Japanese investment adviser Metaplanet has announced plans to issue ¥1.7 billion in one-year 0.36% bonds to buy more Bitcoin. Tokyo Stock Exchange-listed Metaplanet is doubling down on its Bitcoin (BTC) strategy with the issuance of a ¥1.75 billion — around $11.7 million as of press time — ordinary bond to fund additional BTC acquisitions. The third series of ordinary bonds, exclusively allocated to EVO FUND, carries a 0.36% annual interest rate and is fully guaranteed by the company’s president and representative director, Simon Gerovich, per a Nov. 18 regulatory filing.…

Tag: Issuance

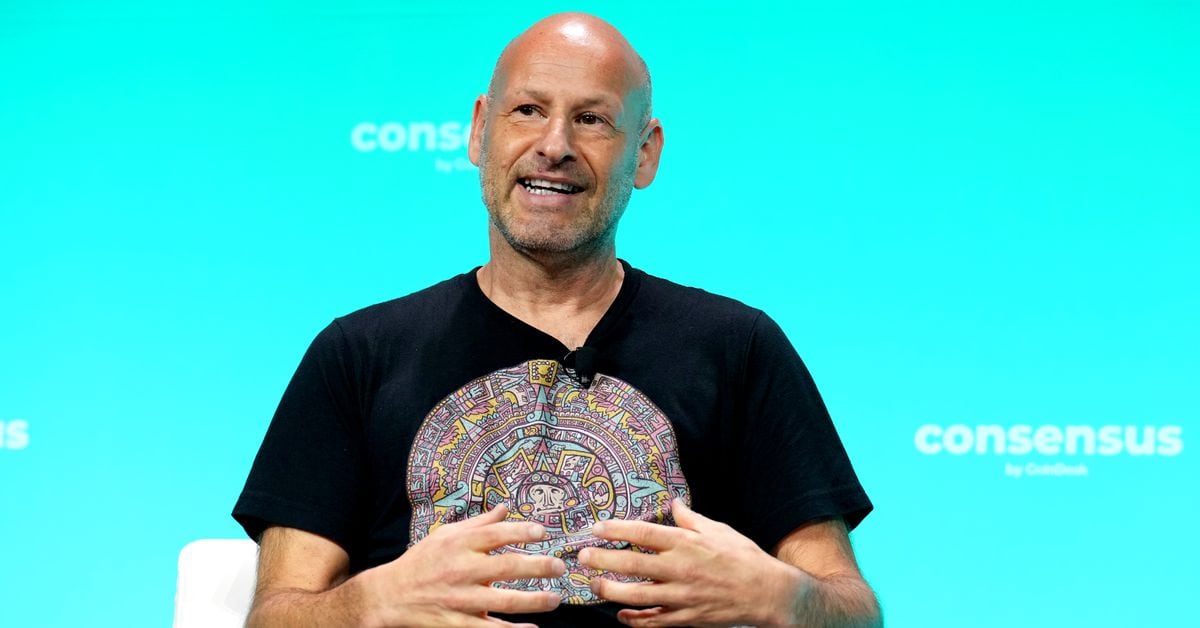

Ethereum Developer Consensys Plots Token Issuance in Sign of Trump Thaw

The long-anticipated LINEA token comes as the next U.S. president is expected to usher in a more favorable regulatory environment for cryptocurrency. Source

Samara Asset Group Eyes $32.8 Million Bond Issuance To Increase Bitcoin Holdings

Este artículo también está disponible en español. In an October 14 announcement, Malta-based Samara Asset Group revealed plans to increase its Bitcoin (BTC) holdings through proceeds from a $32.8 million bond issuance. Samara Targets 1,000 Bitcoin Milestone Publicly-listed asset management firm Samara announced it had mandated investment bank Pareto Securities as a sole manager to schedule a series of fixed-income investor meetings to potentially issue up to a €30 million or $32.8 million Nordic bond. Related Reading Notably, the proceeds from the bond issuance will be utilized toward expanding Samara’s…

Bank of Russia Claims Digital Ruble Issuance Won’t Cause Inflation

The Bank of Russia has explained that the launch of the digital ruble, the Russian CBDC, will not affect the state’s mechanisms to control inflation or the amount of money issued. The institution clarified that the new currency does not pose risks to the country’s financial stability, and will not change the functions of the […] Source CryptoX Portal

USDT Reaches $1 Billion Authorized Issuance on TON

Tether’s USDT, the number one stablecoin by market cap, is growing as part of the TON ecosystem. According to the TON team, the stablecoin reached a milestone recently, registering authorized issuance numbers exceeding $1 billion. However, TON clarified that only $720.6 million was in circulation, while $309.3 million were authorized but unissued. Nonetheless, this marks […] Source CryptoX Portal

Michael Saylor’s MicroStrategy (MSTR) Plans Another $700M Convertible Note Issuance to Redeem Debt, Boost Bitcoin (BTC) Stash

The company, led by Executive Chairman Michael Saylor, started purchasing bitcoin in 2020, adopting it as a reserve asset for its treasury. Since then, it has become the largest corporate buyer of bitcoin, accumulating 244,800 BTC, worth roughly $14.2 billion at current prices. Only days ago, MicroStrategy disclosed the purchase of an additional $1.1 billion worth of bitcoin, leaving it with $900 million available under a previous offering. Original

Polygon Begins Token Swap, in Move to Allow More Issuance

“And then the second one is a means for, effectively, validators to receive emissions,” Boiron added. “Effectively, if you think of these new chains that pop up, what’s going to happen is that with time, they’re going to want to decentralize. And so instead of just having a centralized sequencer, they’re going to need to incentivize people to actually run a decentralized group or a decentralized prover. And if they don’t have a token, or if they don’t want to launch a token yet, how do they do that? Well,…

Germany’s Largest Development Bank Prepares for Tokenized RWA Issuance with Boerse Stuttgart Digital in ECB Trial

“As one of the world’s largest and most active bond issuers, we are actively driving digitalisation initiatives in the issuing and settlement process,” Gaetano Panno, head of transaction management at KfW, said in a statement. “The utilization of new technologies as part of the ECB trials enables us to technically process a ‘delivery vs. payment’ transaction and thus supports our digital learning journey.” Source

Popular ‘Simon’s Cat’ to Join Cat Coin Fray With Issuance on Floki Launchpad

The token is launching in partnership with Floki, BNB Chain, and crypto investment DWF Labs. TokenFi, started in 2023 as a sister project to Floki, is a real-world assets platform helping traditional internet brands tokenize into Web3 projects. It also lets users launch any cryptocurrency without writing code. Source

Intesa Sanpaolo, CDP Tap Polygon Blockchain for €25M Digital Bond Issuance as RWA Tokenization Heats Up

“This transaction demonstrates how public blockchains are a powerful technology for financial institutions, making transactions faster and safer,” Niccolò Bardoscia, head of digital assets trading and investments at Intesa Sanpaolo, said in a LinkedIn post. Source