PayPal co-founder Peter Thiel and a handful of other tech billionaires are reportedly launching a new bank partially dedicated to serving crypto startups. According to a new report from Financial Times, Thiel and other investors – such as the CEO of military contracting company Anduril – to create a bank called Erebor, which references to popular fantasy series The Lord of the Rings. FT says the billionaires intend for the bank to serve crypto startups and take the place of Silicon Valley Bank (SVB), a crypto-friendly bank that ended up…

Tag: Report

Belgium Bank KBC To Debut Bitcoin Via Bolero: Report

KBC Bank, one of Belgium’s largest financial institutions, is reportedly preparing to allow its customers to invest in cryptocurrencies through its Bolero subsidiary. Bolero, an online investment platform operated by KBC, will roll out access to Bitcoin (BTC) and Ether (ETH) investments on its platform later this year, local newspaper L’Echo reported on Wednesday. KBC expects to secure regulatory approval for the product by autumn. A spokesperson for KBC confirmed the bank’s plans to L’Echo. “Individual investors could then invest directly in Bitcoin and Ether in a secure environment, with…

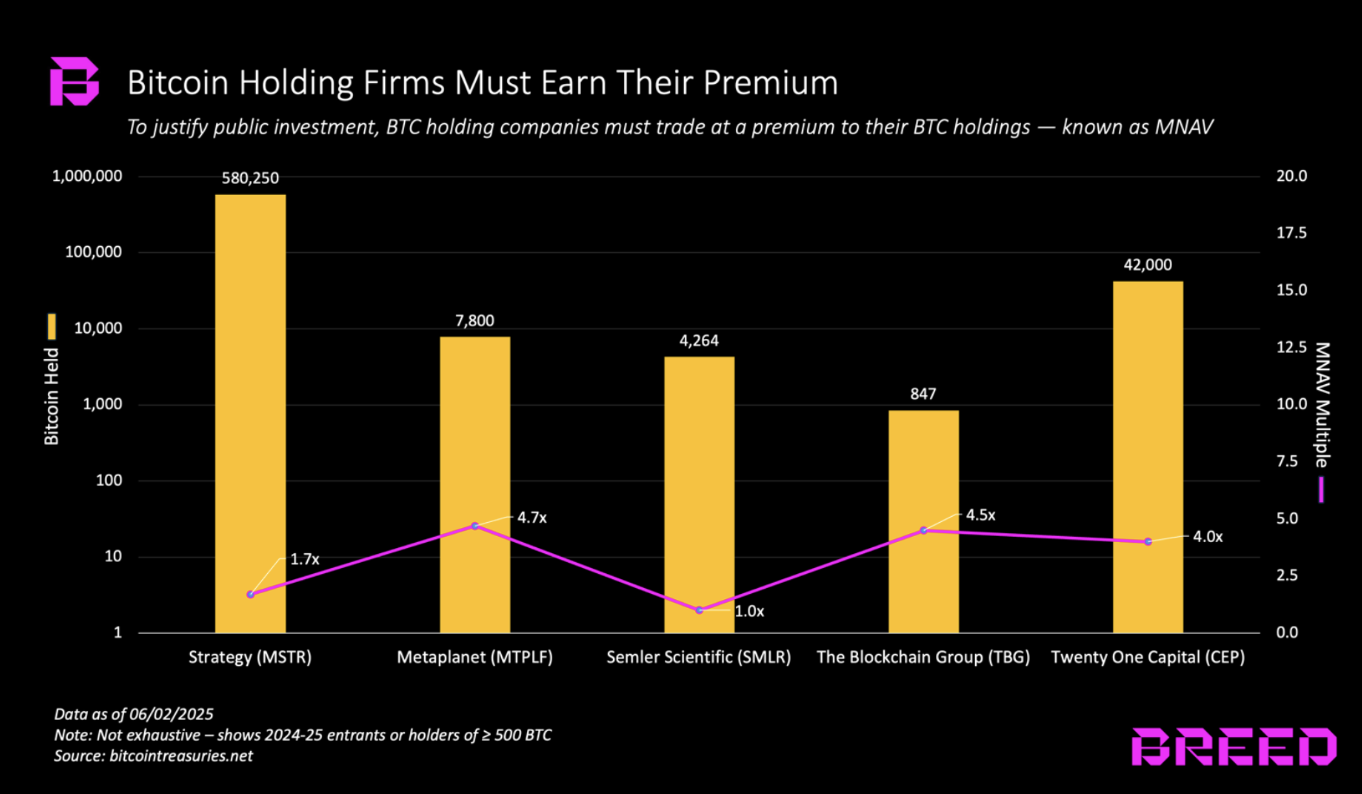

Only a handful of Bitcoin treasury companies will survive: Report

Only a few Bitcoin (BTC) treasury companies will stand the test of time and avoid the vicious “death spiral” that will impact BTC holding companies that trade close to net asset value (NAV), a business entity’s total assets minus its liabilities, according to a report from venture capital (VC) firm Breed. The health of Bitcoin treasury companies hinges on their ability to command a multiple of their net asset value (MNAV), the authors wrote. Breed’s report outlined the seven phases of a BTC treasury company’s decline, which begins with a…

