As bitcoin dipped on Monday and into Tuesday, Peter Schiff—a vocal economic pundit and longtime BTC skeptic—leveraged the digital asset’s decline to lob a critique at Strategy’s Michael Saylor and the cryptocurrency’s volatility. Schiff Goes After Saylor’s Bitcoin Moves Schiff, whose disdain for bitcoin is well-documented, framed the moment as a poetic rebuttal to its […] Original

Tag: Investors

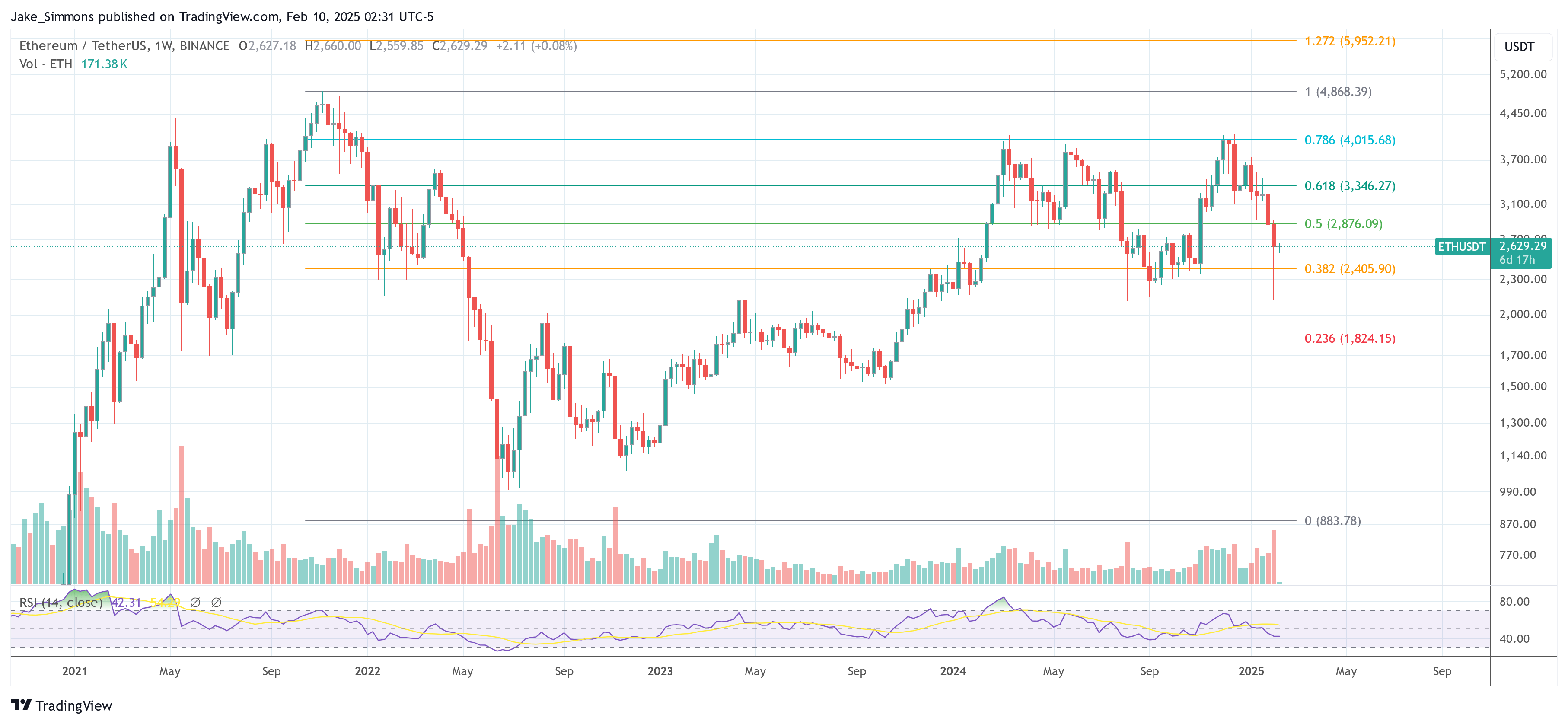

Institutional investors shift from Bitcoin to Ethereum ETFs, one altcoin gains serious buzz

