OpenTrade has raised $7 million in a strategic round led by Notion Capital and Mercury Fund, with backing from a16z crypto, AlbionVC, and CMCC Global. The latest funding brings the London-based company’s total haul to $11 million in just six months, a signal of investor confidence in the startup’s push to bring yield-bearing stablecoins to users in unstable economies. The company runs a “yield-as-a-service” platform designed for fintech apps, exchanges, and neobanks. Clients like Criptan in Spain and Littio in Colombia use OpenTrade’s backend to let users earn interest —…

Tag: Markets

Million Dollar Bitcoin Incoming? New Study Reveals Shocking Prediction!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Rustin talks about Million Dollar Bitcoin Incoming? New Study Reveals Shocking Prediction! Brought to you by Bitcoinwell.com a bitcoin-only platform on a mission to enable independence. #bitcoin #bitcoinnews #shortsopen ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Bitcoin Edges Higher as Stock and Crypto Markets Rally

The cryptocurrency’s price rose past $106K on Tuesday morning, as both stock and crypto markets saw positive gains. Stocks Climb, Bitcoin Follows Bitcoin resumed its upward trend on Tuesday, climbing as high as $106,813.58 as stocks and the broader crypto market posted similar gains. Tech stocks led the rally for the S&P 500 and positive […] Original

