Metaplanet approved an overhaul of its capital structure on Monday, allowing Japan’s largest corporate Bitcoin holder to raise funds through dividend-paying preferred shares aimed at institutional investors. Investors approved five proposals that collectively expand Metaplanet’s ability to issue preferred shares, introduce new dividend mechanics and open participation to overseas institutional capital, said Dylan LeClair, the company’s Bitcoin strategy director. The approved measures include reclassifying capital reserves to allow for preferred share dividends and potential buybacks, doubling the authorized number of Class A and Class B preferred shares and amending…

Tag: Investors

Crypto Investors Lost Faith In The 4-Year Cycle? Analyst Weighs In

With only two weeks left of 2025, market participants wonder whether the Bitcoin (BTC) and the rest of the crypto market will continue to struggle or begin recovering. An analyst discussed the current market sentiment and the impact it may have on market performance. Related Reading The Four-Year Crypto Cycle Is ‘Like Faith In God’ As we approach the end of the year, concerns about the crypto market’s performance continue to mount. Bitcoin, the largest cryptocurrency by market capitalization, has seen a 30% decline from its early October peak. As…

Bitcoin Investors Brace For BoJ Rate Hike As Market Sell-Off Commence — Details

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency. Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems. In two years of active…

Why This Market Analyst Is Warning Crypto Investors To Stop Buying XRP

The XRP price could be on the verge of a massive crash, as a crypto analyst has identified a key technical pattern in the cryptocurrency’s structure that signals a potentially severe downturn. According to the analyst, this formation has appeared only twice in XRP’s history, and each time has preceded a devastating loss. If the pattern were to repeat, the cryptocurrency could be headed for more pain. The analyst warns traders and investors to stop buying XRP at this time, citing heightened risk. Analyst Advices Against Buying XRP As Price…

