Bitcoin (BTC) rebounded 4% on Mar, 7 as markets shook off disappointment over the US Strategic Bitcoin Reserve. BTC/USD 1-day chart. Source: Cointelegraph/TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering from local lows of $84,713 on Bitstamp. These came as US President Donald Trump signed a long-awaited executive order establishing the Reserve, which will ultimately consist of no “new” BTC; only confiscated coins will form the stockpile. “Premature sales of bitcoin have already cost U.S. taxpayers over $17 billion in lost value. Now the federal government will have a…

Tag: News

Bitcoin News Today: $1.04B in Liquidations as BTC Dips to $83K

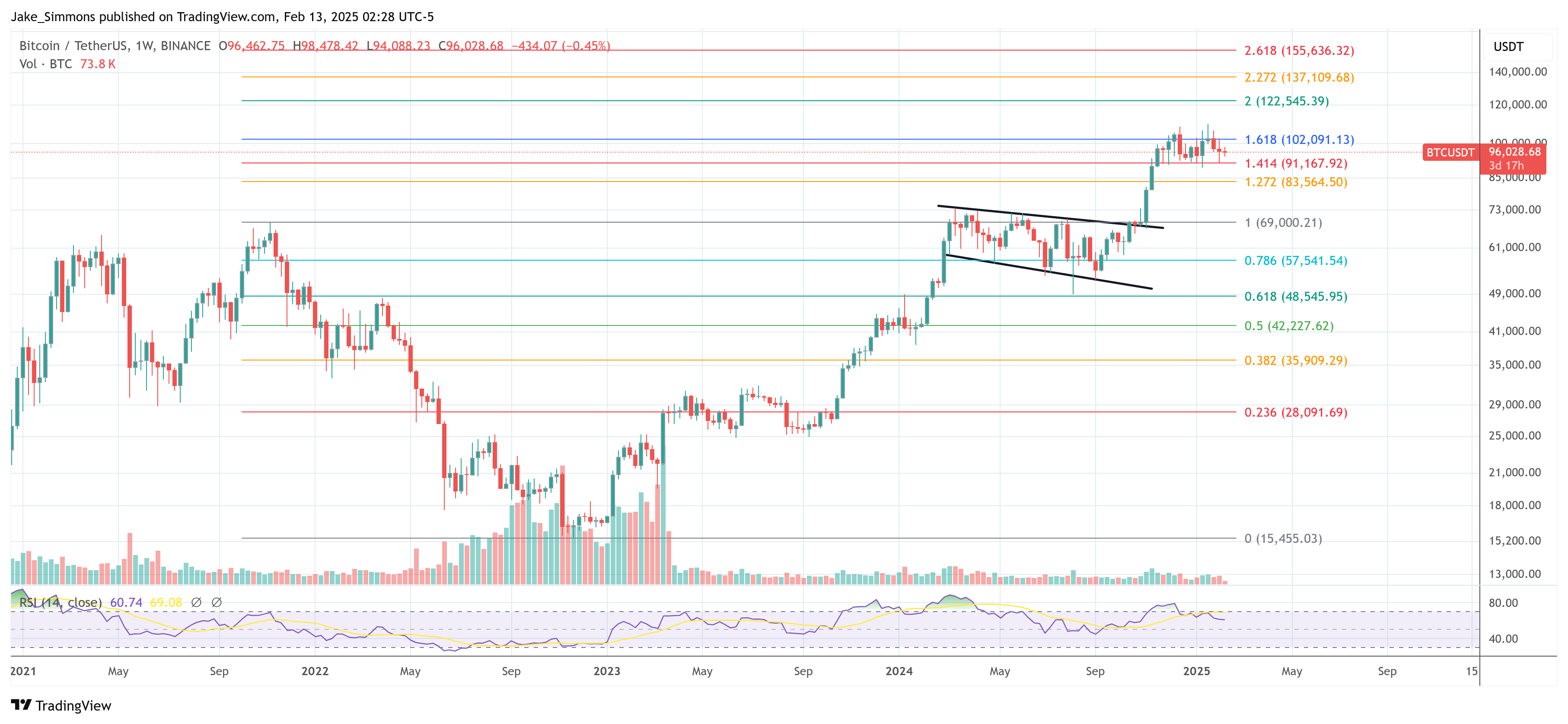

Key Notes The crypto market saw liquidations worth $1.04 billion as Bitcoin dropped from $93K to $82K in the past day. A total of 297,655 traders faced liquidations with the largest one being on Bitfinex, worth $13.40 million. Ali Martinez noted that Bitcoin faces a strong resistance at $97,000 where 2.27 million investors collectively hold 1.64 million BTC. The market-leading digital asset Bitcoin (BTC) has experienced a dramatic 9.90% drop in the past 24 hours, trading at $83,172.87 at the time of writing. The leading cryptocurrency saw a sharp decline…

