of around $83,000, with mounting selling pressure prompting many investors to sell at a loss, reminiscent of major historic market crashes. Realized losses on Bitcoin (BTC) have surged to levels not seen since the 2022 FTX collapse, according to blockchain data platform Glassnode. “The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown,” Glassnode noted in an X post on Friday. Glassnode’s observation came minutes before Bitcoin slipped as…

Ex-prosecutor Denies Promising Not to Charge FTX Exec’s Partner

Danielle Sassoon, one of the US attorneys behind the prosecution of former FTX CEO Sam “SBF” Bankman-Fried, took the stand in an evidentiary hearing involving a deal with one of the company’s executives. In a Thursday hearing in the US District Court for the Southern District of New York, Sassoon testified about the guilty plea of Ryan Salame, the former co-CEO of FTX Digital Markets, which resulted in his sentencing to more than seven years in prison. According to reporting from Inner City Press, Sassoon said that her team would…

Three Years After FTX collapse, Crypto Industry Still Feeling the Impact

When FTX filed for bankruptcy on Nov. 11, 2022, it sent shockwaves throughout the crypto world, erasing billions in market liquidity and shattering confidence in centralized exchanges. The dramatic collapse became a turning point for the digital asset industry, triggering calls for stronger transparency and reactions from regulators. Three years after the exchange’s collapse, transparency initiatives across the crypto industry have proliferated. Proof-of-reserves attestations, audits and onchain analytics represented progress. Still, many of those reforms remain works in progress, and some of FTX’s creditors have yet to be made whole.…

BlackRock’s Plan To Take Over Crypto

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io BlackRock has added Bitcoin to their Global Allocation Fund. Larry Fink, the CEO of BlackRock has made many major investments in crypto and blockchain companies including: Circle USDC, FTX, Anchorage Digital, Bitcoin Core Scientific Mining. BlackRock has also partnered with Coinbase to offer Bitcoin to institutional clients. DISCLAIMER: This is NOT financial or legal advice. I am just offering my opinions. I am not responsible for any investment or legal decisions that you choose to make. This description may contain affiliate links…

Crypto’s Big Comeback: From The 2022 Crash and India’s 30% Tax To A 2025 Surge

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io After reaching a $3 trillion market cap in 2021, the crypto market experienced a crash in 2022, with coins losing over 70% of their value. Events like the FTX collapse shook investor confidence, while in India, the government’s 30% tax on crypto gains impacted the domestic market. By 2025, cryptocurrency has seen a significant resurgence. This report examines the factors behind this comeback, including the positioning of Bitcoin as ‘digital gold’. The analysis explores how the United States government’s approach may be…

FTX Estate Drops Motion On Restricted Country Payouts

The bankruptcy estate of the now-defunct crypto exchange FTX has dropped its bid to limit payouts to creditors in certain “restricted foreign jurisdictions.” On Monday, the FTX Recovery Trust filed a notice withdrawing its request to implement special procedures for jurisdictions such as China, which had been flagged as potentially restricted under the confirmed bankruptcy plan. “If and when the FTX Recovery Trust seeks to renew the relief requested in the Motion, the FTX Recovery Trust shall file a motion and provide notice in accordance with the applicable rules,” the…

URGENT CRYPTO CRASH UPDATE TRUMP TARIFFS NOT HAPPENING?!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io URGENT CRYPTO CRASH UPDATE TRUMP TARIFFS NOT HAPPENING?! 00:00 HI 00:03 Crypto crash update 14:22 Crypto market overview 14:59 Total crypto market cap 20:39 BTC and altcoins 22:36 Are we still in a super cycle? Support The O Show with Ref Links: ✨ Learn more about the network at ➡️ ✨Explore project support opportunities at ➡️ ✨SIGN UP TO KRAKEN ➡️ ✨Get $100 with ITRUST use code WENDY9 ➡️ ✨$500 PHEMEX Bonus ➡️ ✨Market Cipher Use Code WendyO ➡️ ✨Crypto IRAs Advice…

