Recent court documents indicate FTX’s creditors’ digital asset claims will be based on the near-bottom crypto prices at the time of the disgraced exchange’s collapse back in November 2022. A recent disclosure statement shows that FTX’s lawyers are proposing that claims regarding digital assets will be calculated and processed by converting the value of the crypto into cash based on the exchange rate on November 11th, 2022, the day the now-defunct exchange commenced its Chapter 11 case. Crypto prices had cratered at the time due to the FTX turmoil and…

Tag: FTX

FTX Bahamas Unit Reaches Agreement With U.S. Team on Pooling, Distributing Assets

Once the courts have agreed, FTX Digital Markets will take the lead in the realization of real estate and other assets in the Bahamas and FTX Debtors will take the operational lead in “all other recovery activities including any sale transaction involving the FTX.com exchange and realisation of intellectual property.” Source

FTX Bankruptcy Fees Reach $53,000 per Hour, Crypto Exchange Still Owes Over $1B

Even with the owed fees it has paid in trying to deal with bankruptcy issues, FTX continues to face mounting challenges. The collapse of cryptocurrency exchange FTX, previously valued at $32 billion, has resulted in exorbitant legal and advisory fees amounting to an average of $53,000 per hour within three months. According to recent filings with the bankruptcy court, FTX attempted to address its insolvency issues by spending an astounding $118.1 million on professional services between August 1 and October 31 of this year. This equates to more than $1.3…

FTX Files Proposal to Exit Bankruptcy and Repay Billions to Creditors

FTX highlighted its intention to repay billions of dollars in cash to affected customers. Beleaguered cryptocurrency exchange FTX has announced plans to exit bankruptcy and resolve its year-long financial troubles with victims of the troubled digital asset trading platform, Bloomberg reported Monday. According to the report, FTX is in final discussions with the official creditors committee regarding the resolution of the Chapter 11 bankruptcy proceeding and the potential return of customers’ funds. FTX Creditors to Vote on New Restructuring Plan Next Year The company submitted a fresh proposal for its…

FTX Files Reorganization Plan to End Bankruptcy

In the new proposal, creditor and customer claims are classed according to the priority the estate plans to give them, and the value of claims will be calculated based on asset prices as of the date the company filed for bankruptcy. In a separate statement, the estate said the plan was designed to “maximize and efficiently distribute value to all creditors.” Source

FTX proposes plan to end bankruptcy

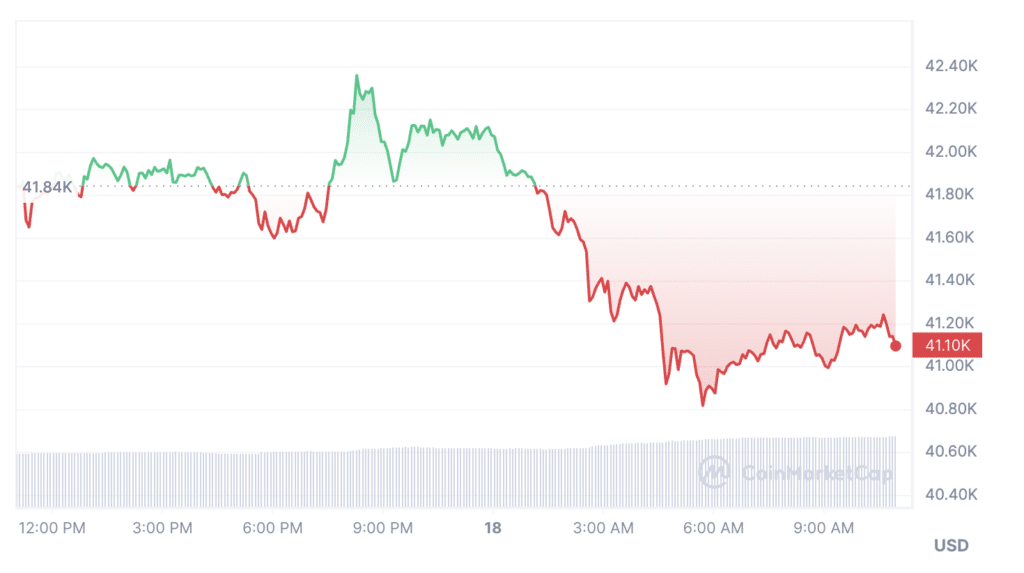

FTX Trading Ltd. Introduced a new proposal to return billions of dollars to customers and creditors. FTX has filed an amended plan of reorganization that will value assets at the rate at the time of the bankruptcy filing—November 11, 2022. At that time, Bitcoin (BTC) was trading at around $17,000; the current price is above $41,100. Source: CoinMarketCap In addition, at the beginning of November 2022, the FTT token was valued at approximately $26. It is now trading at $3.70. FTX is currently discussing how best to end the bankruptcy…

FTX loses $53K every hour on ‘bankruptcy fees’ — latest filings show

Crypto exchange FTX has been burning through approximately $53,000 every hour over the three months ending Oct. 31 — just on bankruptcy lawyers and advisers, the latest round of compensation filings show. Court filings from Dec. 5 to Dec. 16 have shown that the bankruptcy lawyers have charged an accumulated total of at least $118.1 million between Aug. 1 and Oct. 31. Over the 92 days, this equates to $1.3 million per day or $53,300 per hour. The largest bill came from the management consulting firm Alvarez and Marshall, which…

FTX debtors will assess values of crypto claims based on petition date market prices

The debtors of the now-defunct cryptocurrency exchange FTX have filed the amended Chapter 11 plan of reorganization which indicates the value of customer asset claims will be retroactively set to the time when the exchange collapsed in November 2022. In a recent court filing in the United States Bankruptcy Court for the District of Delaware the debtors outlined that “customer entitlement claim” refers to any claim, regardless of type of nature, against the exchange aimed at compensating the holder based on the value as of the petition date. FTX Debtors…

exploring RebelSatoshi, FTX Token, and Terra LUNA

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. For beginner cryptocurrency investors, a few gems can turn out to be profitable: Rebel Satoshi ($RBLZ), FTX Token (FTT), and Terra (LUNA). Let’s dig deep to understand what makes $RBLZ, FTT, and LUNA some of the best altcoins to buy. TLDR Rebel Satoshi ($RBLZ) surges 80% to reach Warriors Round 2 of the presale. FTX Token (FTT) is predicted to drop below $4 after a massive surge in price. …

FTX Bankruptcy Judge Takes Step to Shorten Timeline for Customers’ Recoveries

U.S. Judge John Dorsey, from the Delaware Bankruptcy Court, scheduled a hearing for early next year to calculate the crypto exchange’s debt to the IRS, a sticking point that has stagnated efforts to remunerate the exchange’s many victims. As FTX’s largest creditor, the IRS’ claim must be resolved before FTX victim’s can recover their losses. Source