Bitcoin News Today: BTC Price Skyrockets 8% from $80K Low, Bulls Target Six-Figure Breakthrough

Key Notes Bitcoin surged 8% in 24 hours, trading around $92,400 after dipping below $80,000. Trump announced the inclusion of BTC, ETH, XRP, SOL, and ADA in the US strategic crypto reserve. Analyst Ali Martinez sees the current price level as a strong buying opportunity. Bitcoin saw a major rebound on Monday, recording around 8% surge in value in the past 24 hours. This recovery comes after BTC price briefly dipped below $80,000 on Friday. The broader crypto market has also responded positively, posting a 7% increase in total market capitalization.…

Bitcoin’s (BTC) Surge After Trump’s Crypto Reserve News Showing Signs of Sustainable Bullish Run

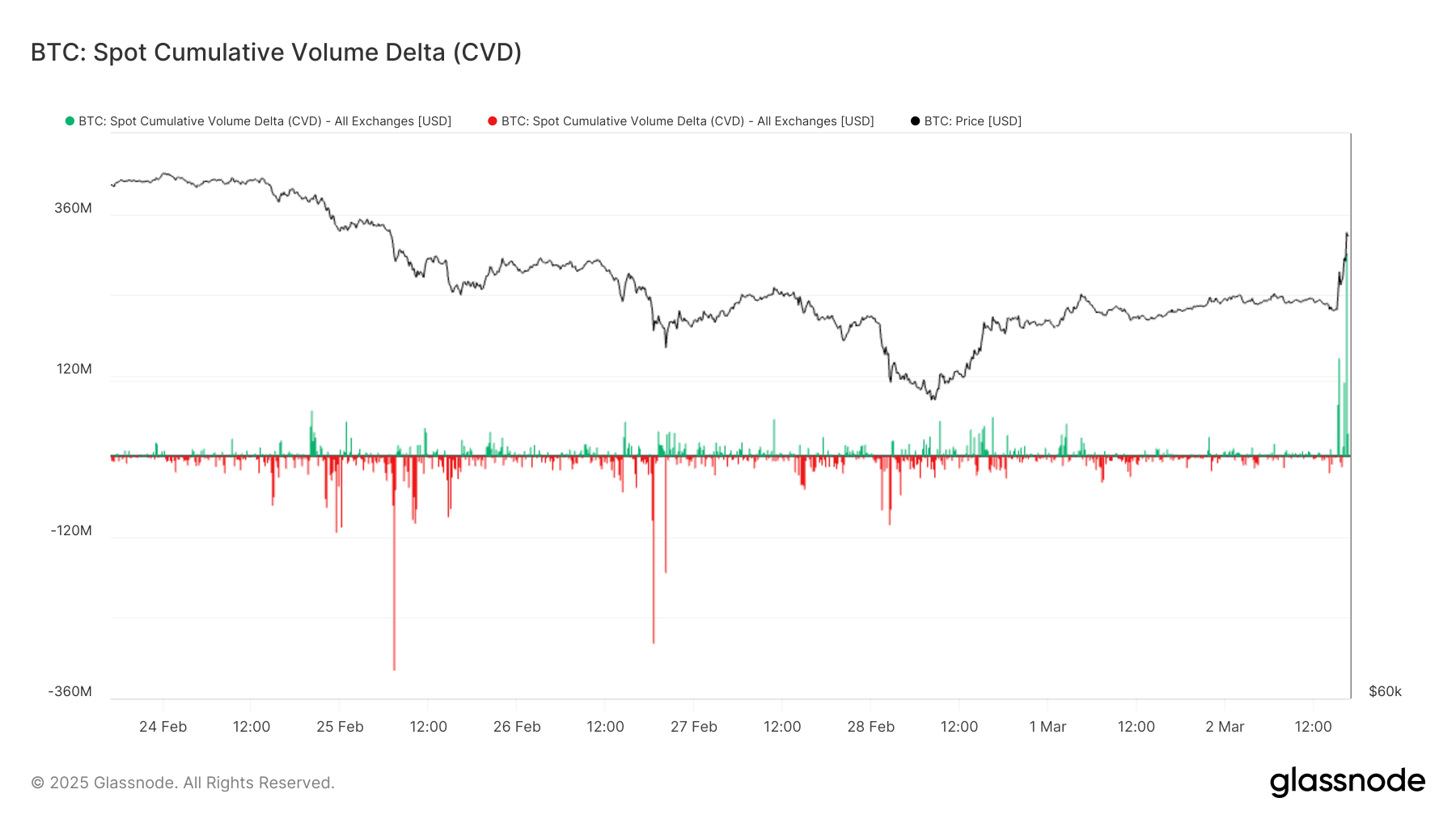

Bitcoin (BTC) has surged 7% in the past hour, crossing $92,000 after Donald Trump announced a crypto strategic reserve. The price is now up 15% from recent lows of $78,000. Data indicates this rally is driven by spot demand rather than speculation, signaling a healthy, organic move. Spot Cumulative Volume Delta (CVD) shows buyers as the aggressors, with over $200 million in spot inflows in the past hour. Meanwhile, futures open interest has declined, reinforcing that this surge is fueled by real buying rather than leveraged speculation. Spot CVD (Glassnode)…

Cointelegraph Bitcoin & Ethereum Blockchain News

Understanding Bitcoin solo mining Solo mining involves an individual miner independently validating Bitcoin transactions and adding new blocks to the blockchain without collaborating with others in a mining pool. This process requires substantial computational power and resources as the miner competes against a global network of participants to find a hash value that meets the Bitcoin (BTC) network’s current difficulty target. It involves repeatedly hashing the block’s header with different nonce values until a valid hash is found. The first miner to discover such a hash earns the right to…

Bitcoin Faces CPI Shock—Research Firm Says ‘Buy The News’

Este artículo también está disponible en español. Bitcoin and the broader crypto markets faced a jolt on January 12 after the latest US Consumer Price Index (CPI) data came in hotter than expected. The shock sent Bitcoin briefly downward before bouncing back, spurring a range of reactions among traders and analysts. The US Bureau of Labor Statistics released figures showing a 0.5% month-over-month rise in CPI, placing annual inflation at 3.0%—above the previously anticipated 2.9%. Meanwhile, Core CPI (excluding volatile food and energy costs) grew by 0.4% month-over-month, settling at…

