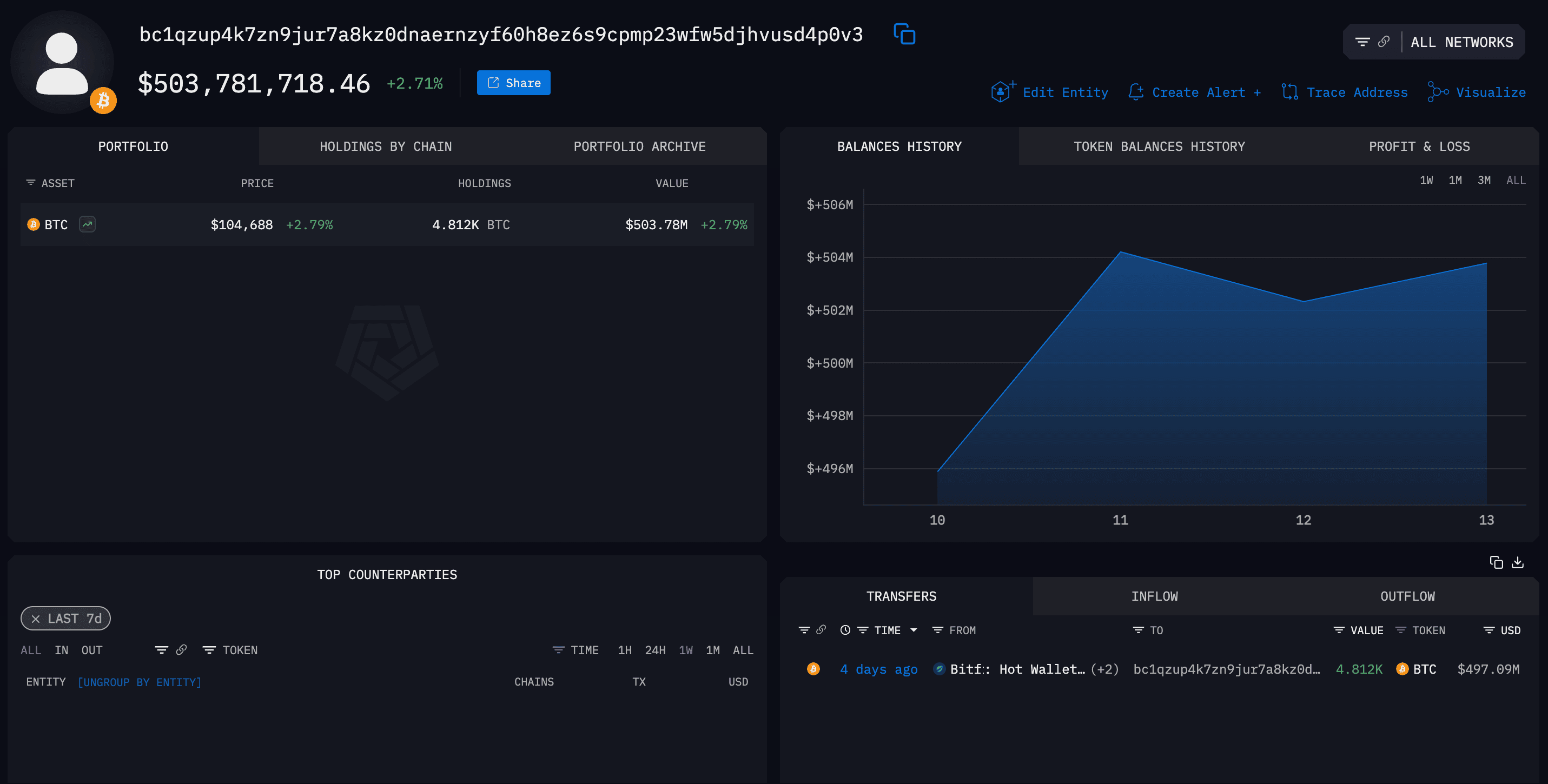

Cantor Equity Partners (CEP) disclosed a $458.7 million bitcoin BTC$104,587.91 acquisition as part of a pending merger with Twenty One Capital, the BTC-focused investment vehicle backed by Tether, Bitfinex, and SoftBank, according to a regulatory filing on Tuesday. The transaction is structured through a complex business combination involving Tether Investments, the El Salvador affiliate of stablecoin issuer Tether, and iFinex, the parent company of Bitfinex, the filing shows. As part of the deal, Tether purchased some 4,812 BTC at an average price of $95,319, with the tokens held in escrow…

