CryptoX – Cryptocurrency Analysis and News Portal But the bankruptcy negotiation was always aimed toward a settlement, because it gets money into people’s hands much more quickly, Paul explained. The lawyers have until Dec. 1 to get a 75% approval rate from the 60 individuals and entities in their group and with any investors who sign up as members in the coming weeks. Original Source The post FTX Creditors’ Lawyers Promote Deal Giving Investors 90% of What’s Left in Sam Bankman-Fried Empire appeared first on CryptoX. CryptoX Portal

Tag: Investors

Thai crypto investors turn to tarot cards, divine signals to predict market

Crypto and stock investors have always found interesting and sometimes bizarre ways to “predict” the market’s ebbs and flows. Some have suggested that our unconscious minds can predict the stock market through “precognitive dreaming,” while others have recently been turning to the advice of artificial intelligence chatbots. However, in Thailand, there appears to be a growing group of investors turning to divine powers and astrology to predict market movements, including crypto — as recently highlighted in a r/cryptocurrency thread on Reddit. One astrologist, who goes by “Pimfah,” has a 160,000-strong Facebook group…

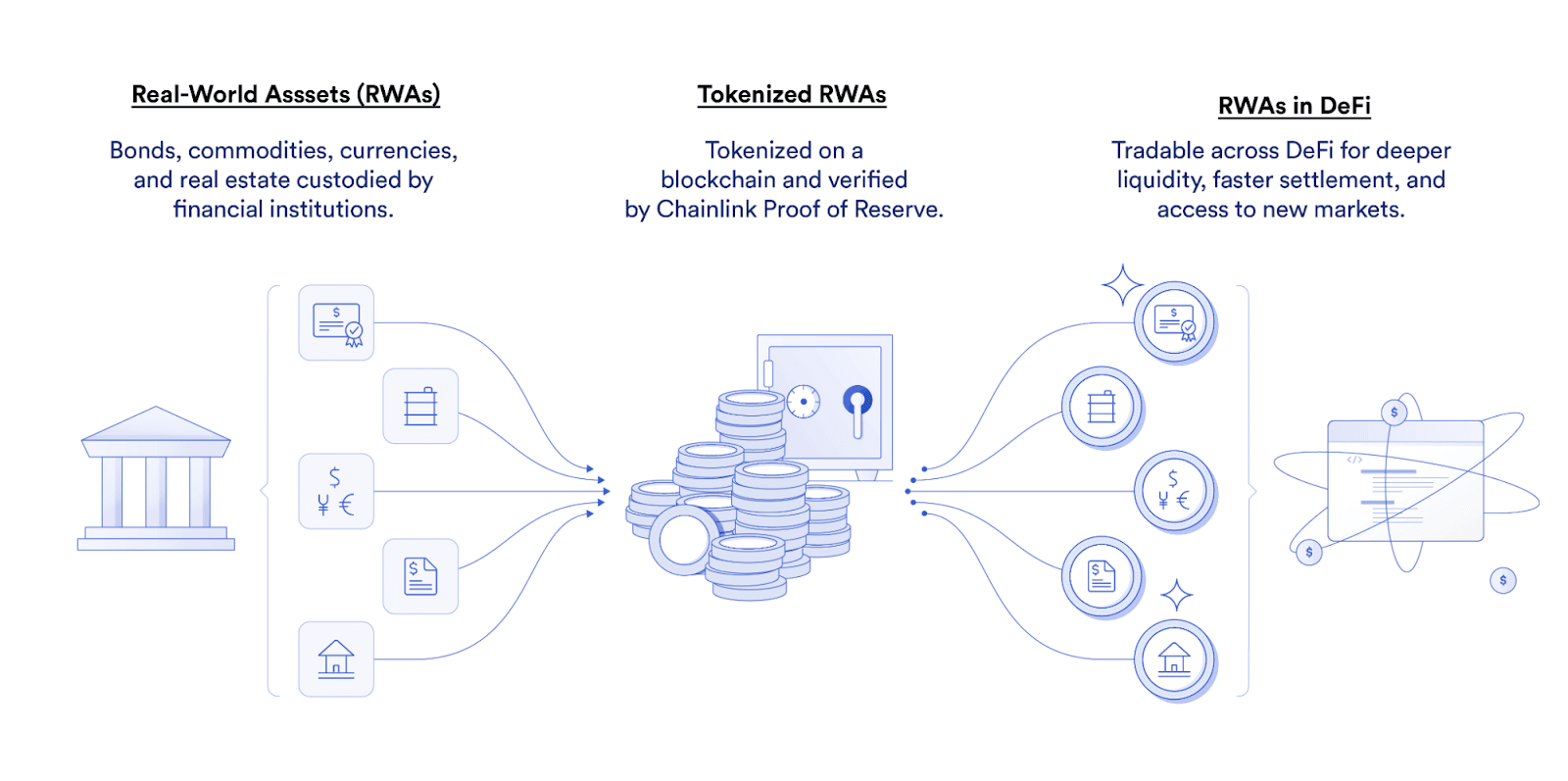

Investors must be ready for the power of asset tokenization

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial. While it remains a relatively new concept, asset tokenization is being deemed as one of the most compelling applications of blockchain technology amongst experts. Backed by benefits like greater portability, improved security, increased efficiencies, and fractionalization, asset tokenization has massive potential and is becoming impossible to ignore. It is transforming finance with enhanced security and liquidity. Not to mention, there is a less obvious benefit here, which…