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. As institutions pivot to Ethereum ETFs, Lightchain AI creates a buzz with a $16.8m presale and real-world utility. As institutional investors adjust their portfolios, Bitcoin ETFs are becoming less appealing, while Ethereum ETFs are gaining significant traction. This shift signals a change in market sentiment, with Ethereum’s upgrades, scalability improvements, and real-world utility leading the charge. However, there’s another altcoin gaining attention — Lightchain AI. With its presale raising…

Bitcoin Price Suppression Below $100,000 Worries Investors, JPMorgan Analysts Reveal The Real Problem

Este artículo también está disponible en español. Bitcoin’s price rally may be under threat as it continues to trade under $100,000. According to analysts at JPMorgan, there’s been a notable decline in institutional interest in the crypto industry, particularly through Bitcoin and Ethereum futures contracts. Institutional Demand Declines, Futures Market Signals Weakness Institutional investors have been a major primer for Bitcoin’s price rallies in the past year and they have been influential in Bitcoin’s break above the $100,000 mark. However, since breaking above this level, the Bitcoin price has failed…

Here’s why majority of Bitcoin investors unlikely to panic sell

With Bitcoin holding steady above $90,000 and many investors in profit, the risk of panic selling is minimal, analysts suggest. Investors are unlikely to panic sell as long as Bitcoin’s (BTC) price stays above the $90,000 threshold, analysts at Singapore-based blockchain firm Matrixport say. As trading volumes have skyrocketed, jumping from $40 billion to nearly $400 billion at times, more investors are jumping in, with Matrixport seeing this trend to “continue driving adoption in 2025.” It’s worth mentioning, though, that most of the volume increases tend to happen when prices…

Korea’s Crypto Leap: FSC to Permit Institutional Investors to Open Virtual Asset Trading Accounts in H2

Starting in the second half of the year, South Korea will allow certain institutional investors, including listed companies, to open virtual asset trading accounts. Risks of Institutional Participation South Korea will allow certain institutional investors to open virtual asset trading accounts starting in the second half of the year, the country’s Financial Services Commission (FSC) […] Source CryptoX Portal

Ethereum’s Remittix Soars Past $12M In Presale As Investors Draw Comparison To Payments Giant XRP

PRESS RELEASE. ETH stands as the second-largest cryptocurrency by market cap, and its well-established ecosystem continues to be a hotbed for innovation. Building on this powerful network, Remittix has emerged as a PayFi contender, recently surpassing $12 million in presale funds. Investors are now buzzing about the project’s real-world applications and likening its potential to […] Source CryptoX Portal

Bitcoin Short Term Investors Now Hold Over 4M $BTC. Can BTC Bull 100x?

Short term Bitcoin holders (STHs) have been aggressively adding the OG cryptocurrency to their portfolios since September 2024, adding over 1.5M BTC. This takes the total tally of Bitcoin with STHs to 4M. In case you didn’t know, short-term holders are those market participants who hold the token for less than 155 days. Can Short-Term Holders Buy More $BTC? Interestingly, all of the previous Bitcoin rallies have come when short-term holders have exhausted their buying momentum. For instance, in the 2013 cycle, STHs held almost 5M BTC, while in the…