BTC price prediction today | Bitcoin price news

Bitcoin has shown continued bullish momentum in 2025, will it continue it’s ascent? In this article, we’ll discuss BTC price prediction today, the potential reasons why it is bullish, and where can we see it in the coming weeks. Bitcoin’s short-term price prediction According to the technical analysis, Bitcoin’s prediction for today is bullish. BTC is currently trading around $104,050, having recently broken through the critical resistance level of $104,000. This surge suggests a continuation of the upward trend that began after a recent pullback to approximately $89,000 where BTC…

Crypto Fear And Greed Index Barrels Toward Extreme Greed Again As Bitcoin Price Clears $101,000, Is This Good News?

Este artículo también está disponible en español. The Bitcoin price has once again pushed above the $100,000 level after three consecutive days of price increases. Particularly, Bitcoin’s return above $100,000 comes on the back of a 12.5% increase after it bounced off the $90,000 support level on Monday, January 13. As expected, this positive momentum with Bitcoin has flowed into other cryptocurrencies. Major altcoins have mirrored Bitcoin’s surge, contributing to a notable increase in the overall cryptocurrency market capitalization A byproduct of this crypto market cap increase has been a…

Bitcoin surges back to $100k amid U.S.-themed bullish news

Bitcoin price surged to reclaim the $100,000 level on Jan. 15 as the flagship digital asset emerged from a turbulent start to the year. After weathering bearish pressure near the $90,000 area this past week, Bitcoin (BTC) price steadily climbed to recover above the six-digit mark. While another correction could still happen, market sentiment remains optimistic about the potential impact of Donald Trump’s inauguration and what the start of his presidency may mean for cryptocurrencies. Market intelligence and on-chain analytics platform Santiment pointed to the broader macroeconomic landscape as a…

Why The Trump Inauguration Is A ‘Buy The News’ Event

Este artículo también está disponible en español. Bitcoin has fallen to a low of $92,508 on January 8 after previously hitting $102,357 on Monday, marking almost a 10% retreat in a matter of days. The immediate catalyst appears to be the January 7 spike in US Treasury yields, with the 10-year rate hitting 4.67% following an unexpectedly strong ISM Prices Paid Index and higher-than-anticipated JOLTS job openings. Why The Trump Inauguration Is Bullish For Bitcoin While these data points renewed worries that inflation could persist, many seasoned observers insist the…