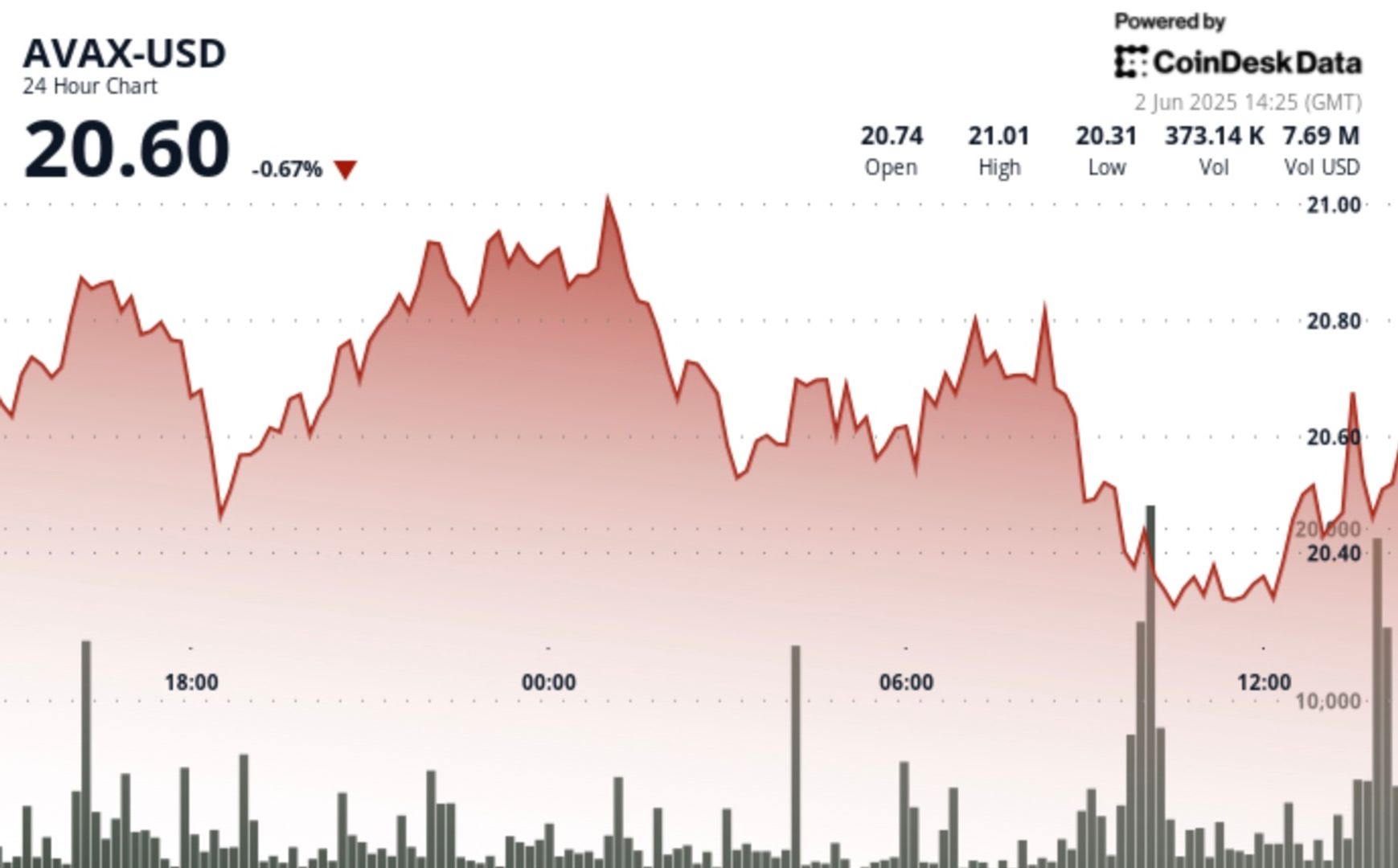

AVAX Plunges 9% as Global Economic Tensions Rattle Crypto Markets

Global economic uncertainties and escalating trade tensions have sent ripples through cryptocurrency markets, with Avalanche (AVAX) experiencing a sharp 8.5% decline over the past 24 hours. Despite forming a potential double bottom pattern at the $19.97 support level with increased buying volume, the overall bearish sentiment continues to dominate AVAX’s price action. Technical Analysis • AVAX experienced a significant downtrend over 24 hours, falling from $21.84 to $20.11. • Pronounced selling occurred when price dropped sharply from $21.49 to $21.01 on exceptionally high volume (2.56M). • Support emerged at $20.00…

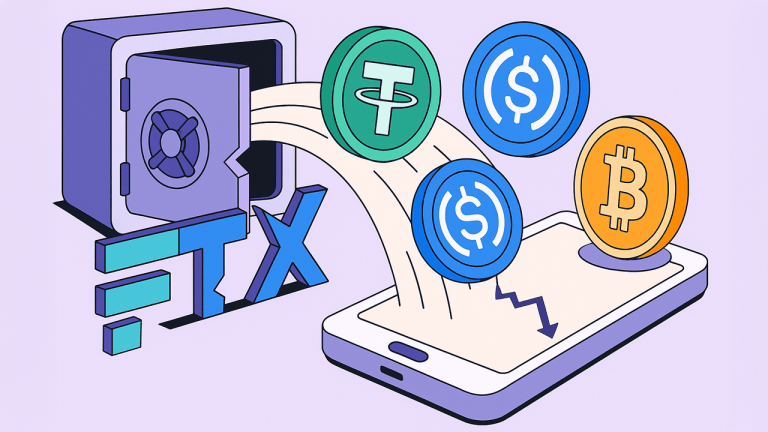

$5B in FTX Funds Are Hitting Wallets—Will Crypto Markets Get a Second Wind?

On Friday, the estate managing the collapsed crypto exchange FTX announced that its recovery trust had begun disbursing over $5 billion tied to both convenience and non-convenience class claims. As distributions roll out over the following three days, Coinbase Institutional observed in its weekly briefing that this injection of capital could invigorate liquidity across crypto […] Source CryptoX Portal

Bitcoin Risk vs Volatility: Understanding Crypto Investing!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Dante talks about Bitcoin Risk vs Volatility: Understanding Crypto Investing! Brought to you by Bitcoinwell.com a bitcoin-only platform on a mission to enable independence. #bitcoin #bitcoinnews #shortsopen ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Bitcoin climbs to highest level since late February: CNBC Crypto World

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io On today’s episode of CNBC Crypto World, major cryptocurrencies and broader markets climb following positive Big-Tech earnings. Plus, Robinhood’s Q1 earnings report reveals crypto revenue increased 100% compared to the prior year. And, Alisia Painter, co-founder of bitcoin-based blockchain Botanix Labs, discusses the cryptocurrency’s performance and what can be expected in May. Chapters: 00:00 – CNBC Crypto World, May 1, 2025 0:22 – Bitcoin climbs 0:44 – The headlines 3:07 – Alisia Painter of Botanix Labs For access to live and exclusive…

Crypto Markets Brace For $5 Billion FTX Liquidity Shock: Expert

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. In a video published on Wednesday, crypto analyst and trader Miles Deutscher devoted a lengthy segment to the long-anticipated distribution of FTX bankruptcy proceeds, arguing that tomorrow’s release of…

XRP Futures Hit Regulated Markets With a Bang as Tradestation Joins

XRP futures just hit the big leagues as Tradestation turbocharges its crypto game with CME-backed contracts, unlocking massive volume potential for institutional-grade digital asset trading. XRP Gets a Futures Makeover—Tradestation’s CME Push Signals High-Volume Play Tradestation Securities Inc., a self-clearing online brokerage firm based in Plantation, Florida, revealed on May 27 its participation in CME […] Source CryptoX Portal

Ray Dalio: Why You Need Bitcoin in Your Investment Portfolio

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Ray Dalio talks about why you need Bitcoin in your investment portfolio! Brought to you by Bitcoinwell.com a bitcoin-only platform on a mission to enable independence. #bitcoin #bitcoinnews #shortsopen ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version