Shiba Inu set for recovery as investors eye Neo and InQubeta

Crypto is volatile, but two popular altcoins have been resilient despite harsh market conditions. Shiba Inu (SHIB) recently processed a large chunk of transactions, while InQubeta(QUBE) has been steadily gaining investor attention. InQubeta eases investment in crypto AI startups Many artificial intelligence (AI) startups are launching or planning to in the months ahead. However, it can be challenging for potential investors to get involved. InQubeta aims to change that. It’s a crowdfunding platform that lets investors make fractional investments via non-fungible tokens (NFTs) in AI startups using the QUBE, the platform’s…

SynFutures, a Perpetual Futures DEX, Raises $22M Series B From Big-Name Investors

“The name “Oyster AMM” reflects the completely permissionless listing of futures trading pairs on SynFutures DEX, as well as the ‘pearls’ that appear on a liquidity curve with limit orders, as is the case with our model,” Rachel Lin, SynFutures’ co-founder and CEO, said. Source

Gemini, Genesis, DCG Sued by New York Attorney General for Allegedly Defrauding Investors

New York Attorney General Letitia James today filed a lawsuit against cryptocurrency companies the Gemini Trust Company (Gemini), trading firm Genesis Global Capital, and crypto conglomerate Digital Currency Group (DCG) for allegedly defrauding more than 230,000 investors, including at least 29,000 New Yorkers, of more than $1 billion. Source