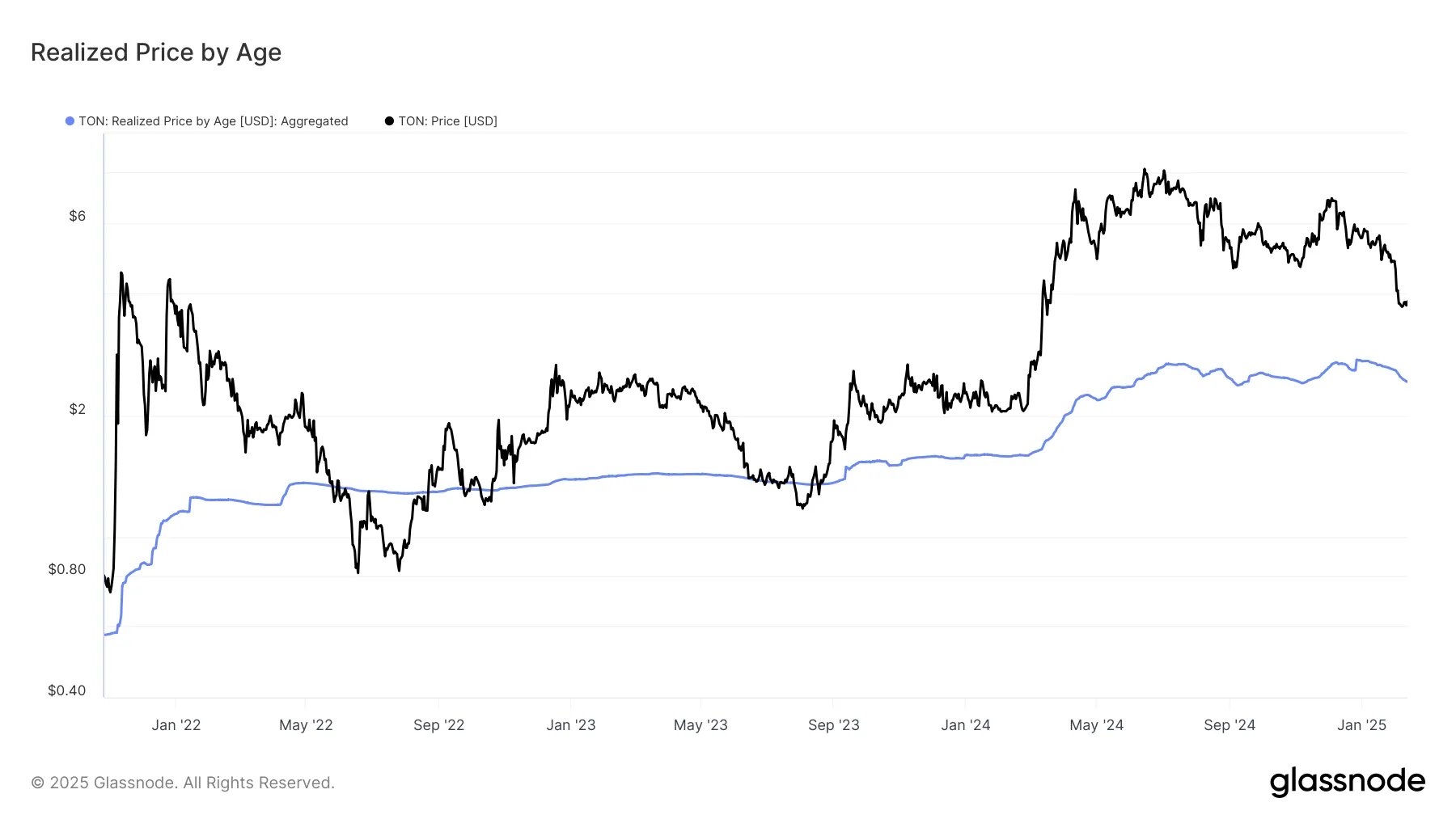

Toncoin (TON) Investors Sitting On 54% Profit Despite Price Plunge

On-chain data shows the Toncoin investors are holding a significant amount of unrealized profit even after the recent bearish action in the asset’s price. Toncoin Is Still Trading A Notable Distance Above Its Realized Price In a new post on X, the on-chain analytics firm Glassnode has discussed about the latest trend in a few indicators related to Toncoin. The first metric of relevance is the “Realized Price,” which tells us, in short, the cost basis of the average investor on the TON network. When the spot price of the…

Wall Street’s Ethereum Shorts Explode: Should Investors Worry?

Este artículo también está disponible en español. In a dramatic shift, hedge funds appear to be ramping up short positions in Ethereum at a rate not seen before, sparking questions on whether the second‐largest cryptocurrency by market capitalization could be facing troubled waters—or if something else is at play. According to renowned analysts from the Kobeissi Letter (@KobeissiLetter), short positioning in Ethereum “is now up +40% in ONE WEEK and +500% since November 2024.” Their findings, shared on X, argue that “never in history have Wall Street hedge funds been…

Retail Investors Boost Bitcoin Accumulation By 72% Amidst Intense Whale Selling

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency. Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems. In two years of active…