On Tuesday, the United States Federal Reserve released a study on the possible effects of a retail central bank digital currency (CBDC) on U.S. monetary policy implementation. The study, dated April, was a staff working paper titled “Retail CBDC and U.S. Monetary Policy Implementation: A Stylized Balance Sheet Analysis.” The paper considered four scenarios that illustrate the potential effects of a retail CBDC on monetary policy from the perspective of three stakeholder groups: the Fed, commercial banks and U.S. households. The first scenario involved exchanging cash for CBDC, which affected…

Tag: Paper

India cooperates with IMF on crypto consultation paper

The Department of Economic Affairs of India is finalizing a consultation paper on crypto currencies, which then will be handed over to the federal government. The implementation of the document could bring the country of 14 billion people closer to the international regulatory consensus on digital assets. On Monday, May 30, during an event hosted by the Ministry of Labour and Employment, Economic Affairs Secretary Ajay Seth revealed that his department is finishing the work on the consultation paper, which would define the nation’s stance on crypto. The document was…

Indian Government Finalizing Crypto Consultation Paper — ‘We Are Looking at a Global Paradigm on Digital Assets’ – Regulation Bitcoin News

India’s economic affairs secretary has reportedly revealed that the government’s consultation paper on cryptocurrency is “fairly ready.” He explained that the Indian government is looking at “a global paradigm on digital assets,” emphasizing that “There has to be a broad framework on which all economies have to be together.” Economic Affairs Secretary Ajay Seth on Crypto Indian Economic Affairs Secretary Ajay Seth provided an update Monday on the government’s progress to establish India’s crypto policy. Speaking about the government’s consultation paper on crypto, he was quoted by CNBC TV18 as…

India 'Fairly Ready' With Crypto Consultation Paper, Govt. Official Says

A top Indian Finance Ministry official told reporters that the nation is close to finalizing a consultation paper on crypto after consultations with the IMF, World Bank and others. Source

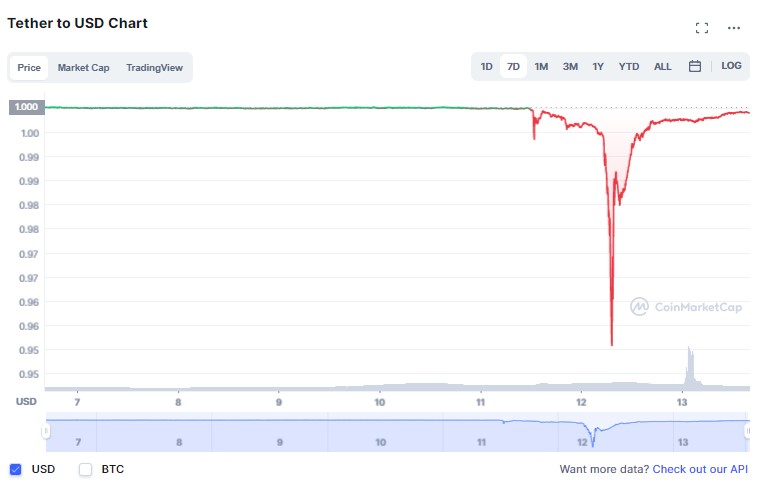

Tether Cuts 17% Of Its Commercial Paper Holdings Over Q1 2022

As per the official report published on May 18, Tether, the issuer of the world’s most used stablecoin, USDT, has cut 17% of its commercial paper holdings and increased United States Treasury bills with this reserve amount to back its stablecoin, USDT. Tether made the reduction over Q1 2022 and continues for a further 20% decline since April 1. The firm will highlight this 20% reduction in the Q2 report. The crypto project took these steps following the USDT stablecoin losing its dollar peg. The stablecoin dropped to 95 cents…

Tether reports 17% decrease in commercial paper holdings over Q1 2022

USDT Stablecoin issuer Tether (USDT) has reported it cut its reserves allocation to commercial paper investments and increased that of United States Treasury bills over the first quarter of 2022. In a Thursday blog post, Tether reported its reserves were “fully backed,” seemingly in an effort to assuage many users’ fears around USDT briefly depegging from the dollar on May 12. According to the stablecoin issuer, its commercial paper holdings over Q1 2022 decreased 17% from roughly $24 billion to $20 billion, with an additional 20% reduction to be reflected…

Tether Cut Commercial Paper Reserve by 17% in Q1

Tether reduced its commercial paper holdings by 17% from $24.2 billion to $19.9 billion in the quarter ended March 31, according to it latest attestation report. Source

Tether Reduces its Commercial Paper Holdings in Favor of US Treasuries for its Reserves

Quick take: Tether’s CTO has stated that the company has reduced its holdings of commercial paper and increased its US Treasuries as reserves for USDT Tether also announced that the USDT stablecoin had stood the test of time USDT also suffered depegging this week as stablecoins were in the spotlight after UST’s and LUNA’s depreciation in the markets Tether’s and Bitfinex’s CTO, Paolo Ardoino, has updated on the status of USDT reserves during a Twitter Spaces chat on Thursday. According to Mr. Ardoino, the majority of Tether’s reserves are in…

Hong Kong watchdog warns stablecoins could undermine HKD in CBDC paper

The Hong Kong Monetary Authority (HKMA) has warned that stablecoins could undermine the Hong Kong dollar in a just released discussion paper about its retail central bank digital currency, e-HKD. The HKMA today issued a discussion paper, outlining the policy and design issues involved in the introduction of e-HKD, and encourages the public and industry to participate in the consultation and share their views. Find out more: https://t.co/GndjuZ2Pay pic.twitter.com/hRz2noD0Ps — HKMA 香港金融管理局 (@hkmagovhk) April 27, 2022 Many in the crypto industry believe that interest in developing central bank-issued digital currencies…

Regulatory Arm of UAE Financial Centre Releases Defi Discussion Paper – Regulation Bitcoin News

The regulatory arm of UAE’s financial centre, Abu Dhabi Global Market (ADGM), has released a discussion paper that is seeking stakeholders’ comments regarding the regulation of decentralized finance (defi). The paper also makes clear the regulator’s stance regarding the anonymity of defi transactions. Paper Not Guidance for Financial Institutions The FSRA, a regulatory arm of the UAE financial centre ADGM, has issued a discussion paper that seeks the public’s comments on policy considerations for decentralized finance (defi). The release of the document comes as the defi space has seen strong…