A consortium of major banks, including Bank of America, Citi, Deutsche Bank, Goldman Sachs, and UBS, announced on Friday that they will collaborate to explore the development of stablecoins pegged to G7 currencies. A New Era For Crypto In Mainstream Finance The renewed interest in stablecoins comes in the wake of US President Donald Trump’s endorsement of the sector, which has reignited discussions about integrating blockchain technology into mainstream finance. Currently, the stablecoin market is heavily dominated by Tether (USDT), based in El Salvador, which accounts for approximately $179 billion…

Tag: Issuing

Citigroup CEO Confirms Interest In Issuing A Proprietary Stablecoin—Reuters

Ronaldo is an experienced crypto enthusiast dedicated to the nascent and ever-evolving industry. With over five years of extensive research and unwavering dedication, he has cultivated a profound interest in the world of cryptocurrencies. Ronaldo’s journey began with a spark of curiosity, which soon transformed into a deep passion for understanding the intricacies of this groundbreaking technology. Driven by an insatiable thirst for knowledge, Ronaldo has delved into the depths of the crypto space, exploring its various facets, from blockchain fundamentals to market trends and investment strategies. His tireless exploration…

Russia’s Largest Bank Starts Issuing Bitcoin Bonds

Sberbank, Russia’s largest financial institution, has announced the issuance of the first batch of structured bitcoin bonds. The instruments are currently offered to a limited number of qualified investors, but the bank expects to provide more crypto-linked securities soon. Sberbank Pioneers Bitcoin Bonds in Russia Cryptocurrency is slowly starting to become a mainstream asset in […] Original

Stablecoin Issuing System M^0 (M Zero) Integrates with Crypto Custody Firm Fireblocks

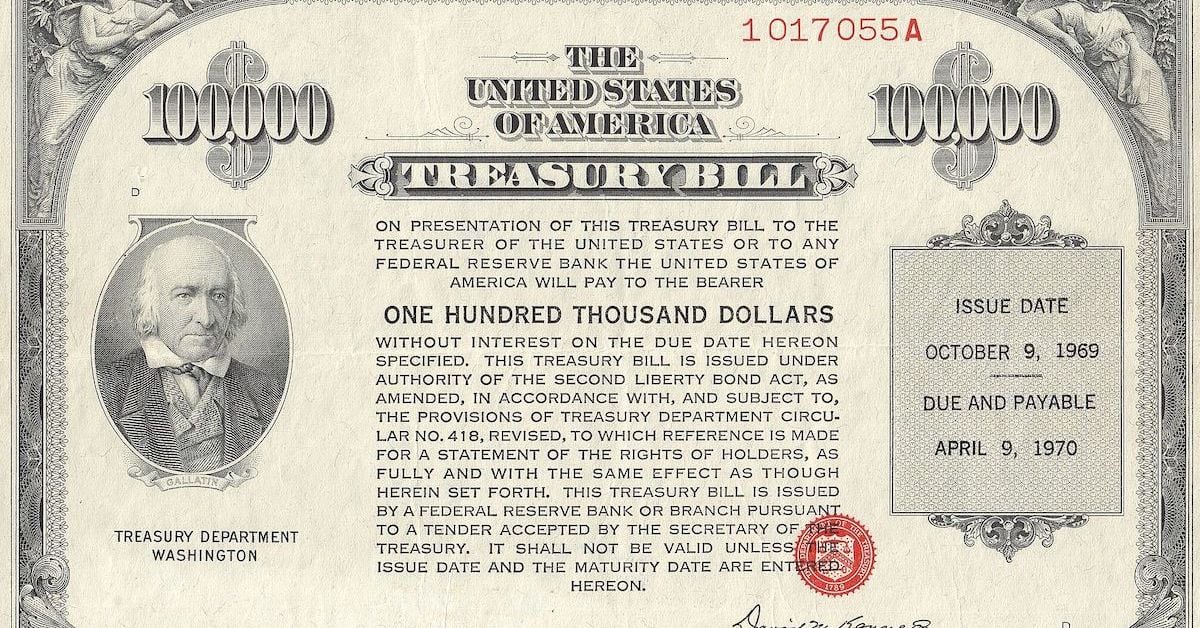

The success of stablecoin issuers like Tether, whose USDT is the largest by market cap, and Circle, producer of the No. 2, USDC, have focused attention on the industry and seeded a new crop of dollar-pegged tokens. Those tokens are generally backed by yield-generating reserves, typically U.S. Treasury bills. Source

Nigeria’s SEC Denies Issuing Provisional Crypto Licenses

Nigeria’s Securities and Exchange Commission (SEC) has announced that it has not yet issued any crypto licenses, contrary to some reports. The SEC plans to start issuing licenses for digital services and tokenized assets in August 2024. This move follows increased scrutiny of crypto exchanges and a push to regulate the industry, including a mandate […] Source BitcoincryptoexchangeExchanges CryptoX Portal

U.S. House Passes Bill Banning Federal Reserve From Issuing a CBDC

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Republican Senators Cruz, Hagerty, Scott, Budd, Braun File Bill to Ban Fed From Issuing a Digital Dollar

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Manta Network Hit by DDoS Attack Day After Issuing MANTA Token Issuance

Manta is the latest in a rising cohort of new blockchains that offer faster transactions at lower costs than popular networks, such as Ethereum. These newer networks are usually backed by prominent funds and extensively market their blockchain in crypto circles on X and other social media platforms, hoping to capture market share and fees, which bolsters the value of their tokens. Source

UK financial watchdog restricts Binance partner from issuing crypto ads

The Financial Conduct Authority (FCA) of the United Kingdom has placed restrictions on peer-to-peer lending platform Rebuildingsociety, the firm with whom crypto exchange Binance partnered for compliance with the regulator’s marketing regime. In an Oct. 10 notice, the FCA said Rebuildingsociety was not authorized to “approve the content of any financial promotion for a Qualifying Cryptoasset for communication by an unauthorised person” and needed to withdraw any existing approvals. The notice suggested that Binance may no longer have a U.K. partner in compliance with the FCA’s marketing requirements, which went…

Binance and Banking Giant MUFG Want to Drive Web3 Adoption in Japan by Issuing Stablecoins

Other jurisdictions like the European Union and even the U.K. have taken more stringent approaches to regulating stablecoins, particularly after one such cryptocurrency, terraUSD, rapidly lost parity with the U.S. dollar last year, leading to the collapse of not just the issuer but a string of other prominent players in the crypto world. Source