Strategy co-founder and executive chairman Michael Saylor posted a chart of the company’s Bitcoin holdings on June 8, signaling a possible upcoming acquisition. On June 8, Saylor posted “Send more Orange” on X. Saylor’s cryptic posts are often followed by announcements of new Bitcoin (BTC) purchases. If Strategy follows up the post with another BTC buy, it will mark the ninth week of consecutive Bitcoin purchases from the company. The post comes shortly after the company purchased an additional 705 BTC between May 26 and June 1 for around $75…

Tag: Launches

Moscow Exchange launches Bitcoin ETF futures trading for qualified investors

After a series of pro-crypto moves, Russia is enabling qualified investors to gain exposure to Bitcoin. Regulated Bitcoin (BTC) trading is coming to Russia, but for qualified investors only. On Wednesday, June 4, the Russian news agency TASS reported that the Moscow Exchange will list a Bitcoin ETF futures contract. The product will be linked to the value of the IBIT Bitcoin Trust ETF, a U.S.-based Bitcoin spot ETF. “Trading in this new product will begin on June 4, 2025, and will be exclusively available to qualified investors,” Moscow Exchange.…

Blockchain Firm Veraviews Launches Fraud-Focused UAE Ad Exchange

Blockchain-powered advertising firm Veraviews has launched the UAE’s first domestically developed advertising exchange and supply-side platform. Veraviews SSP Targets UAE Ad Transparency The Dubai-based blockchain company Veraviews introduced the Ad Exchange and SSP under the United Arab Emirates (UAE) Ministry of Economy’s NextgenFDI initiative. The platform connects advertisers directly with UAE publishers to sell digital […] Source

IG Group Launches Bitcoin, Ethereum, XRP Trading in UK

Key Notes UK’s IG Group now permits crypto trading services for 31 digital currencies. This move marks a growing crypto adoption in the UK. Despite a positive adoption trend, the UK is not interested in establishing a national strategic Bitcoin reserve. UK-listed IG Group has launched a new offering that allows customers to trade Bitcoin BTC $104 125 24h volatility: 0.1% Market cap: $2.07 T Vol. 24h: $22.14 B , Ethereum ETH $2 492 24h volatility: 0.2% Market cap: $300.45 B Vol. 24h: $12.32 B , XRP XRP $2.15 24h…

An Orb by Delivery: World Launches at-Home Iris Scanning in Argentina

World, the proof of personhood and wallet platform, will allow users in Argentina to request a domiciliary iris scan for verification. This new feature is currently available only in the capital but will be extended nationwide. World Starts Rolling out Domiciliary Iris Scans in Argentina World is executing measures to ease access to its verification […] Source CryptoX Portal

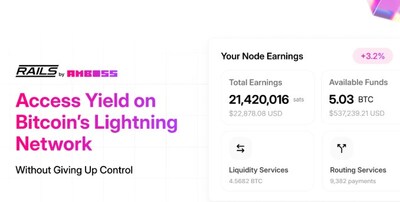

Amboss Launches Rails: Earn Yield on Bitcoin and Enhance Lightning Network Utility

Amboss, a solutions provider for the Bitcoin Lightning Network, has launched Rails, a self-custodial bitcoin service aimed at enhancing asset utility for companies, custodians, and high net worth individuals. Rails allows participants, referred to as Liquidity Providers (LPs), to maintain full custody of their bitcoin while generating returns through payment routing and liquidity leases, thereby […] Original

Grayscale Launches AI Crypto Sector—20 Tokens and $21B Market Cap

Grayscale’s launch of the Artificial Intelligence Crypto Sector signals a major shift in decentralized AI, expanding crypto’s role in cutting-edge tech. Grayscale’s $21B AI Crypto Sector is Here Crypto asset manager Grayscale announced on May 27 the launch of its new Artificial Intelligence Crypto Sector, a move that highlights the growing importance of decentralized AI […] Source CryptoX Portal

Amboss Launches Rails: Empowering Bitcoin Yield and Lightning Network Growth

NASHVILLE, Tenn., May 29, 2025 /PRNewswire/ — Amboss, a leader in AI-driven solutions for the Bitcoin Lightning Network, today unveiled Rails, a self-custodial Bitcoin service designed to enhance asset utility. Developed for companies, custodians, and high net worth individuals, Rails enables participants to put their Bitcoin to work while contributing to the performance and scalability of the Lightning Network. This launch marks a significant step forward in creating decentralized, reliable payment infrastructure for the Bitcoin ecosystem. Rails introduces a secure, innovative way for participants—termed Liquidity Providers (LPs)—to maintain full custody…

XRP Gains Nasdaq Traction as Vivopower Launches Saudi-Backed XRP Treasury Plan

XRP storms into institutional finance as Vivopower launches a strategic XRP treasury play, deploying $121 million to anchor XRPL growth with Saudi-backed momentum. Nasdaq-Listed Vivopower Ignites XRP Treasury Strategy Backed by Saudi Royalty Vivopower International PLC (Nasdaq: VVPR) announced on May 28 that it is pioneering a groundbreaking initiative to establish the world’s first publicly […] Source CryptoX Portal

MidasRWA launches mTBILL on Algorand offering 4.06% yield

German tokenization protocol Midas has launched a tokenized US Treasury bill on the Algorand blockchain, offering European investors exposure to yield-bearing government bonds with no investment minimum required. The mTBILL is a tokenized certificate that references short-term US Treasury exchange-traded funds (ETFs), Midas announced on May 29. The first atomic swap was executed by a third party on the Algorand blockchain on May 27. As part of the transaction, $2 million in USDC (USDC) was exchanged for mTBILLS. Midas says the mTBILL offers a lower barrier to entry for retail…