Bitcoin ETFs recorded their second-largest outflow on record with a stunning $870 million exit, while Ether ETFs shed another $260 million. Solana was the lone bright spot once again, managing a modest but positive inflow. Bitcoin ETFs Record Second-Largest Outflow Ever There are days when the crypto market feels like a steady tide. Then there […] Original

Tag: Million

Polymarket Secures Exclusive UFC Partnership, Reaching 700 Million Fans

Key Notes The partnership introduces real-time prediction displays during fights and marks Polymarket’s entry into mainstream sports entertainment. Zuffa Boxing receives its first brand partner ahead of its January 2026 launch with integrated forecast features at live events. The collaboration expands prediction markets beyond politics into combat sports, targeting TKO’s billion-household global distribution network. TKO Group Holdings named Polymarket as its exclusive prediction market partner for UFC and Zuffa Boxing operations on Nov. 13, bringing the crypto-powered forecast platform to the mixed martial arts organization’s global audience of 700 million…

Bitcoin ETFs Rebound With $524 Million Inflows

Bitcoin ETFs made a roaring comeback with over half a billion dollars in inflows, snapping their quiet streak. Ether ETFs, meanwhile, faced heavy redemptions, while solana funds quietly extended their run of steady inflows. Crypto ETFs Diverge: Bitcoin Surges, Ether Retreats, Solana Keeps Winning After a sluggish Monday, crypto exchange-traded funds (ETFs) burst into motion […] Original

Bitcoin Path To $1 Million Clears With OG Sellers Fading: Weisberger

Former chairman and co-founder of CoinRoutes and now president of BetterTrade.digital Dave Weisberger used a November 11 video to restate Bitcoin’s long-term bull case, arguing that the market’s “morose” sentiment and technician-driven calls for downside are missing the structural shift underway on both fundamentals and market microstructure. He framed his analysis in two parts—why Bitcoin is being bought and what the current market structure implies—contending that the thesis toward seven-figure pricing remains intact even without an obvious near-term catalyst. The Path To $1 Million Per Bitcoin On fundamentals, he drew…

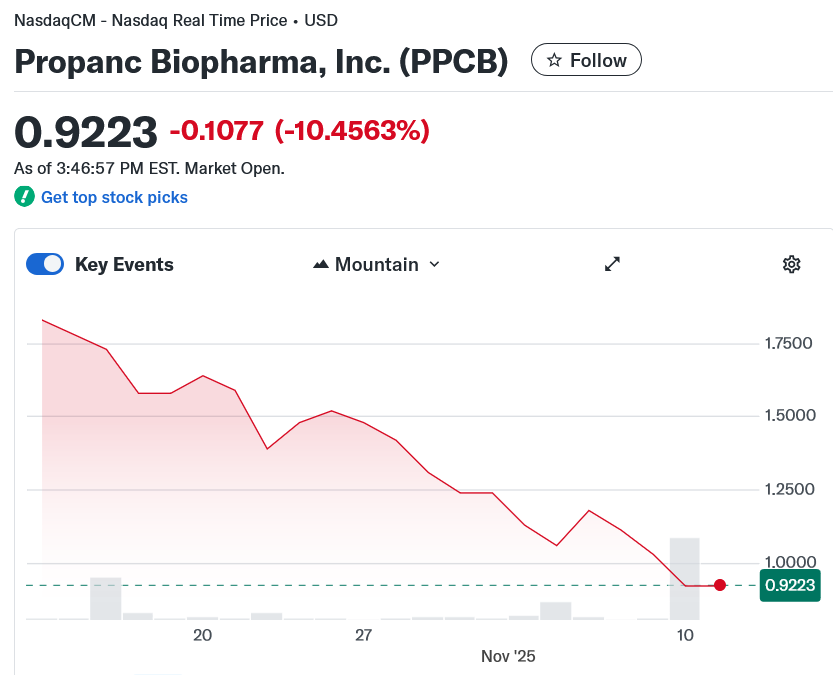

Propanc Biopharma Secures up to $100 million for Crypto Treasury

Australia-based Propanc Biopharma has announced that it has secured $100 million from a crypto-focused family office to launch a crypto treasury — a move its CEO described as “transformative” as its cancer therapy product enters human trials next year. The private placement, structured through convertible preferred stock, provides Propanc with an initial $1 million investment and up to $99 million in follow-on funding over the next 12 months from Hexstone Capital, a family office that invests in several crypto treasury companies. The cancer-treating biotech company stated that the proceeds will…

Bitcoin ETFs Close Week With $558 Million Outflow

Bitcoin exchange-traded funds (ETFs) wrapped up the week deep in the red with $558 million in outflows, while ether ETFs shed another $47 million. In contrast, solana ETFs stayed resilient, notching another $13 million inflow to close the week strong. Solana Keeps Winning Streak Alive as Bitcoin and Ether ETFs Bleed The week ended on […] Original

Square Flips the Switch: 4 Million Merchants Can Now Accept Bitcoin Payments Instantly

Square officially flipped the switch on bitcoin payments today, Nov. 10, 2025, giving over four million U.S. merchants (except those in New York) the ability to accept bitcoin ( BTC) at checkout. Square Opens Bitcoin Checkout The feature—called Bitcoin Payments—integrates directly into Square’s point-of-sale system and uses the lightning network to process transactions instantly. Merchants […] Original

Crypto Liquidation Hits $341 Million as Bitcoin Reclaims $106,000

Key Notes Bitcoin price is currently around $106,000, hinting at a massive recovery. Crypto market liquidations are at $341.85 million, with Bitcoin traders affected the most.the broader cryptocurrency industry has recorded up to 117,978 traders liquidated within the last. The crypto market cap has surged by almost 4% to rest at $3.56 trillion. In the wake of the ongoing Bitcoin BTC $106 326 24h volatility: 4.7% Market cap: $2.12 T Vol. 24h: $70.85 B price recovery to $106,000, 24 hours. The liquidations from BTC, ETH ETH $3 623 24h volatility:…

$300 Million Worth Of XRP On The Move, Where Are They Headed?

The XRP market is experiencing a new wave of large transactions as long-term holders adjust their positions. Over $300 million worth of XRP has recently been moved from crypto exchanges, signaling a shift in investor sentiment. While such withdrawals often suggest accumulation, current on-chain data present a mixed picture, indicating both opportunity and caution. Related Reading Over $300 Million XRP Exit Crypto Exchanges According to on-chain data from Glassnode, investors have withdrawn more than 140 million XRP, valued at approximately $309 million, from crypto exchanges. At the same time, XRP’s…

Bitcoin ETFs Break 6-Day Slump With $240 Million Inflow

After nearly a week of redemptions, bitcoin and ether ETFs swung back into positive territory on Thursday, drawing $240 million and $13 million in inflows, respectively. Solana ETFs extended their green run with a solid $29 million boost. ETF Turnaround: Bitcoin and Ether Snap Outflow Streaks as Solana Maintains Inflows The streak finally snapped. After […] Source CryptoX Portal