Three Chinese firms that control more than 90% of Bitcoin mining hardware market are reportedly setting up manufacturing hubs in the U.S. as direct result of President Trump’s tariff war. According to a recent report by Reuters, the world’s top three Bitcoin (BTC) mining hardware manufacturers, all originating from China, are gearing up to penetrate the U.S. market. The three companies, which are Bitmain, Canaan and MicroBT, have a stronghold on 95.4% of the machinery used in global mining rigs, according to an estimation from Consultancy Frost & Sullivan in…

Tag: Markets

JPMorgan Meets With SEC On Capital Markets Moving Onchain

Executives with America’s biggest bank met with the Securities and Exchange Commission’s Crypto Task Force to discuss digital asset regulation and potential ramifications of capital markets moving onchain. The JPMorgan Chase executives discussed with the SEC the “potential impact of existing capital markets activity migrating to public blockchain” — including which areas of the existing model might change and how firms could assess the risks and benefits of those changes, according to an SEC note shared on Tuesday. The two groups also discussed JPMorgan’s existing “business footprint” in the crypto…

God Bless Bitcoin | Full Movie | Documentary

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io God Bless Bitcoin asks the timely question: How do we fix our broken money? Through in-depth conversations with bitcoin and interfaith religious leaders, the film exposes the broken, unjust, and immoral nature of our current fiat-based monetary system, one that is intimately connected to the military industrial complex and the propagation of war. The film also shows how and why members of the poor and middle class feel a financial squeeze even when they work hard and lead fiscally responsible lives. God…

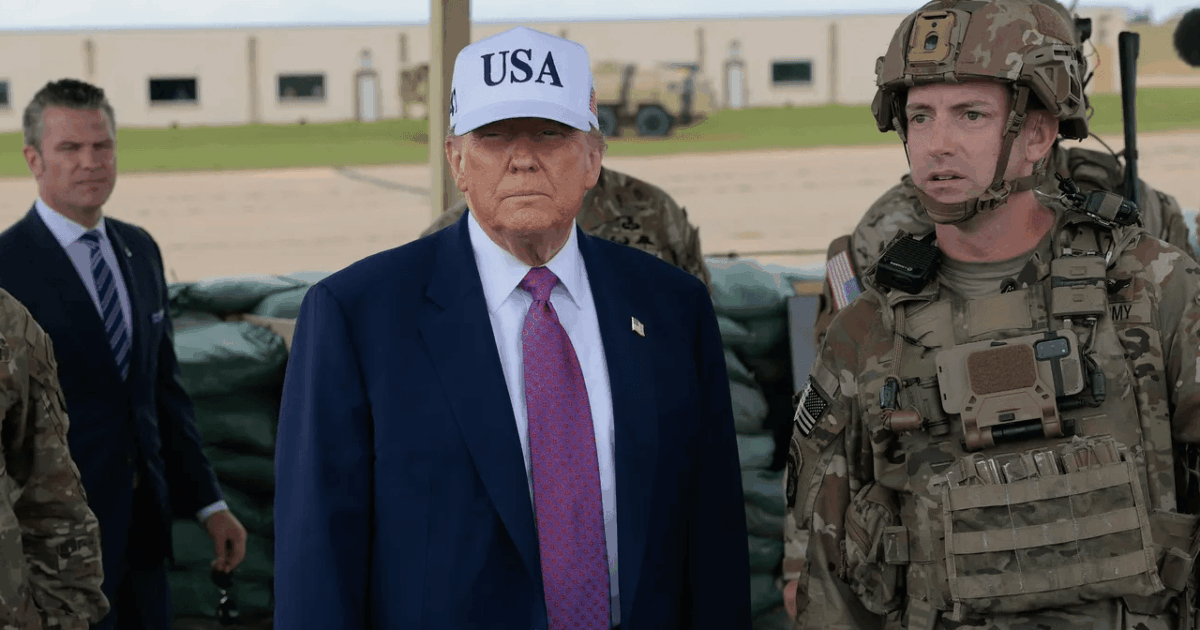

Trump on Middle East Chaos: ‘It’s Possible We Could Get Involved’ as Markets Brace for Fallout

On Sunday, June 15, 2025, the crypto economy edged up 0.92%, cruising at a total valuation of $3.29 trillion. Gold ticked higher by 1.37%, and silver posted a modest 0.17% gain against the U.S. dollar over the past 24 hours. Meanwhile, last week’s stock market momentum faded after an Israeli airstrike on Iran prompted a […] Source CryptoX Portal

Former Blockchain Exec Joins SEC As Director Of Trading And Markets

The US Securities and Exchange Commission (SEC) has announced several new hires, including those with experience in the cryptocurrency and blockchain industry. In a Friday notice, the SEC said Jamie Selway would join as the agency’s director of trading and markets. Selway worked as the global head of institutional markets for Blockchain.com from 2018 to 2019. Brian Daly, a partner at Akin Gump Strauss Hauer and Feld LLP with experience in crypto, will also join the commission, heading its investment management division. “I’ve long respected and appreciated the SEC’s commitment…

Bitcoin Plummets Below $104K as Tehran Airstrikes Send Shockwaves Through Markets

Bitcoin dipped below $104,000 on Wednesday, reaching an intraday low of $103,362 following reports of airstrikes in Tehran that unsettled global markets and triggered risk‑off sentiment. The cryptocurrency slid approximately 4.1% in the latest session, mirroring investor caution amid escalating Middle East tensions. In contrast, gold surged to $3,410 an ounce, up about 0.6% over […] Original

Bitcoin Tumbles Below $106K as $645M in Liquidations Rattle Crypto Markets

On Thursday, bitcoin slid into a steady decline, slipping beneath the $106,000 threshold and touching a fresh intraday low of $105,798. By 7:30 p.m. Eastern time on June 12, the top cryptocurrency had dropped 2.3% against the greenback. Bitcoin’s Slump Sends Waves Through $3.32T Crypto Market Overall, the mood stays gloomy, with bitcoin traders likely […] Original

Bitcoin 2025: Why It’s Still HUGE!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Dante talks about Bitcoin 2025: Why It’s Still HUGE! Brought to you by Bitcoinwell.com a bitcoin-only platform on a mission to enable independence. #bitcoin #bitcoinnews #shortsopen ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Hedge Funds Embrace Weekend Crypto Trading as 24/7 Markets Expand

The always-on crypto market is reshaping global finance, pushing hedge funds and trading firms to look beyond traditional hours and staff desks through the weekend. Qube Research & Technologies, a global quantitative investment management firm headquartered in London, is hiring for a “Crypto | Quant Trader (Weekend Shift)” role in London, which requires weekend availability in addition to a four-day workweek. The role, which includes overseeing continuous crypto trading, monitoring strategy performance and risks and implementing signals and data sets, requires working every other weekend and a normal day shift…

The quiet campaign to make Scott Bessent the next Fed Chair — why crypto markets should care

What does crypto have to gain, or lose, if Trump taps Scott Bessent as the next Fed Chair and accelerates the shift toward pro-growth, risk-friendly policies? Scott Bessent is quietly rising in conversations about the Next Fed Chair Scott Bessent, the current U.S. Treasury Secretary, has quietly emerged at the center of a growing conversation around who will lead the Federal Reserve after Jerome Powell’s term ends in May 2026. According to a Jun. 10 report by Bloomberg, discussions are underway within and beyond the Trump administration about the possibility…