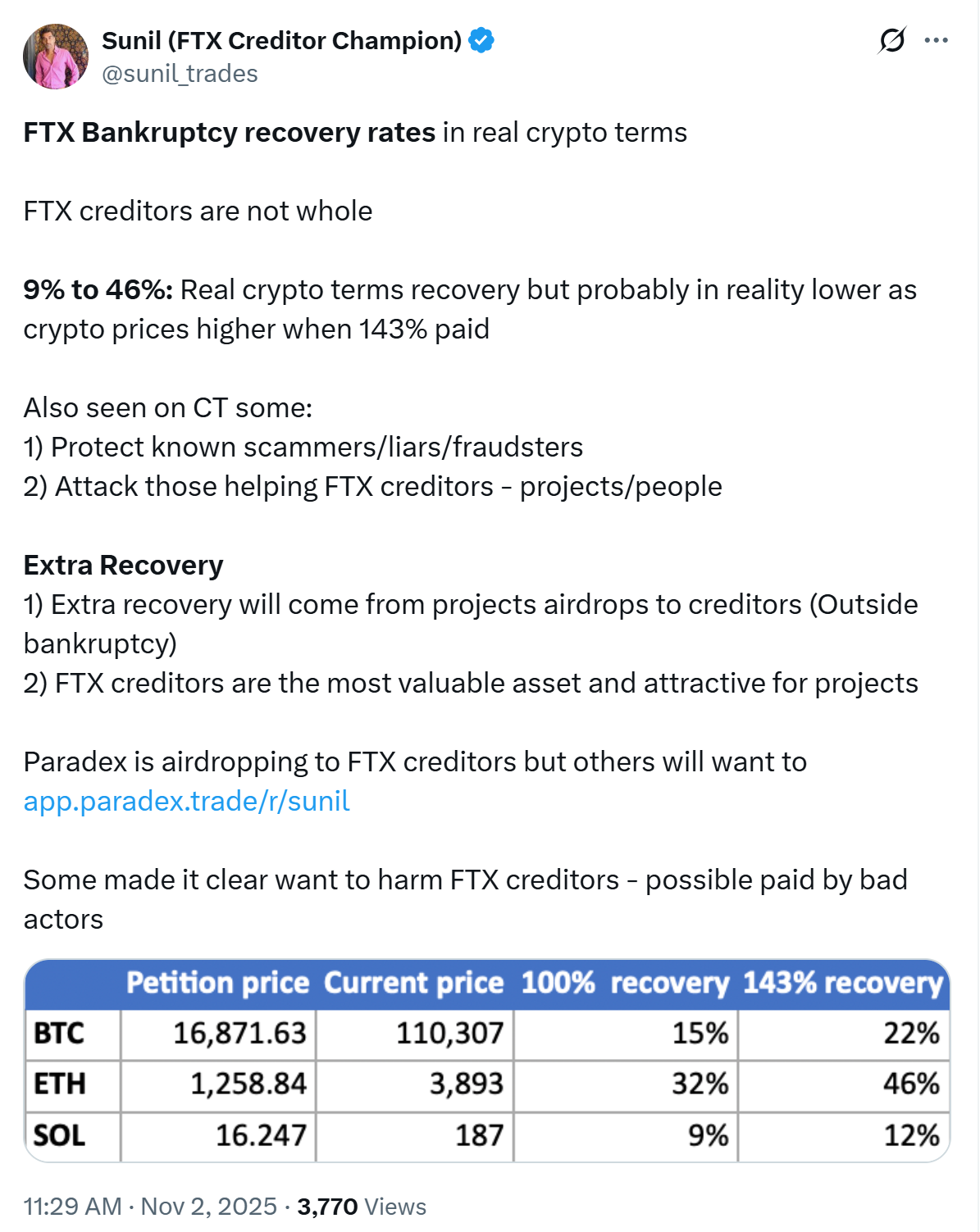

FTX Creditors May Recover as Little as 9% After Adjusting for Crypto Prices

FTX creditors may receive far less than initially believed once payouts are adjusted for today’s inflated crypto valuations, according to Sunil, a prominent FTX creditor representative. In a Sunday post on X, Sunil estimated that the real crypto recovery rate for FTX creditors ranges between 9% and 46%, noting that the actual value could be even lower as Bitcoin (BTC), Ether (ETH) and Solana (SOL) prices have surged since the exchange’s collapse in 2022. “FTX creditors are not whole,” he wrote, adding that the exchange’s planned 143% fiat repayment doesn’t…

Bankman-Fried Blames Lawyers for FTX Collapse, Says $100B in Value Was Lost

The fallen FTX founder Sam Bankman-Fried is back on X, insisting his collapsed exchange wasn’t actually insolvent. He’s now claiming that outside lawyers strong-armed the company into filing for bankruptcy. Critics Torch Sam Bankman-Fried’s Latest Claims “FTX was never bankrupt, even when its lawyers shoved it into bankruptcy,” declared a document shared from Sam Bankman-Fried’s […] Source CryptoX Portal