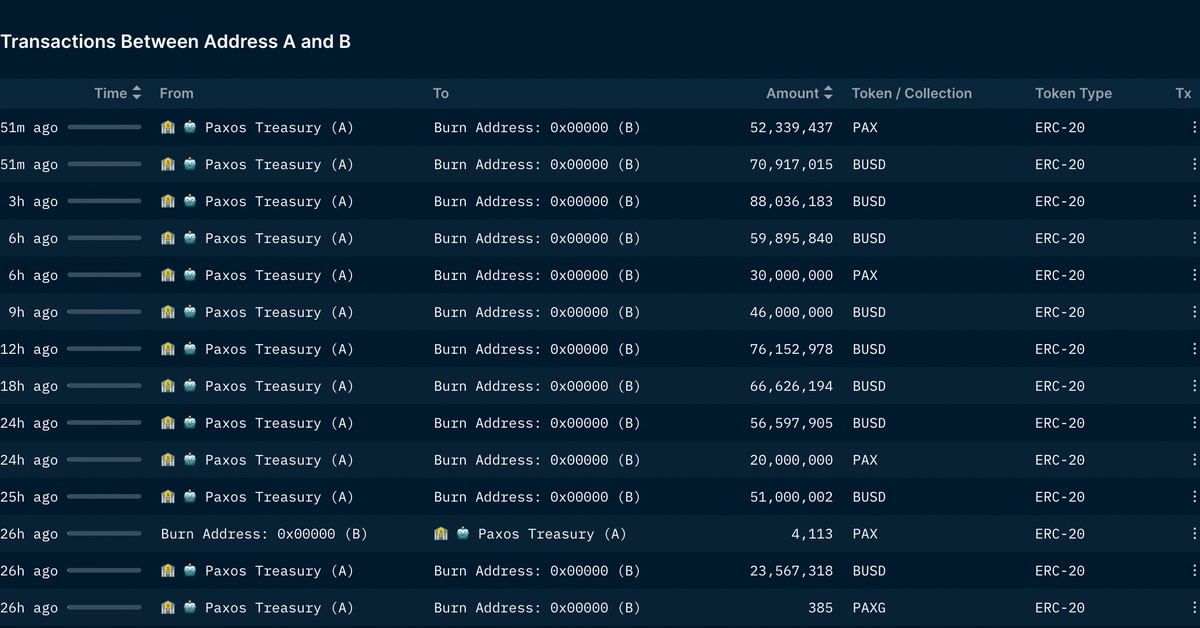

The maneuver is a sign of investors exiting BUSD quickly. The $700 million redemption in a little more than a day represents some 6% of the total coins in circulation. Changpeng “CZ” Zhao, chief executive of Binance, the world’s largest crypto exchange by trading volume, tweeted Monday that BUSD market capitalization “will only decrease over time.” Source

Tag: Issuer

Paxos Receives Wells Notice from SEC, NYDFS Orders Issuer to Stop Minting BUSD – Bitcoin News

According to a report published on Feb. 12, 2023, the New York-based financial institution and technology company, Paxos, has received a Wells Notice from the U.S. Securities and Exchange Commission (SEC) regarding alleged violations of investor protection laws. Paxos revealed the following day, that it would no longer mint BUSD and it was ending its relationship with the Binance-branded stablecoin in Feb. 2024. Report Claims SEC Plans to Sue Paxos for Alleged Investor Protection Violations, Firm Directed to Stop Minting BUSD Sources cited by the Wall Street Journal (WSJ) say…

Stablecoin Issuer Tether's Reserves Partly Managed by Cantor Fitzgerald: WSJ

The Wall Street bond trading powerhouse is managing Tether’s $39 billion bond portfolio, according to the report. Source

Stablecoin issuer Paxos reportedly probed by New York regulators

Paxos Trust Company — the New York-based stablecoin issuer behind Binance USD (BUSD) and Paxos Dollar (USDP) — is reportedly being investigated by the New York Department of Financial Services (NYDFS). A “person familiar with the matter” told Bloomberg in a Feb. 10 report that the exact motive behind the probe is currently unclear. An NYDFS spokesperson declined to comment on ongoing investigations but noted that the department is broadly working to protect consumers from risks associated with investing in the cryptocurrency market: “The department is in continuous contact with regulated…

Stablecoin Issuer Paxos Is Being Investigated by New York Regulator

The New York Department of Financial Services is investigating crypto company Paxos, though the scope of the investigation is not yet clear. Source

Stablecoin Issuer Tether Reports $700M Profit for Q4 2022

CryptoX – Cryptocurrency Analysis and News Portal Its assets as of Dec. 31 stood at $67 billion, with liabilities of $66 billion, almost all of which relates to digital tokens issued. Source The post Stablecoin Issuer Tether Reports $700M Profit for Q4 2022 appeared first on CryptoX. CryptoX Portal

Stablecoin Issuer Tether Reports $700M Profit, Complete Exit From Commercial Paper

Tether’s assets as of Dec. 31 stood at $67 billion, with liabilities of $66 billion, almost all of which relates to digital tokens issued. Source

86% of Stablecoin Issuer Tether Was Controlled by 4 People as of 2018: WSJ

Tether began from separate companies led by ex-plastic surgeon Giancarlo Devasini and former child actor Brock Pierce. Devasini, who helped develop crypto exchange Bitfinex and is now its CFO, owned about 43% of Tether in 2018, according to the documents seen by the Journal. Source

Deloitte Set to Audit USDC Issuer Circle

Circle reassured the USDC holders and the general public that it remained committed to transparency. USDC issuer, Circle, has announced that it will be audited by Deloitte in the future instead of Grant Thornton. According to the firm, its last audit covers 2019,2020, and 2021 and has been filed publicly with the Securities and Exchange Commission (SEC). The statement formed part of the state of the USDC economy report, which it released on Tuesday. Deloitte May Be the First Since the collapse of FTX, there has been an increased call…

USDC issuer Circle terminates SPAC merger with Concord

According to a new press release published on Dec. 5, USD Coin (USDC) issuer Circle announced the mutual termination of its proposed merger with special purpose acquisition company, or SPAC, Concord Acquisition. The deal was announced in July 2021 with a preliminary valuation of $4.5 billion and was then amended in February 2022 when Circle’s valuation ballooned to $9 billion. USDC is currently the second largest stablecoin in circulation, with a market cap of $43 billion. Under the terms of the agreements, Concord had until Dec. 10 to consummate the transaction…