As Bitcoin is currently still struggling to reclaim major highs, a recent analysis of its fundamentals has highlighted a possible buying opportunity for Bitcoin based on insights from the Non-Realized Profit metric. A CryptoQuant analyst known as Darkfost highlighted this metric’s importance in a recent post on the CryptoQuant QuickTake platform, mentioning what its trend means for investors. According to the analyst, the Non-Realized Profit metric offers a window into the unrealized gains or losses held by Bitcoin investors, which can influence future market movements. Understanding The Current Zone In…

Tag: Investors

Dollar-Cost Averaging a Favorite of Crypto Investors

“This difference might indicate that lower-income investors need more support with investment decisions, including maintaining regular contributions and sticking to a trading decision without emotional influence,” the report said. “Lower-income investors most often choose riskier strategies like trying to time the market,” the report added, noting that respondents making less than $75,000 tend to prefer that strategy instead of dollar-cost averaging, whereas the vast majority of respondents making more than $150,000 privileged the more cautious route. Source

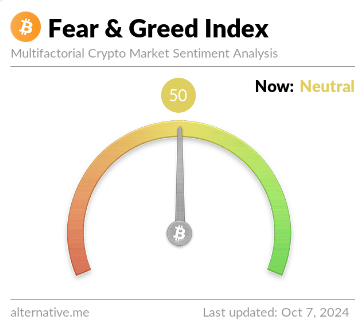

Bitcoin Investors Not Sold On Uptober As Sentiment Remains Neutral

Data shows that the Bitcoin trader sentiment is currently neutral, a sign that investors are indecisive about the direction of the cryptocurrency. Bitcoin Fear & Greed Index Is Right In The Balance Right Now The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment among the traders in the Bitcoin and wider cryptocurrency markets. This index determines the sentiment by accounting for the data of the following five factors: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends. To…

ETH expected to surge as investors eye ETH EFTs, as new DeFi coin raises $70k in 10 hours

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. As Ethereum ETFs face outflows amid geopolitical tensions, new opportunities like Cutoshi are emerging, drawing investor interest with its blend of memecoin appeal and DeFi features. Cryptocurrency ETFs made progress in 2024, with Ethereum ETFs approved and trading this year. Currently, the crypto ETF market size is around $82 billion, and it will increase drastically as we get ETFs in various sectors. Ethereum ETFs have not impacted the ETH…

Toncoin struggles as TRON surges; investors eye Lunex network’s DeFi exchange

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Toncoin loses investor interest due to a negative funding rate, while TRON gains momentum, surpassing Bitcoin and Ethereum. Toncoin (TON) is quickly losing investor interest due to its negative funding rate, but TRON is picking up bullish momentum after surpassing Bitcoin and Ethereum in terms of Q3 revenue. Meanwhile, savvy investors are more interested in Lunex Network’s viral DeFi exchange with its unique cross-chain interoperability. Toncoin’s negative funding rate…

Bitcoin Investors Show Fear, Could A Price Bottom Be Imminent?

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency. Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems. In two years of active…

Washington State Accuses 2 Cryptocurrency Platforms of Defrauding Investors

Two cryptocurrency platforms face allegations of fraud by Washington State’s Department of Financial Institutions. Both companies allegedly lured investors with promises of huge returns, but later blocked withdrawals and demanded extra fees. An investor lost $64,000 to one platform after being asked for a “safety reserve” fee. The platforms are accused of exploiting social media […] Source

FBI Warns of Ichcoin Targeting American Crypto Investors

The Federal Bureau of Investigation (FBI) has issued a warning about Ichcoin, a fraudulent cryptocurrency platform that is deceiving investors across the U.S. by luring them in through social media, then tricking them into wiring large sums of money. Victims are led to believe their investments are growing but are ultimately left with nothing, often […] Source CryptoX Portal

New Bitcoin Investors Show Confidence Amid Market Recovery, Says Glassnode

In a report by Glassnode and researchers Cryptovizart and Ukuria OC, bitcoin has reclaimed a key short-term cost basis after the Federal Reserve’s recent interest rate cut. This recovery signals the potential for further price momentum, although broader market conditions remain cautious. Bitcoin Reclaims Short-Term Cost Basis According to Glassnode, bitcoin’s price has risen above […] Original

Kamala Harris’s Unrealized Capital Gains Tax Would Hurt All Crypto Investors

The proposed 25% levy would hurt early investors in bitcoin and lead to a selloff in the wider market, says Zac Townsend, CEO and co-founder of Meanwhile. Source