How to Understand a Stablecoin Attestation Report (Step-by-Step Guide)

Key takeaways Stablecoin attestation reports provide third-party verification that each token is backed by real-world assets like cash and US Treasurys. Attestation ≠ audit: Attestations are point-in-time checks, not deep financial audits, so users should still perform broader due diligence. Not all tokens are redeemable. Time-locked, test or frozen tokens are excluded from reserve calculations to reflect only actively circulating coins. USDC sets an industry benchmark with regular third-party attestations, transparent reserve reporting and compliance with MiCA regulations. Stablecoins play a crucial role in the digital asset ecosystem, bridging traditional…

Binance has most Bitcoin liquidity, But Bitget leads with altcoins: Report

A report by CoinGecko compared major exchanges on the liquidity they offer to traders across several major crypto assets. Binance continues to dominate among crypto exchanges, especially when it comes to Bitcoin (BTC) trading. However, a report by CoinGecko, published on June 25, suggests that smaller exchanges can compete with Binance in the altcoin market. Specifically, Bitget (BGB) exchange leads in the key mid-spread band for altcoins, which is where most real trading occurs. CoinGecko’s report shows that Binance remains unchallenged in terms of Bitcoin liquidity. Binance controlled around 32%…

Kalshi Raises $185M at $2B Valuation: Report

Kalshi, a prediction market and competitor to Polymarket, has reportedly closed a $185 million funding round that values the company at $2 billion, indicating growing investor appetite for the emerging sector. The round was led by crypto investment company Paradigm, with participation from venture capital companies Sequoia Capital, Multicoin Capital and other investors, The Wall Street Journal reported on Wednesday. CEO and co-founder Tarek Mansour said the funding will be used to expand Kalshi’s technology team and integrate its prediction contracts into more brokerage platforms. Currently, Kalshi contracts are available…

Trump Administration Mulls ‘Debanking’ Executive Order: Report

US President Donald Trump’s administration is reportedly considering an executive order aimed at preventing banks from cutting off services to politically unfavorable industries, including cryptocurrency firms, according to a report from The Wall Street Journal, citing unnamed sources. The move would come in response to allegations that some banks have denied services to tech and crypto entrepreneurs as part of a coordinated debanking campaign critics have dubbed “Operation Chokepoint 2.0.” At least 30 technology and cryptocurrency founders were reportedly denied access to banking services during the Biden administration. Trump administration…

Reddit Is Weighing World’s Scanning Orbs For User Verification: Report

Social media platform Reddit is reportedly considering using the iris-scanning orbs developed by World — a project by Tools for Humanity, co-founded by OpenAI CEO Sam Altman — for its user verification system. According to a Friday Semafor report citing two people familiar with the matter, the platform is weighing the World ID system as a way for Redditors to verify that they are unique individuals. The report suggested that the verification system could still allow users to remain anonymous if they chose to do so. In response to the…

Norway to Temporarily Ban Bitcoin Mining: Report

Key Notes Norway will temporarily ban the establishment of new data centres that mine cryptocurrency. The authorities think this operation does not generate jobs or contribute to income for the local community. Cambridge reports that half of Bitcoin mining is powered by low-carbon or renewable energy sources. . Norway is considering a temporary ban on Bitcoin BTC $105 550 24h volatility: 1.0% Market cap: $2.10 T Vol. 24h: $23.08 B mining operations in its region. The authorities are concerned about the massive use of electricity and its impact on…

South Korea Central Bank Won’t Oppose Stablecoin: Report

The head of South Korea’s central bank has reportedly said he is not against the country issuing a won-based stablecoin, but is still concerned about managing the foreign exchange of the token. Reuters reported on Wednesday that Bank of Korea Governor Rhee Chang-yong said at a press conference that “issuing won-based stablecoin could make it easier to exchange them with dollar stablecoin rather than working to reduce use of dollar stablecoin.” That in turn could increase demand for dollar stablecoin and make it difficult for us to manage forex,” he…