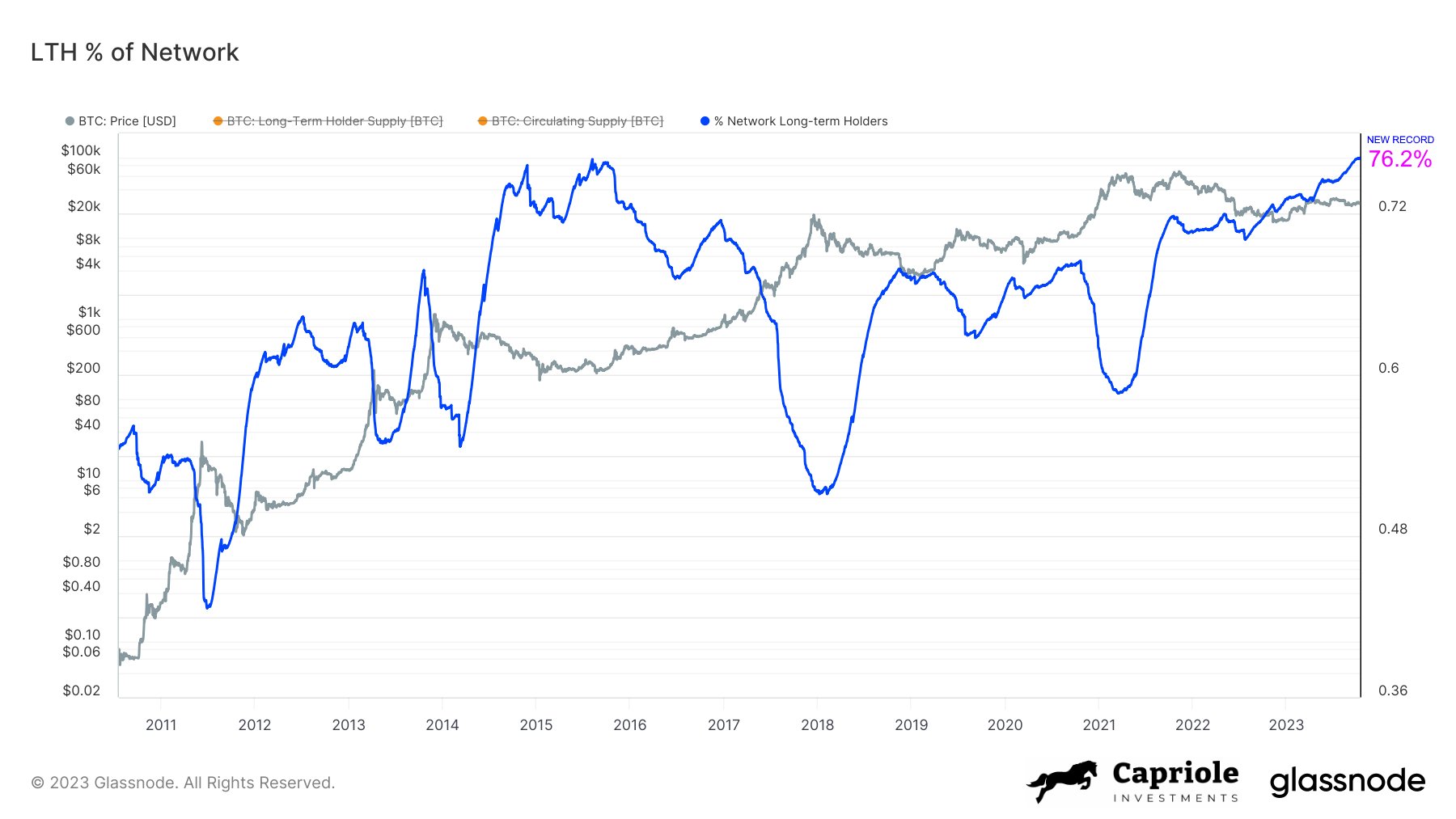

Bitcoin’s long-term investors own over 76% of all BTC for the first time

Bitcoin (BTC) is becoming scarcer than ever — if you are a BTC price speculator or new to the market. The latest data from on-chain analytics firm Glassnode shows a record portion of the available BTC supply is locked up in long-term storage. Bitcoin long-term holder presence beats all-time highs At more than 76%, Bitcoin’s long-term holders (LTHs) control more of the BTC supply than at any point in history. Despite the supply increasing with every block, in percentage terms, the low-time preference Bitcoin investor cohort has a record market…

SuperDao Closes Down, Returns Money to Investors

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity…

Will Cardano Slide To $0.20? What Awaits ADA Investors

Cardano (ADA) investors are currently grappling with a critical juncture as the cryptocurrency struggles to maintain its positive momentum within a triangle pattern. Priced at $0.246925 according to CoinGecko, the ADA market is currently navigating through a complex landscape of potential pitfalls and prospects. Despite a 1.3% decline in the last 24 hours and a measly 0.1% dip over the past week, the market sentiment remains cautious, with traders closely monitoring the possibility of a downturn to $0.20. At the heart of the current ADA price conundrum lies the intricate…

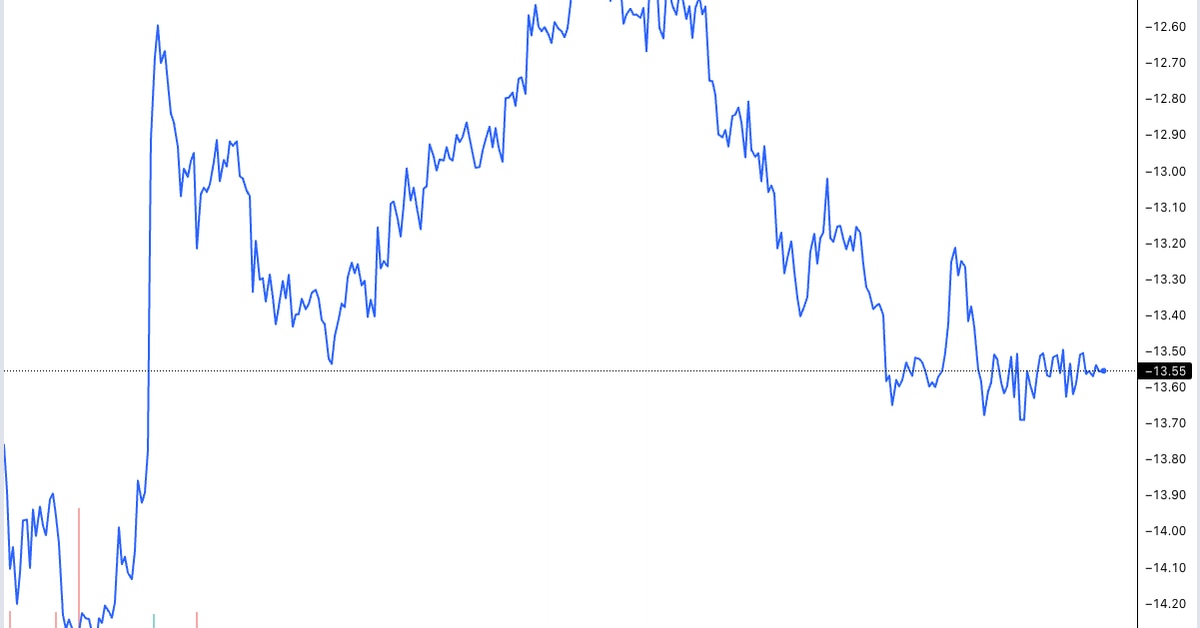

GBTC Discount Continues to Narrow as Investors Await ETF Conversion Decision

The fund’s shares have traded at a discount to NAV since December 2021. Source