Pro-XRP lawyer, John Deaton, has said that the actions taken by the United States Securities and Exchange Commission (SEC) against the crypto industry are driven by a broader motive to safeguard corporate capitalism rather than prioritizing the protection of investors. Deaton highlighted what he views as an assault on cryptocurrencies, particularly in relation to the SEC’s actions targeting Coinbase and Ripple. In his remarks, he touched on several aspects, such as the accredited investor rules, the SEC’s approach to regulating cryptocurrencies and its position concerning retail investors in the Ripple…

Tag: Investors

Bitcoin At Decision Point As Investors Hold Neutral Sentiment

Bitcoin may be at a decision point right now as investor sentiment is exactly neutral. Which way will the market tip in the coming days? Bitcoin Fear & Greed Index Suggests Market Is Neutral A few days back, Bitcoin had observed a sharp plunge that had taken the cryptocurrency’s value towards the $29,000 level. In the days that followed, the asset had only consolidated around these relatively low levels, but during the last 24 hours, things appear to have changed a bit. The impetus for this latest volatility appears to…

How It Captured PEPE Investors’ Attention

Dogecoin (DOGE) has been making headlines again with its recent price rally, causing a significant impact on the PEPE network and its investors. As the price of DOGE surged around mid-July, on-chain data indicates that investors began to abandon their holdings in PEPE, leading to a sharp decline in the network’s activity. Daily Active Addresses, a crucial metric used to gauge the level of network activity, took a hit during this period. On July 14, PEPE recorded 5,086 active users. However, by the close of July 25, that number had…

For Crypto Investors Down Bad in Hector, the DAO Can’t Die Fast Enough

Hector Network will take six to 12 months to hold a liquidation. Token holders want their money back sooner. Source

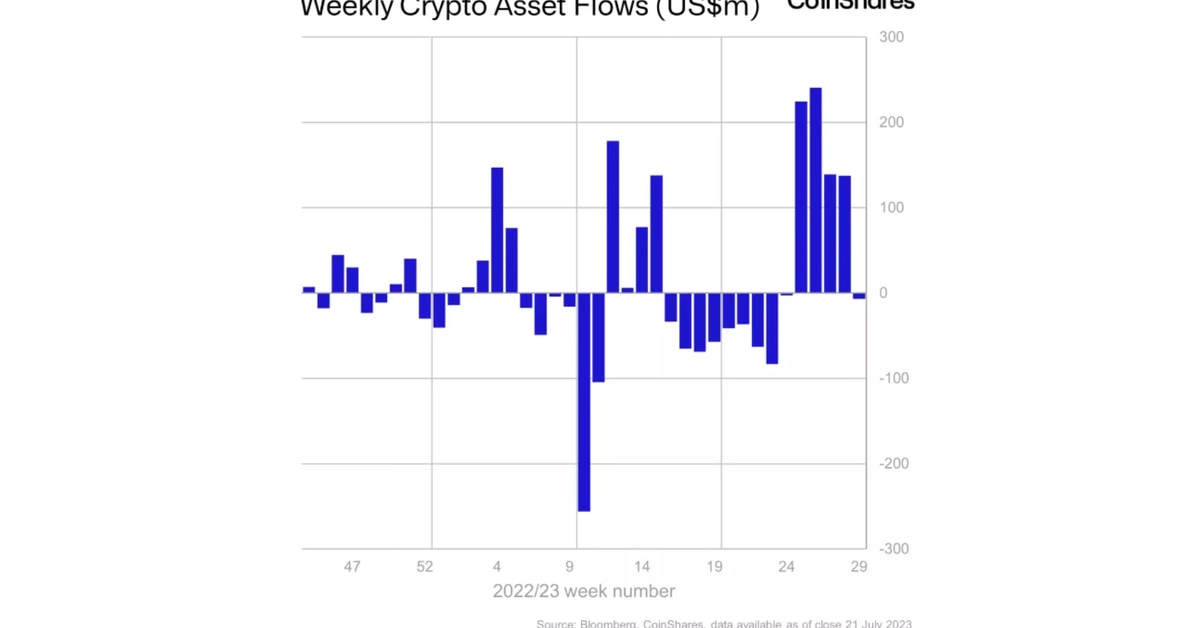

Bitcoin funds decline as crypto investors flock to Ether and XRP

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied Bitcoin-related investment products decline, as investor outflow is visible for the first time since Blackrock’s filing for a spot Bitcoin ETF. The outflow was revealed in a report by James Butterfill, CoinShares’ head of research. Bitcoin (BTC) investment products saw a notable outflow of $13 million during the week ending July 21. A reversal came after five consecutive weeks of inflows. The overall digital asset funds also witnessed weekly outflows of $6.5 million, following four weeks…

Investors anticipate Borroe at $1 billion, BNB under pressure and MATIC firm in 2023

Achieving a market cap of $1 billion is difficult for any digital currency. However, Binance (BNB) and Polygon (MATIC) are among the few that have surpassed this milestone. In addition to forecasting the future of BNB and MATIC, some investors believe Borroe, a crypto project, could also achieve the same feat this year. >>Buy ROE tokens now<< Borroe is a web3 invoice and recurring revenue Marketplace Borroe is a revenue financing solution for web3 participants with cash flow issues. It consists of a blockchain and artificial intelligence (AI)-driven crowdfunding marketplace where…

Crypto investors cool on Bitcoin funds, turning to Ether and XRP

Bitcoin-related investment products appear to have lost some of their sheen among crypto investors, recording its first week of outflows since Blackrock filed for spot Bitcoin ETF in June. According to a July 24 report by CoinShares’ head of research, James Butterfill, Bitcoin (BTC) investment products saw outflows of $13 million for the week ending July 21, reversing five weeks of inflows. Short Bitcoin products also saw outflows of $5.5 million in the week. Bitcoin Fear and Greed Index is 50 ~ NeutralCurrent price: $29,178 pic.twitter.com/T1DMFpsX9p — Bitcoin Fear and Greed…

Crypto Investors Sour on Bitcoin (BTC) Funds After Massive Inflows, Turn to Ether (ETH) and Ripple’s XRP: CoinShares

ETH-focused investment products enjoyed the largest inflows among all cryptocurrencies, totaling $6.6 million. The growth suggests that “sentiment, which has been poor this year, is beginning to turn around” for the second largest crypto asset, noted James Butterfill, head of research at CoinShares. Original

Borroe and Injective bullish as investors examine potential

Borroe and Injective are increasingly being explored due to their approaches and potential to transform crypto. We should take a closer look at the latest advancements that have piqued the interest of investors and why these initiatives can be significant. Borroe’s ROE is set to rise by 25% Borroe is a platform that empowers web3 businesses to convert their future recurring income into non-fungible tokens (NFTs) for upfront cash. Its mission is to create a funding engine for the web3 ecosystem. This concept allows businesses to access much-needed funds quickly and…

Solana’s Parrot Protocol submits proposal to go tokenless, investors risk face -89% returns

A recent proposal from Parrot Protocol’s team, a Solana-based liquidity network, has sparked controversy among its community members. The proposal, up for vote until July 27, calls for the redemption of its PRT tokens for liquid treasury value, and the transition to a no-token protocol. Based on the proposal, the PRT redemption price was established at $0.0045 per token. According to data from CryptoRank, the protocol raised over $89 million since its inception in 2021, with a current return on investment (ROI) of -89% for investors in its Initial DEX…