Tag: News

Michael Saylor EXPOSES WHY $13M Bitcoin is Coming FASTER Than You Think

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin just broke $100K and overtook Amazon, sparking big questions about where it’s headed next. In this episode, we explore whether Bitcoin could hit $1 million by 2026 with a new Fed chair likely to unleash more money printing. With insights from Michael Saylor, Arthur Hayes, and Bill Miller, we dive into why Bitcoin may soon surpass gold, how global adoption is accelerating, and what this all means for your financial future. SPONSORS ✅ Ledn Simply Bitcoin clients get 0.25% off their…

Mine $318,000 In Bitcoin FROM HOME!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶SECURE YOUR CRYPTO w/ Arculus! (USE CODE BASE10) – JOIN THE BASEMENT DISCORD – ●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬● All of our videos are strictly personal opinions. Please make sure to do your own research. Never take one person’s opinion for financial guidance. There are multiple strategies and not all strategies fit all people. Our videos ARE NOT financial advice. Digital Assets are highly volatile and carry a considerable amount of risk. Only use exchanges for trading digital assets. Never keep your entire portfolio on an…

Coinbase’s earnings miss is ‘inconsequential’ considering crypto player’s $2.9B Derbit deal

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Coinbase Global missed first quarter estimates on its top and bottom lines amid headlines that it will be acquiring crypto derivatives exchange Deribit in a deal valued at $2.9 billion. Benchmark Company managing director and senior research analyst Mark Palmer weighs in on whether Coinbase’s lackluster performance is actually “inconsequential” in comparison to the Deribit deal. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime here: #yahoofinance #stocks #earnings #crypto #bitcoin #coinbase #stockmarket…

Best crypto prediction 2025 & best crypto to invest in 2025 #bitcoin #cryptopredictions #news

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 📈 Crypto Price Prediction 2025: What’s Next for Bitcoin, Ethereum, and More? 🚀 $100 into $1000 challenge#crypto #cryptotrading #cryptotrader #daytrading non financial adv Wondering what the crypto market might look like in 2025? 🌐 Dive into expert predictions for top cryptocurrencies like Bitcoin, Ethereum, and emerging altcoins. Will the market skyrocket, or are we in for a reality check? Find out what the future holds for crypto investors! 🚀 cryptocurrency 2024 news best crypto to invest in 2025 best staking crypto 2024…

Top 14 Crypto Coins that will EXPLODE in MAY 2025!! [URGENT]

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 14 CRYPTO COINS YOU MUST HAVE FOR 2025!! (Last Chance) 🟡 Try Bitunix to long or short crypto! No KYC: Use Code ‘AltcoinDaily’ for up to $8,000 USDT Trading Bonus! 🔴 Best Crypto Exchange to Buy & Trade Bitcoin: 💰Grab up to $30,000 worth of deposit bonuses ☝️ ** Accounts cannot be created within the US. 🔵 Swap your crypto assets on SilentSwap (PRIVATE & noncustodial)! 10% off fees – Just use my affiliate link: * always pay your taxes & follow…

Pi crypto price eyes a breakout ahead of Consensus news

Pi Network price surged in a high-volume environment on Friday, mirroring the broader crypto market rally driven by Bitcoin and major altcoins. Pi Coin (PI) token surged to an intraday high of $0.78 on Friday, its highest point since April 12, and 41% above its lowest level this month. The 24-hour volume soared by 170% to $353 million. Two broader factors drove this rally. First, it surged as Bitcoin (BTC) and most altcoins soared, pushing the total crypto market cap to over $3.25 trillion. This surge was because of the…

Bitcoin Price (BTC) News: $105K in Play

They crypto bull move continued into the weekend thanks to a trio of positive macro developments. Likely most responsible for the move was a President Trump Truth Social post regarding trade talks being held in Switzerland between the U.S. and China. “A very good meeting today,” said Trump. “Many things discussed, much agreed to,” he continued. “A total reset negotiated in a friendly, but constructive, manner. We want to see, for the good of both China and the U.S., an opening up of China to American business. GREAT PROGRESS MADE!!!”…

Trump Trade News Ignites Bitcoin Mania—$100K Coming?

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn. Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer…

Asset Entities stock surges over 200% after Strive merger and Bitcoin news

Asset Entities surged over 200% in trading following news that it will merge with Strive Asset Management to form the first publicly traded Bitcoin treasury asset manager. The combined entity will operate under the Strive brand and remain listed on NASDAQ, with a mission to maximize long-term Bitcoin exposure per share. The new company intends to accumulate Bitcoin (BTC) aggressively using a multi-pronged approach. This includes a first-of-its-kind offering that allows accredited investors to exchange Bitcoin for equity in the public company, potentially in a tax-free manner under Section 351…