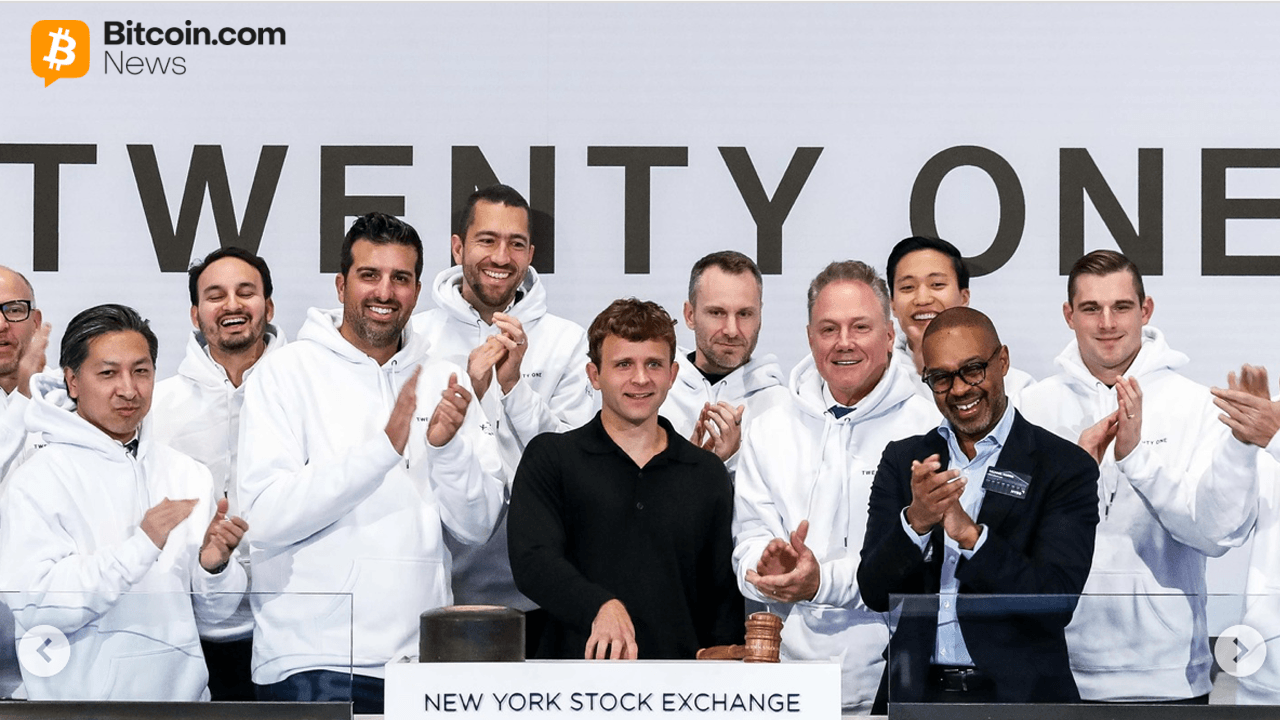

From SPAC to NYSE: XXI Opens Lower as Investors Size up Its Bitcoin Treasury Model

Bitcoin treasury firm Twenty One Capital made its NYSE debut under the ticker XXI on Tuesday, and the stock promptly slipped 19.97% as the newest digital asset treasury (DAT) experiment hit the public stage with more grit than glamour. World’s Third-Largest Corporate Bitcoin Holder Lists on NYSE Twenty One Capital arrived on the New York […] Original

Elite Traders Hunt Retail Investors On Prediction Markets

Prediction markets are emerging as a new battleground in the crypto economy, where the best-informed traders are competing against casual retail bettors for profits. Most users are behaving more like sports bettors than disciplined traders, according to a Tuesday report from research firm 10x Research, which said they are trading “dopamine and narrative for discipline and edge.” It added: “Accuracy and profit are driven not by the crowd, but by a tiny, informed elite who price probability, hedge exposure, and extract premium from retail-driven longshots.” The rising liquidity and retail…

Bitcoin Retail Investors Tell a Tale Of ‘Structural Decline’

Bitcoin (BTC) retail investors are setting new records as “structural decline” sets in this bull market. Key points: Bitcoin entities holding up to 1 BTC are sending less per day to Binance than ever before. A tale of “structural decline” comes in the era of spot Bitcoin ETFs. Whale positioning hints at a new BTC price bottom. ”Shrimp” Binance BTC inflows set all-time lows Data from onchain analytics platform CryptoQuant shows BTC inflows to largest crypto exchange Binance collapsing in 2025. Bitcoin retail investors — entities holding up to 1…

Robert Robert Kiyosaki Offers Crash Advice With Deep Bitcoin Conviction—What Investors Need to Know

Robert Kiyosaki urges people to brace for deepening financial turmoil by building new income streams, securing essential trade skills, and accumulating hard assets as he warns of a severe global downturn approaching 2026. Kiyosaki’s Recession Playbook and Asset Warnings Robert Kiyosaki, author of the best-selling book Rich Dad Poor Dad, has weighed in on what […] Original

Pundit Predicts That XRP Is About To Make Investors Extremely Rich

A crypto analyst has made an unexpected declaration, predicting that XRP investors could become extremely rich in just a few months. This bold claim comes with a new technical analysis, suggesting that XRP is now entering a pivotal price area that previously triggered explosive rallies. Despite the cryptocurrency’s low price and recent downtrend, the analyst remains confident that XRP could mirror past trends and skyrocket to new highs. Related Reading XRP To Make Holders Wealthy In 3 Months? In a recent X post, popular market analyst ‘Steph Is Crypto’ issued…

With whales accumulating XRP and Bitcoin surging 36%, why are more investors turning to BZHash for stable, reliable returns?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. As market volatility rises, more crypto holders are shifting away from price-driven speculation and toward stable, output-based models like cloud mining for predictable returns. Summary Rising volatility in XRP and Bitcoin has pushed some investors to move away from price speculation and toward models that offer steadier, decoupled returns. Platforms like BZHash are gaining attention for providing predictable computing-power-based earnings, appealing to holders who want stability during turbulent market…